Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

In a new episode of Coin Stories with host Nathalie Brunell, investor and podcaster Preston Pysh offered a structurally grounded answer to a question many Bitcoin holders have been asking all summer: if corporate treasuries keep announcing big buys, why does price keep chopping and fading? Pysh’s diagnosis is not about a sudden loss of conviction from long-term holders, but about market-structure dynamics introduced by sophisticated “fast-money” firms that are designed to suppress volatility while extracting basis and funding premia.

Why Is Bitcoin Not Rising Much Higher?

Brunell framed the dilemma bluntly, asking why spot Bitcoin has gone sideways despite momentum from “the Trump administration” and “all these corporate treasury companies buying,” and who is “really on the sell side” creating headwinds for “$150k and $200k” targets people still float for year-end. Pysh began with empathy for that dissonance: “I definitely can feel the frustration and the pain because like it just feels like every day there’s another announcement of, oh, so and so company just bought ten thousand plus bitcoin. The price was down on the day or whatever.”

Related Reading: Bitcoin Holds Strong In ‘Wall Of Worry’, Path To $183,000 Remains Open – Analyst

From there, he pointed to the rise of delta-neutral, volatility-harvesting strategies run by major Wall Street trading houses. “If I was going to guess what I think it is, I think that you have fast money Wall Street traders—Jane Street to kind of name one actor and there’s many of them out there—that… are in the business of sucking volatility out of the market and really not having any exposure, other than they’re going long and short simultaneously and they’re arbitraging the difference.”

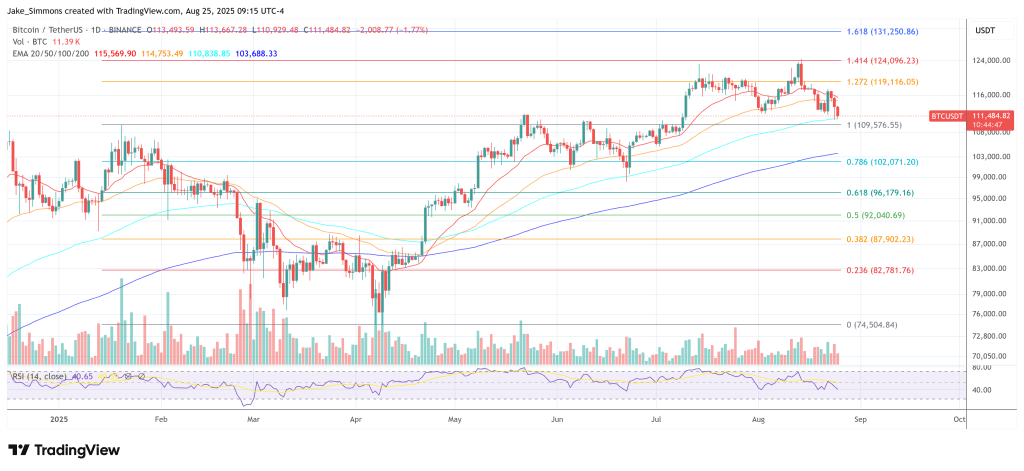

In practice, these trades pair spot, futures, and perpetual swaps so the desk is directionally flat while clipping the spread. The second-order effect, Pysh argued, is visible on the chart: “It’s going to make that volatility continue to collapse as it’s going up… the volatility is getting further and further dampened in that process.”

That suppression, he continued, changes how an uptrend feels. Instead of the typical explosive expansions that have historically punctuated Bitcoin bull markets, price action compresses into narrower bands, punctuated by mean-reversion.

“Where I think it takes you is this scenario where the spring is coiling and it kind of pops one way or the other,” he said. Directionally, the multi-cycle trend still points higher, but he resisted the lazy inference that a textbook volatility squeeze must resolve vertically. “Markets are highly dependent on liquidity… They’re dependent on all these other external factors… I’m not… saying the volatility is collapsing, it’s going up and we’re going to… the moon. I’m not saying that.”

Related Reading

Liquidity, in Pysh’s framework, is the gating variable that determines whether a coiled spring actually releases to the upside. He watches global risk proxies as a read-through for fiat liquidity rather than confining analysis to crypto-native flows.

“When I’m looking at the liquidity metrics of just global equity is a great way I like to… view… I’ll look at all the global equity markets and if they’re all ripping, that’s telling me that the markets are flush with liquidity—fiat liquidity. And right now that’s what we’re seeing… they’re all like bidding. So to me, that’s a healthy indicator that Bitcoin could go higher. But it also is dependent on whether that, whatever the source of that is, continues to persist.”

Feels like the most bearish bull market in Bitcoin.

What has been putting the sell pressure on btc? https://t.co/9EUuLJnerH pic.twitter.com/vPvpimm7rX

— Natalie Brunell ⚡️ (@natbrunell) August 23, 2025

Even so, Pysh cautioned against treating volatility compression as a deterministic countdown to six-figure price targets. “People just have to be careful… none of this is a guarantee that it’s going to continue to rip or that compression is signaling that we’re going to $200k in weeks.”

He also acknowledged that, if one still subscribes to the four-year halving cadence, this leg looks different from prior cycles. “We’ve maybe seen a little bit of what we’ve seen, which is this dampening of what we have historically seen in the price action… At this part of the cycle… you would have seen a very aggressive move kind of already taking place and… to be honest with you, back… Christmas time frame I would have guessed by now,” he admitted, trailing off as if to concede that the expected vertical expansion simply hasn’t materialized on schedule.

At press time, BTC traded at $111,484.

Featured image created with DALL.E, chart from TradingView.com