Wednesday, August 27, 2025

Pre-market futures are mostly up slightly again this morning, with no major economic prints this Hump Day to distract from the laser-focus most market participants currently have today: Q2 earnings results from NVIDIA NVDA, the world’s top chipmaker and market play on the AI space.

Carrying a Zacks Rank #3 (Hold) into this afternoon’s report, NVIDIA currently controls about 8% of the entire S&P 500. The $4+ trillion market cap behemoth has gained roughly $2 trillion since its early April selloff. It’s coming of an earnings miss in Q1, but is expected to grow a robust +47% on the bottom line year over year. Revenues are expected to grow more than +53% to $46.14 billion, which would be an all-time record high.

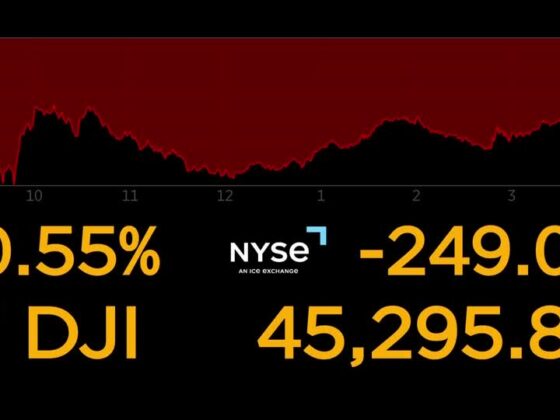

Currently, the Dow and S&P 500 are flat in early trading, with the Nasdaq -16 points. The small-cap Russell 2000, which has led market indexes over the past few trading days, is down -6 points at this hour. Bond yields are flattening on the nearer-term ends: +4.27% on the 10-year (still 2 basis points [bps] higher than the high range of a perceived 25 bps Fed rate cut in September), +3.65% on the 2-year, and creeping up to +4.93% on the 30-year.

Wisconsin-based department store Kohl’s KSS impressed investors to the upside this morning, posting a positive earnings surprise of nearly +70% to $0.56 per share this morning. The Zacks consensus was looking for $0.33 per share. Revenues, however, came in light of expectations to $3.35 billion. Shares are currently up +19% in early trading as the company narrowed revenue guidance but vastly increased its outlook on earnings.

Foot Locker FL, on the other hand — which agreed to be sold to Dick’s Sporting Goods DKS in May for $2.4 billion — posted a huge earnings miss in its Q2 results this morning: -$0.27 per share versus expectations of +$0.05, for a -640% negative earnings surprise. Revenues missed by a much slimmer margin: -0.24% to $1.86 billion. The closing date for the Dick’s acquisition comes a week from next Monday. For more on FL’s earnings, click here.

Elsewhere, Abercrombie & Fitch ANF posted a +2.2% earnings surprise this morning, to $2.32 per share. Sales growth slowed overall, but its Hollister brand grew +19% in the quarter. Shares are -3% on the news. Mastercraft Boat Holdings MCFT shares are up +11% on a boffo earnings beat in its fiscal Q4 this morning: 40 cents per share versus expectations of 18 cents, for a +122% positive surprise.