Michael Burry of “Big Short” fame just plowed into a struggling health insurance stock.

Michael Burry is best known as one of the earliest and most vocal investors to predict the housing collapse of 2008 — a prescient call that earned him notoriety and a Hollywood portrayal by Christian Bale in the 2015 film The Big Short. Much like Berkshire Hathaway's Warren Buffett, Burry has built a reputation for leaning into contrarian opportunities — buying when fear is high and valuations are depressed.

According to recent filings, both Buffett and Burry recently initiated stakes in struggling health insurance provider UnitedHealth Group (UNH 1.17%) — whose 40% sell-off makes it the poorest-performing stock in the Dow Jones Industrial Average so far in 2025.

Let's examine what could position UnitedHealth as a potential multibagger, while also unpacking the intriguing structure of Burry's investment that makes his exposure to the troubled health insurer particularly compelling.

Why invest in UnitedHealth stock right now?

This year has been particularly challenging for UnitedHealth. Earlier this year, management was forced to revise financial guidance after disclosing that the company's Medicare Advantage segment was facing higher-than-expected costs. At the same time, operational setbacks within the company's pharmacy benefits management platform, Optum Rx, further added pressure to earnings growth — souring investor sentiment.

UNH PE Ratio data by YCharts

While these headwinds won't disappear overnight, the market's reaction appears to be overly severe. UnitedHealth now trades at just 13.2 times earnings — near its lowest multiple in five years. After such a steep sell-off, there's a strong case that maximum pessimism is already priced into the stock.

This is precisely the type of setup Burry gravitates toward: a business that may appear like trouble at first glance, but in reality may be a fundamentally sound, mispriced asset with meaningful potential to rebound.

Layering equity with call options signals a calculated bet

Burry does not invest by himself — he is the founder of hedge fund Scion Asset Management. Hedge funds are known to structure their investments in more sophisticated ways than simple equity purchases.

According to Scion's latest 13F filing, the firm acquired 20,000 shares of UnitedHealth Group stock, along with 350,000 call options during the second quarter. A call option grants the right, but not the obligation, to buy stock at a predetermined price in the future. Since these options were purchased when UnitedHealth stock hovered near multi-year lows, they were likely bought at a discount.

By layering options on top of direct stock ownership, Scion gains leveraged exposure to a potential rebound while also limiting its up-front capital outlay. This structure can be an efficient way to amplify returns if the turnaround materializes.

To me, this signals that Burry does not view UnitedHealth as a falling knife, but rather a high-quality blue chip company mispriced by the market — one with room for an upward valuation rerate as management works to stabilize operations and restore investor enthusiasm.

Image source: Getty Images.

Should investors follow Burry into UnitedHealth Group?

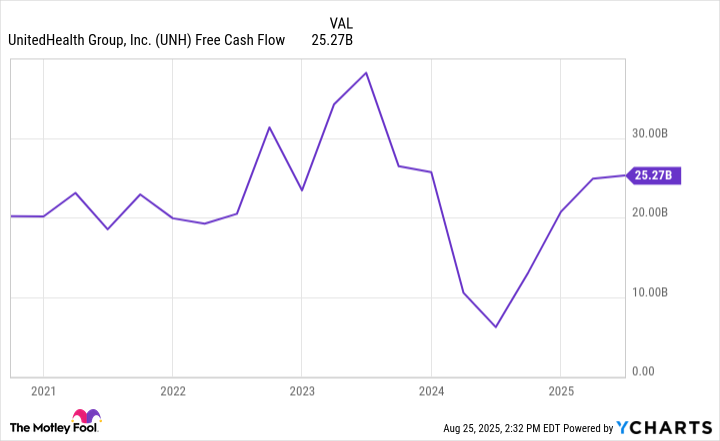

UnitedHealth Group is trading as if its best days are in the rearview mirror. In reality, the company still generates tens of billions of dollars in free cash flow annually — a figure continuing to trend upward following a temporary slowdown in recent years.

UNH Free Cash Flow data by YCharts

Despite recent operational turbulence, UnitedHealth remains a fundamentally strong enterprise with a durable business model in a lucrative industry: health insurance.

When paired with its depressed valuation, UnitedHealth presents a compelling value stock opportunity at the moment. Investors are essentially being offered a leading health insurance business at a bargain price. For contrarians like Burry, this setup is where outsized returns are made.

I think the sell-off has created a rare opportunity to buy into a critical business at a considerable discount as opposed to a premium. For long-term investors willing to look beyond the current hoopla surrounding UnitedHealth, the company has the recipe of a growth play positioned as a value stock hiding in plain sight.

Adam Spatacco has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Berkshire Hathaway. The Motley Fool recommends UnitedHealth Group. The Motley Fool has a disclosure policy.