The FTSE 100 (^FTSE) ended slightly lower on Wednesday on a mixed day for European shares ahead of results from Nvidia (NVDA) after the New York market close.

“The future direction of markets will be determined by Nvidia’s results tonight. A lot is riding on these figures given how the chip company is such a dominant name in the US stock market and a popular investor holding globally,” said Russ Mould, investment director at AJ Bell.

The FTSE 100 index closed down 10.30 points, 0.1%, at 9,255.50. The FTSE 250 (^FTMC) ended 56.20 points lower, 0.3%, at 21,805.03 while the AIM All-Share (^FTAI) finished down 2.74 points, 0.4%, at 762.37.

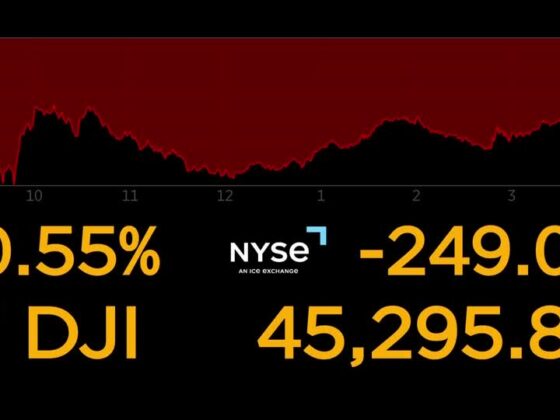

In New York, the Dow Jones Industrial Average (^DJI) rose 0.3%, the S&P 500 (^GSPC) was 0.2% higher, as was the Nasdaq Composite (^IXIC).

Nvidia (NVDA) was hovering around opening levels ahead of second quarter earnings, remaining close to all-time highs.

The AI chip manufacturer is expected to report revenue of 46.05 billion dollars in the quarter, with earnings per share of 1.01 dollars according to FactSet consensus.

DataCentre revenue is forecast at 41.43 billion dollars.

Looking to the third quarter, FactSet consensus points to revenue of 53.43 billion dollars, non-GAAP EPS of 1.18 dollars, and DataCentre revenue of 49.30 billion dollars.

Joshua Mahoney, analyst at Rostro, noted the “incredible rise” of Nvidia has taken the company from a one trillion dollar valuation to over four trillion dollar market cap in just two years.

“Whilst markets are constantly second guessing when this gravy train will come to a halt, the persistent ability to beat market earnings expectations has helped drive the stock on its upward trajectory.”

The yield on the US 10-year Treasury was at 4.26%, trimmed from 4.28% on Tuesday.

The yield on the US 30-year Treasury was 4.91%, narrowed from 4.93%.

The pound ebbed to 1.3469 dollars late on Wednesday afternoon in London, compared to 1.3483 dollars at the equities close on Tuesday.

The euro fell to 1.1606 dollars, against 1.1656 dollars. Against the yen, the dollar was trading higher at 147.73 yen, compared with 147.37 yen.

In Europe, the mood was mixed amid ongoing political uncertainty in France.

The CAC 40 (^FCHI) in Paris ended up 0.4%, recouping some of Tuesday’s falls, while the DAX (^GDAXI) 40 in Frankfurt closed 0.4% lower.

Analysts at Wells Fargo offered some reassurance.

“While clearly problematic for the French economic outlook, from a longer-term perspective we believe France’s fiscal uncertainties will have limited impact on the broader eurozone economy and the euro,” the broker said.