Is there a trade-off between diversity and investment performance?

It’s a common question with a definitive answer: No

That’s my conclusion after conducting an extensive review of the literature on the relationship between diversity and investment risk and performance.

An Overview of the Studies

In total, the research I analyzed comprises 56 studies published over the past 28 years that combined examine almost 50 years of data. They largely focus on gender diversity. In fact, 45 of the 56 examine gender diversity only. Only 11 considered racial, ethnic, and other types of diversity, and most of this cohort also took gender diversity into account.

This emphasis is largely a function of the available data. Information on first names and pronoun use is easily accessible to researchers who can use it to make assumptions about gender. To examine other forms of diversity, however, researchers need self-identification data, which is harder to find, though some clever studies do leverage public information about portfolio managers’ birthplaces to explore cultural and socioeconomic diversity. Still, whatever the distinctions among the studies’ methods and focus, the results are consistent across the board regardless of the form of diversity under analysis.

Fifty-two of the 56 studies focus on portfolio management. Roughly one third of these examine diversity at the team level and the rest at the individual level. The four remaining studies consider the ownership of the firm hired to manage the investment team. Of course, ownership and portfolio management at many firms may have considerable overlap.

Diversity and Investment Performance: The Results

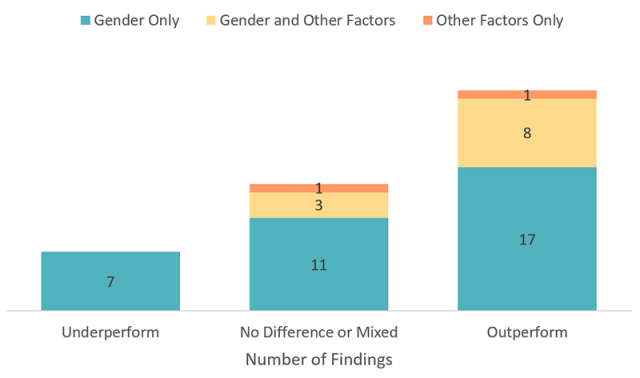

With that background, the findings on investment performance are as follows:

- No Difference or Mixed: There were 15 findings of either no variation in performance or outperformance only in some circumstances, whatever the characteristics of the manager. Most of these were academic studies of mutual funds.

- Outperformance: 26 findings noted an association between diversity ad outperformance. More than half of these were based on studies of hedge funds, private equity funds, or venture capital funds, and were produced by industry firms.

- Underperformance: Seven findings associated diversity with underperformance.

(These 48 findings do not add up to the 56 total studies because some studies have multiple findings on performance, while others focus on risk or other portfolio characteristics and draw no conclusions on performance.)

In my assessment, the evidence for the “No Difference or Mixed” is strongest. Why? Because such findings are heavily tilted toward academic studies that are more likely to be risk-adjusted, peer-reviewed, and based on standardized and heavily scrutinized mutual fund data.

Nevertheless, the impressive showing of the “Outperformance” category implies that diversity may have a more positive affect on investment performance. On the whole, the weight of the evidence indicates that diversity is associated with performance that is at least as good as the mean.

Investment Performance and Diversity: Research Findings Focus and Conclusion

Diversity and Risk

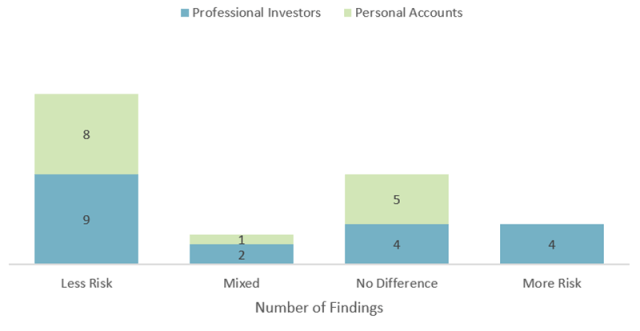

More than half of the studies address portfolio risk. The results appear straightforward at first glance, with almost two-thirds associating diversity with lower risk.

However, when it comes to risk-raking, we need to distinguish between personal accounts and professional investors.

The findings on personal accounts are quite consistent. There is no indication that women take more risk than men. These studies draw from large data sets, such as all accounts at a major brokerage firm. Their findings are among the oldest in the literature and have been replicated periodically over the past 28 years. They have almost become accepted wisdom.

However, while there may be a strong association between gender and risk-taking in personal accounts, factors other than gender may be driving the results. While most studies control for income and marital status, other factors can affect risk taking, such as risk tolerance and financial knowledge. According to one cross-border study, gender differences in risk-taking are not present in countries with more gender equality, which supports the hypothesis that gender is not determinative when it comes to risk.

Studies of risk-taking by professional investors further support this hypothesis: 11 such studies find women professional investors take less risk, four find no difference in risk-taking, and four find that women take more risk.

Overall, this literature suggests that something other than gender may be driving the results. Future studies will hopefully zero in on what that driver might be.

Diversity and Risk in Investing: Research Findings

Conclusion

The evidence shows that diversity and investment performance co-exist. Investors don’t have to make a choice between the two.

Is there a study I missed? Let me know at www.versanture.com/contact.

For more on the relationship between diversity and investment results, don’t miss “Diversity and Investment Performance: A Summary of the Research.”

If you liked this post, don’t forget to subscribe to Enterprising Investor.

All posts are the opinion of the author. As such, they should not be construed as investment advice, nor do the opinions expressed necessarily reflect the views of CFA Institute or the author’s employer.

Image credit: ©Getty Images/ matdesign24

Professional Learning for CFA Institute Members

CFA Institute members are empowered to self-determine and self-report professional learning (PL) credits earned, including content on Enterprising Investor. Members can record credits easily using their online PL tracker.