Ethereum price is on track for its strongest Q3 since the network launched in 2015, gaining 83% so far and fueling forecasts that it could reach as high as $7,500 by year-end.

Summary

- Ethereum price is on track for its strongest Q3 since 2015, already up 83% compared with a historical median of 8.19%.

- Institutional inflows are driving momentum, with $11B year-to-date into ETH funds and U.S. spot ETFs now holding over $23B.

- Network upgrades like Pectra have cut rollup costs and lifted staked ETH to 35M (29% of supply), strengthening fundamentals.

- Analysts forecast Ethereum could climb toward $6,000–$7,500 if ETF demand holds, though key support sits near $4,350.

Ethereum price heads for best Q3 since inception

Ethereum (ETH) price is on track for its most profitable third quarter since the network went live in 2015.

Data from Coinglass shows ETH has already delivered over 83% return in Q3 2025, far above its historical median of 8.19% and nearly ten times the long-term average of 9.3%.

No other third quarter has reached this level. The closest came in 2020, when Ether climbed 59.5%, followed by 2021 with 31.86%.

The rally began in July, when Ethereum rose 49% in a single month, its best performance since July 2022.

That momentum carried into August, when it briefly touched $4,946 on Aug. 25, surpassing the all-time high set in November 2021. As of this writing, ETH is trading around $4,550, down more than 8% from the peak.

The price action is particularly striking given Ethereum’s seasonal record. Out of the past nine third quarters, six have closed in negative territory.

Q3 2018 saw a 48.69% decline, Q3 2019 dropped 37.43%, and Q3 2022 managed only a modest 24.09% gain after steep losses earlier that year. Against that backdrop, 2025 is breaking long-standing patterns.

History also shows that strong third quarters have often set the stage for further gains.

In 2017, ETH rose about 27% in Q3 before tripling over the following six months. In 2021, a 31.86% Q3 rally was followed by a surge that lifted the token from around $2,300 in late September to nearly $4,900 by November.

Amid so much activity around Ethereum’s price, the question now is: where does it go next?

Flows, ETFs, and positioning behind Ethereum price

Institutional inflows have been a defining feature of Ethereum’s price performance in Q3 2025.

CoinShares data shows that in the week ending Aug. 15, digital asset funds recorded $3.75 billion in inflows, the fourth-largest weekly total on record. Ethereum-linked products accounted for $2.87 billion of that amount, or 77% of the total.

By mid-August, year-to-date inflows into Ethereum funds had reached $11 billion, supported by rising assets under management across multiple providers.

The U.S. has been a key driver of this momentum. Spot Etherum ETFs listed in the U.S. have attracted $7.1 billion in net inflows this year, with $5.3 billion coming in just the past month.

The iShares Ethereum Trust has expanded its assets from under $2 billion in mid-April to almost $13 billion. Total holdings in U.S.-listed ETH ETFs now exceed $23 billion, creating a steady base of demand that was absent in earlier cycles.

At the same time, call activity continues to outweigh put demand, suggesting that investors are more focused on upside exposure than downside protection.

Liquidity has also improved alongside these inflows. Bid-ask spreads on major exchanges are now narrower than in early 2025, reflecting deeper engagement from both ETF and derivatives traders.

Taken together, record ETF inflows, rising futures exposure, and concentrated call option activity show why institutional money has been the driving force behind Ethereum’s strongest third-quarter performance to date.

Fundamentals and upgrades shaping Ethereum price

Network upgrades have played an important role in supporting Ethereum’s price this year.

The Pectra upgrade, activated in May 2025, introduced several Ethereum Improvement Proposals aimed at improving scalability, user experience, and validator efficiency.

Among the most notable was EIP-7702, which added account-abstraction-like features, allowing wallets to operate more flexibly without compromising security.

Meanwhile, EIP-7251 raised the maximum validator cap, making it easier to consolidate staking operations. Higher blob targets also lowered transaction costs on rollups by improving data availability for layer-2 networks.

These changes are already influencing usage patterns. Average transaction costs on major rollups, including Arbitrum (ARB) and Optimism (OP), have declined since May.

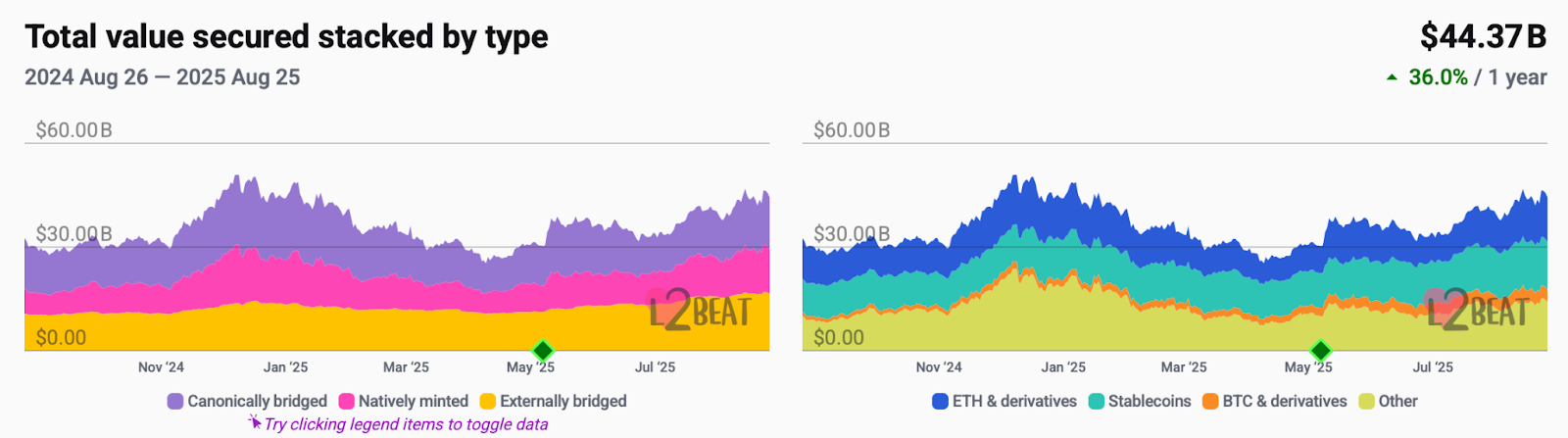

Cheaper data storage has made it more practical for applications to scale on Ethereum rather than moving to competing chains. The shift is reflected in the rise of total value secured on layer-2s, which now exceeds $44 billion, according to L2Beat.

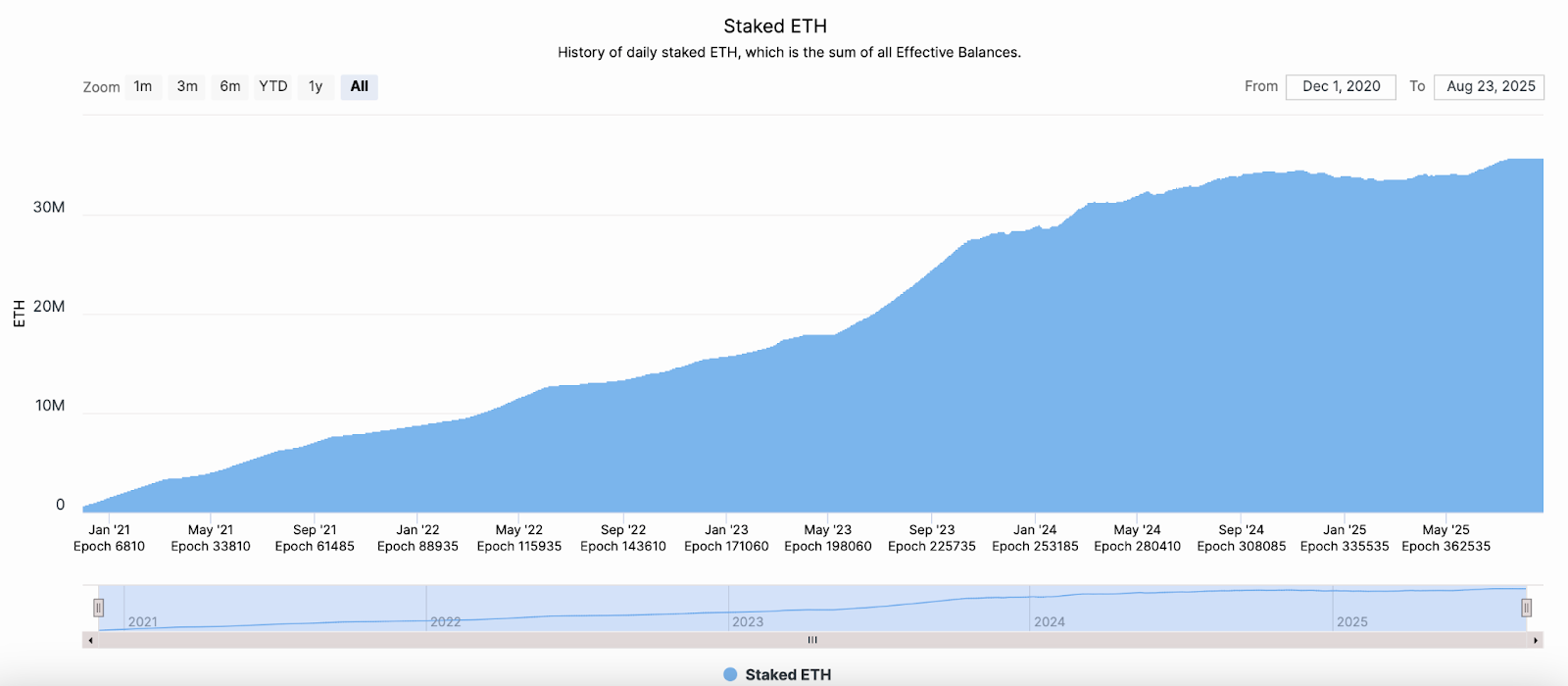

Staking metrics highlight the same trend. More than 35 million ETH is currently staked, equal to about 29% of the circulating supply.

The staking ratio has climbed steadily since the Merge in 2022, signaling growing confidence in Ethereum’s long-term yield model.

At the same time, issuance has remained close to neutral. The burn mechanism introduced in EIP-1559 continues to offset new issuance during periods of high activity, keeping net supply growth near zero.

Development is already shifting toward the next upgrade, Fusaka, expected toward the end of 2025. Key proposals include PeerDAS, a system for distributed data sampling designed to further reduce costs for rollups, along with enhancements to blob-producing operations.

If delivered on schedule, these changes would lower costs for developers and strengthen Ethereum’s position as the base layer for decentralized applications.

Ethereum price prediction and technical analysis

Ethereum’s price is consolidating after setting a new high. Market analyst Ted Pillows noted that Ether is currently testing the $4,560 support level. If this zone fails, the next key level sits near $4,350, where buyers previously stepped in.

At the same time, Standard Chartered on Aug. 13 raised its year-end target for ETH to $7,500 from $4,000, citing consistent ETF inflows and stronger fundamentals.

Technical analysts point out that a sustained move above the $5,000 zone could open the way toward $5,500–$6,000 in the near term, with higher projections possible if inflows remain firm and derivatives positioning holds.

The challenge is volatility. Large single-day ETF withdrawals or a broader macroeconomic shock could quickly reverse the momentum.

For now, the path forward hinges on key levels. Holding above $4,560 and reclaiming $5,000 keeps the case for a move toward $6,000–$7,500 intact. A drop below $4,350, however, would likely trigger deeper short-term corrections.

Ethereum’s fundamentals and institutional demand appear stronger than in previous cycles, but its price remains volatile and closely tied to macro conditions, capital flows, and upgrade timelines. As always, trade wisely and never invest more than you can afford to lose.