Nvidia (NVDA) is attempting to extend AI beyond the server rack and into the real world.

The centerpiece is Jetson AGX Thor, a Blackwell-class processor designed to run autonomously on robots, production lines, and medical equipment, rather than just cloud data centers.

As Nvidia's latest financial earnings report comes in after the bell on Aug. 27, the question isn't whether it can produce faster chips; it's whether Jetson can transform the advantage into a profit center without sacrificing premium margins.

💵💰Don't miss the move: Subscribe to TheStreet's free daily newsletter💰💵

The play extends Nvidia's entire stack—GPUs, high-speed networking, and CUDA/NIM software—to where latency and reliability are most important. Early activity from major robotics and logistics companies suggests that the flywheel is starting.

Investors will look for signs of edge mix and price, how supply and export laws impact the deployment, and whether software attachment may make Jetson feel like a subscription rather than a cycle. Guidance should nudge rather than answer those questions.

What Nvidia’s Been Lining Up

On the rack-scale side, Blackwell systems like the GB200 NVL72 connect 72 GPUs to a single NVLink domain, allowing large language model training and speedier real-time inference. The goal is performance without requiring a complete rebuild of the data center.

Networking has also been gaining traction. Spectrum-X/Spectrum-XGS and the InfiniBand stack connect clusters so that AI traffic flows with less contention and higher determinism.

And the software scaffolding becomes thicker.

CUDA is the on-ramp, while AI Enterprise and NIM microservices are the “make it run anywhere” layers, which might shift more of the model toward recurring income rather than one-time cycles.

Independent counts still place Nvidia around the ~80% mark in high-end AI chips, explaining why roadmaps continue to focus on this area despite the expansion of bespoke hardware.

The wildcards haven't gone away—export constraints in China and tight packaging/HBM dynamics continue to affect what ships when—so keep an eye out for color on mix, availability, and how much of the stack is monetized in software.

Nvidia Still Dominates the AI Server Market

TrendForce estimates Nvidia powers ~90% of GPU-based AI servers and ~64% of all. AI chips globally (even after accounting for custom silicon), proving its grip on the market remains strong despite growing internal chip efforts from cloud giants.

The runway is massive. Dell’Oro forecasts global data-center capex will top $1 trillion by 2029, driven by AI infrastructure.

Related: Nvidia will deliver key earnings report this week

Bank of America expects AI accelerators to account for 65%+ of data-center spend by 2030, with Nvidia keeping an ~80% share.

Meanwhile, Jetson Thor is pushing Nvidia’s edge AI strategy forward — targeting robots, humanoids, and medical devices.

From the cloud to the warehouse floor, Nvidia’s end markets are expanding fast. If forecasts hold, its dominance may be just getting started.

Nvidia’s Jetson Thor Ushers in a New Era of Physical AI

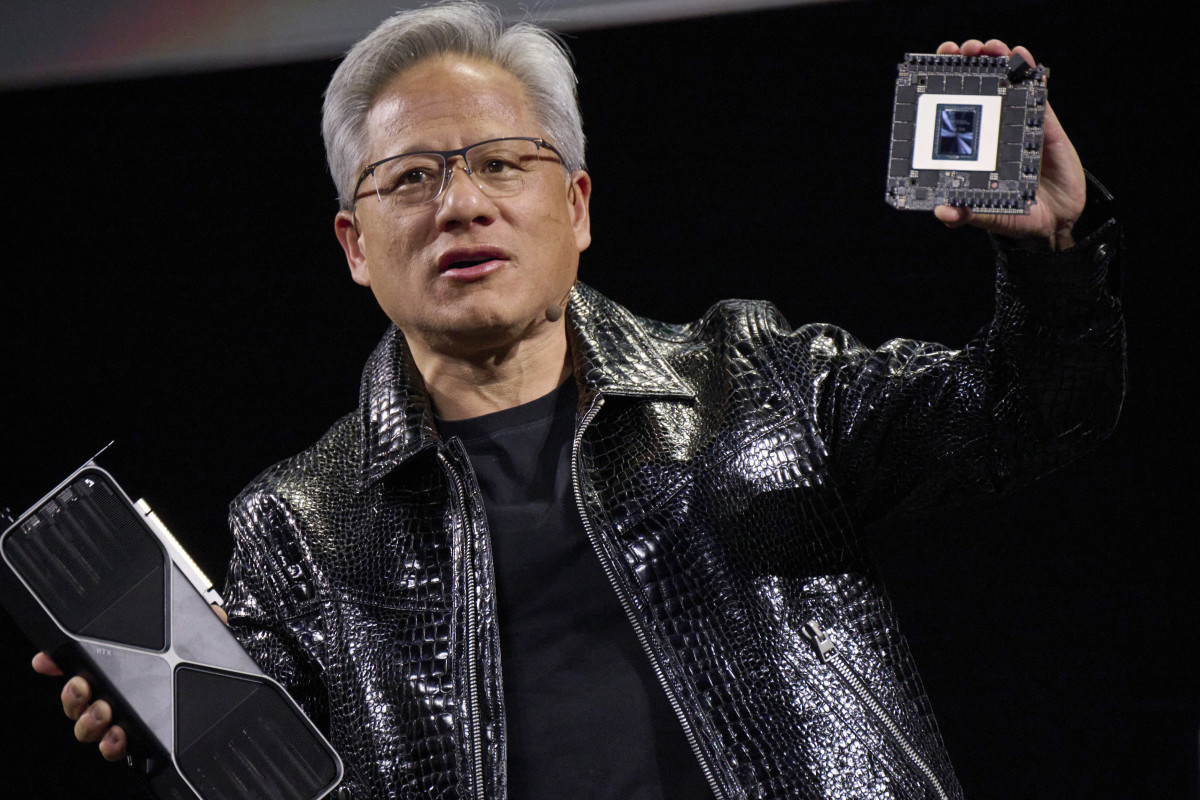

Nvidia just got in the robotics arms race — launching Jetson AGX Thor, its newest Blackwell-powered platform designed to supercharge the age of physical AI.

Thor delivers a staggering 2,070 FP4 teraflops of AI compute with 128GB of memory, all within a 130-watt power envelope. That’s 7.5x more AI compute and 3.5x better energy efficiency than its predecessor, Jetson Orin.

Related: NVIDIA (NVDA) Is Today's Momo Momentum Stock

Nvidia CEO Jensen Huang didn’t mince words: “We’ve built Jetson Thor for the millions of developers working on robotic systems that interact with and increasingly shape the physical world… Jetson Thor is the ultimate supercomputer to drive the age of physical AI and general robotics.”

Amazon Robotics, Boston Dynamics, Caterpillar, Figure, and Meta have already adopted it, and others, like OpenAI and John Deere, are actively testing it.

“The development of capable humanoid robots hinges on our ability to run powerful AI models directly on the robot,” said Figure CEO Brett Adcock. “Jetson Thor’s server-class performance… allows us to deploy the large-scale generative AI models necessary for our humanoids.”

More News:

- Billionaire George Soros supercharges Nvidia stake, loads up on AI plays

- Tesla just got its biggest break yet in the robotaxi wars with a key permit

- Bank of America drops shocking price target on hot weight-loss stock post-earnings

Amazon Robotics’ Tye Brady called it a game-changer for logistics: “NVIDIA Jetson Thor offers the computational horsepower and energy efficiency necessary to develop and scale the next generation of AI-powered robots.”

Caterpillar’s Joe Creed added,

“Jetson Thor offers the AI performance we need… enhancing precision, reducing waste and improving safety.”

What to Watch in Nvidia’s Q2 Earnings

Nvidia plans to report after the bell on Wednesday, Aug. 27. The press announcement is normally released between 4:20 and 4:30 p.m. ET, followed by the earnings call at 5:00 p.m. ET (2:00 p.m. PT).

For many investors, the earnings report is the event to watch, apart from NVDA's AI ventures.

What actually matters now? Guidance.

Investors want to hear:

- How rapidly Blackwell ramps up as Hopper demand begins to slow

- Whether supply is still constraining shipments

- Where gross margins are headed

- If data center capex is expanding

- How China and networking is evolving

- How much software attachment contributes

The call will also discuss hyperscaler spending intentions, the balance of inference and training, and Nvidia's buyback speed.

What's next for Nvidia's stock price

The setting is simple: a strong beat-and-raise might sustain the AI surge, but any signs of slower orders, packaging issues, or margin pressure could cause a reversal.

Margins will be sharply focused. Management previously reported ~71.8% GAAP and ~72.0% non-GAAP gross margins, however China licensing and H20 product dynamics may pose a downside risk.

The focus remains squarely on the Data Center, where Visible Alpha consensus is around $41 billion, driven by early Blackwell/GB200 traction and relieving networking bottlenecks.

Q3 guidance is essential. Investors want to know how Blackwell and Rubin will be implemented, what hyperscaler capex patterns are, and whether the supply-demand balance will remain tight.

The previous quarter established a high benchmark, with $44.1 billion in overall revenue and $39.1 billion from Data Center. To impress investors this time, Nvidia will likely need another beat-and-raise, sustained margins of around 72%, and confident commentary on GB200 uptake.

Related: Analyst reboots Nvidia stock forecast before earnings