Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

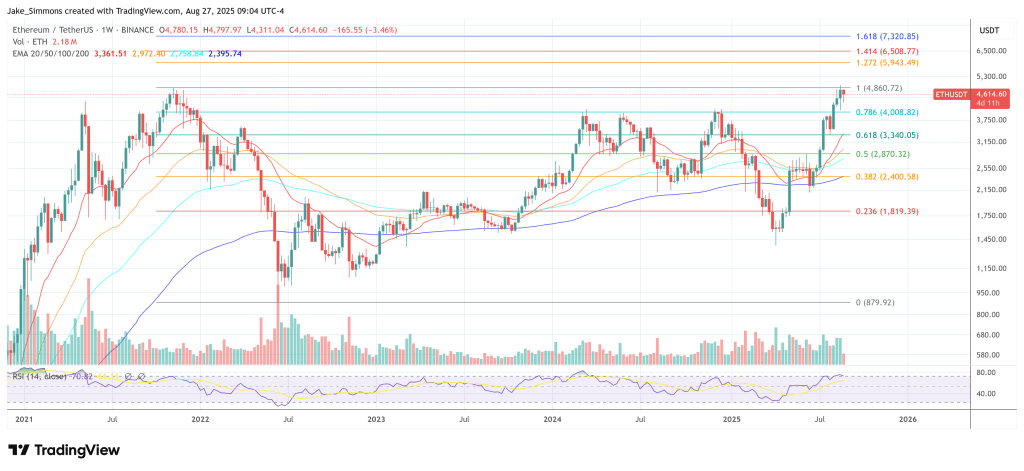

Fundstrat co-founder Tom Lee laid out a forceful, policy-driven Ethereum bull thesis in an interview on August 26, arguing that a US regulatory pivot, Wall Street’s move to on-chain infrastructure, and institutional demand routed through public “crypto treasuries” set the stage for a sharp fourth-quarter repricing. “In the near term, you know, $5,500 should be happening in the next couple of weeks,” Lee said, adding that by year end ETH “should be closer to $10,000 to $12,000,” with the bulk of crypto’s yearly gains typically arriving in Q4.

Ethereum’s ‘1971 Moment’

The brain behind BitMine’s ETH treasury strategy frames 2025 as a structural break comparable to the US dollar’s 1971 break from gold. In his view, Washington’s posture has shifted from seeing crypto as a threat to positioning it as an instrument of financial leadership. “In the last 12 months, there’s been a sea change, partly because of the election, where crypto is no longer considered an enemy… but really part of how the US financial system will get leadership,” Lee said.

He pointed to stablecoins—“the breakout product, you know, the chat-GPT moment”—the proposed GENIUS Act and what he called the SEC’s “Project Crypto,” contending these signals show regulators want “Wall Street to use the blockchain to actually make America more innovative and actually spread America’s financial influence around the world.”

Related Reading

From there, Lee’s thesis centers on Ethereum as the default institutional settlement layer. “Wall Street doesn’t want the fastest chain… They want a reliable chain that they can build upon. Ethereum has had zero downtime in its entire history. So to me, it’s the natural selection.”

Calling Ethereum a “fat protocol,” he argued that value accrues at the base layer as tokenization and payment rails migrate on-chain. Citing work “from Mosaics and from Fundstrat,” Lee said that, if the network captures major payment and banking flows, “you get to a network value of $60,000 value per ETH” over a 10- to 15-year horizon.

BitMine’s Strategy

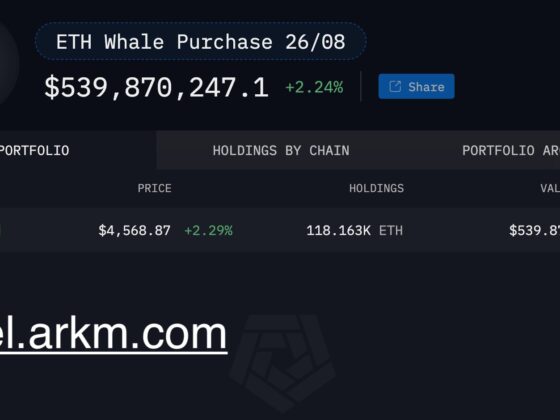

A substantial part of the conversation focused on the public-equity vehicle he chairs, Bitmine, which he described as an actively managed Ethereum treasury. Lee contrasted holding spot ETH with owning a company that uses capital markets to expand ETH per share. “When Bitmine started… there was only $4 worth of Ethereum held per share,” he said of a July 8 baseline.

“As of August 24, we now have $39.84 worth of Ethereum held per share… So the reason we had a 10x in your holdings is because Bitmine is actively managing to grow your Ethereum held per share by using capital markets and attracting the interest of institutional investors.”

He argued that this approach can be “anti-dilutive” when executed at an equity premium to net asset value: “If your ETH per share is going up, none of the capital markets is dilution.” Lee added that Bitmine has “a billion-dollar stock repurchase program in place because if the stock becomes too cheap relative to its ETH holdings, it would make more sense to actually buy back stock.”

Related Reading

On strategy, Lee outlined an ambition to control roughly 5% of staked ETH, claiming a “power law” effect as network importance scales. “If you’re a staking entity that owns 5 percent, then you have a positive influence on future upgrades… [and] one of the most important vectors for when Wall Street wants to build on Ethereum,” he said. With Ethereum’s proof-of-stake mechanics, he asserted that current holdings could generate substantial income: “With the $9 billion worth of ETH held today, that’s about almost $300 million of net income.”

Tom Lee’s Macro View

Institutional demand, Lee maintained, is finally rotating toward ETH via regulated wrappers and equities, even as many large allocators still underweight it. “Ethereum is still generally not liked by institutions because most have bet on Bitcoin… that’s why Ethereum is probably falling into… the most hated rally,” he said, noting that year-to-date ETH gains of 35 percent have outpaced Bitcoin’s 17 percent.”

Lee’s macro overlay extends beyond crypto. He reiterated a constructive equity view contingent on Federal Reserve easing and a cyclical upturn. “If the Fed follows through and begins to cut… and then we get a drop in mortgage rates and the ISM turning up and therefore financials really begin to participate, I think that’s why we get to 6,800 or so on the S&P,” he said. While acknowledging that “September is the month everyone’s going to be worried about,” he characterized any pullback as buyable: “Since 2022… that has always been a dip buying opportunity.”

At press time, ETH traded at $4,614.

Featured image created with DALL.E, chart from TradingView.com