U.S. financial markets were steady Tuesday after President Trump said he had removed Lisa Cook from the Federal Reserve's Board of Governors, an unprecedented move that analysts say could rattle investors.

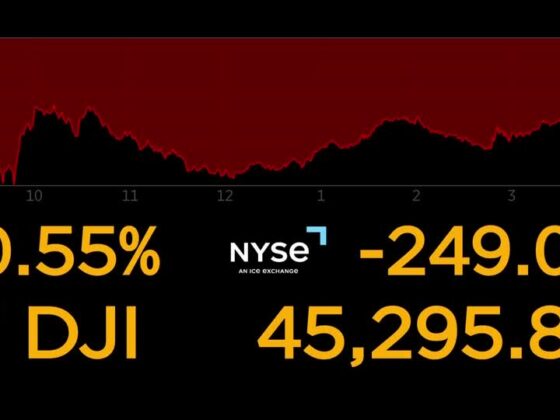

As of 9:45 a.m. EST, the S&P 500 was down 2 points, or 0.1%. Meanwhile, the Dow Jones industrial Average gained 2 points. The tech heavy Nasdaq Composite shed 56 points. But this muted start to morning trading in the U.S. contrasted with sharp declines on global markets, as investors digested news of a potential Fed shakeup that could reshape the composition of the Board of Governors.

The nonplussed start to morning trading came as investors digested news of a potential Fed shakeup that could reshape the composition of the Board of Governors.

Mr. Trump made his announcement in a letter posted on Truth Social on Monday evening, accusing Cook of mortgage fraud. The president said the move was “effective immediately.”

Mr. Trump was repeating allegations against Cook first leveled earlier this month by Federal Housing Finance Agency Director Bill Pulte. The senior housing official, who runs the agency that regulates mortgage giants Fannie Mae and Freddie Mac, alleged earlier this week that Cook falsified bank and property records to “obtain more favorable loan terms.”

“I have determined that there is sufficient cause to remove you from your position,” Mr. Trump wrote on Monday in the letter addressed to Cook. The president had previously called on the Fed official to resign.

Cook responded to the Monday post with a statement saying that Mr. Trump has no authority to fire her and that she will not resign, setting up a potential legal showdown that will test the president's authority to fire a member of the central bank. Under the Federal Reserve Act, the president can only remove a Fed official “for cause.” Fed board members serve for 14-year terms.

Mr. Trump “purported to fire me ‘for cause' when no cause exists under the law, and he has no authority to do so. I will not resign. I will continue to carry out my duties to help the American economy as I have been doing since 2022,” Cook said in a statement.

Global markets tumbled after the President's announcement. In Asian trading, most benchmarks declined. Germany's DAX lost 0.3%, while the CAC 40 in Paris slumped 1.4%. Britain's FTSE 100 gave up 0.5%.

Meanwhile, U.S. Treasury yields were mixed, with longer-term yields rising and lower-term yields edging lower. The 30-year Treasury yield rose to 4.92% on Tuesday morning, up two basis points from 4.90%. The yield on the 10-year Treasury also inched higher to 4.93%.

While Mr. Trump's move to fire Cook could be a source of unease for investors, it did not appear to shake their faith in a September rate cut. Traders see an 86% chance that the central bank will cut interest rates by a quarter of a percentage point, according to data from CME Group this morning.

Ulrike Hoffmann-Burchardi, CIO Americas and global head of equities at UBS Global Wealth Management expects the Fed to lower rates by a total of 1 percentage point over the central bank's next four meetings.

During a speech last week at the Jackson Hole, Wyoming economic forum Fed Chair Jerome Powell signaled a rate cut could be on the horizon. The Fed will “proceed carefully,”Powell said, but added that the shifting balance of risks “may warrant adjusting our policy stance.”

contributed to this report.