Ethereum has officially entered a new phase after breaking its previous all-time highs and pushing into uncharted territory. The recent surge carried ETH to $4,886, yet the rally stopped short of the much-anticipated $5,000 milestone. While bulls continue to show resilience, the market now faces a pivotal moment. Analysts are divided: some expect Ethereum to continue its upward march into price discovery, while others warn that the market could be preparing for a deeper correction.

Related Reading

This uncertainty comes amid rising speculative activity. According to CryptoQuant, a critical indicator known as the Leverage-Driven Pump has flashed six times this month alone. Each instance reflects a surge in price fueled by leverage in the derivatives market rather than purely organic spot demand. Historically, such signals have produced mixed outcomes: some rallies retraced quickly, others extended before exhaustion set in.

With institutional accumulation supporting long-term growth and derivatives adding fuel to short-term volatility, Ethereum stands at a crossroads. Whether this phase becomes the foundation for a sustainable climb above $5,000 or a setup for profit-taking will depend heavily on how leverage unwinds in the coming sessions. The next few days could prove decisive for ETH’s trajectory.

Ethereum Faces Risks Amid Strong Fundamentals

According to top analyst Maartunn, Ethereum has now seen its Leverage-Driven Pump indicator flash six times this month alone. Out of these signals, four retraced either partially or fully, one continued pumping after stopping out shorts, and the latest one remains live right now. Based on this pattern, Maartunn suggests that Ethereum could soon retrace again, as excessive leverage in derivatives markets often creates unstable conditions that end in pullbacks.

However, while technical signals point toward short-term risks, the fundamentals remain strongly bullish. Ethereum has not only broken past its 2021 all-time high of $4,860 but is also backed by robust institutional accumulation. Companies such as BitMine and SharpLink Gaming are acquiring ETH in large amounts, locking up billions in supply. This trend reduces available liquidity on exchanges, effectively amplifying scarcity during periods of heightened demand.

Another key factor is the decline in ETH balances on centralized exchanges, showing that investors prefer to hold or stake their coins rather than trade them actively. This outflow aligns with long-term accumulation behavior, historically a precursor to major rallies.

While leverage-driven volatility could bring short-lived retracements, Ethereum’s market structure is tilting toward continuation. If institutions keep accumulating and supply keeps leaving exchanges, ETH could sustain momentum and push well beyond its 2021 highs in the months ahead.

Related Reading

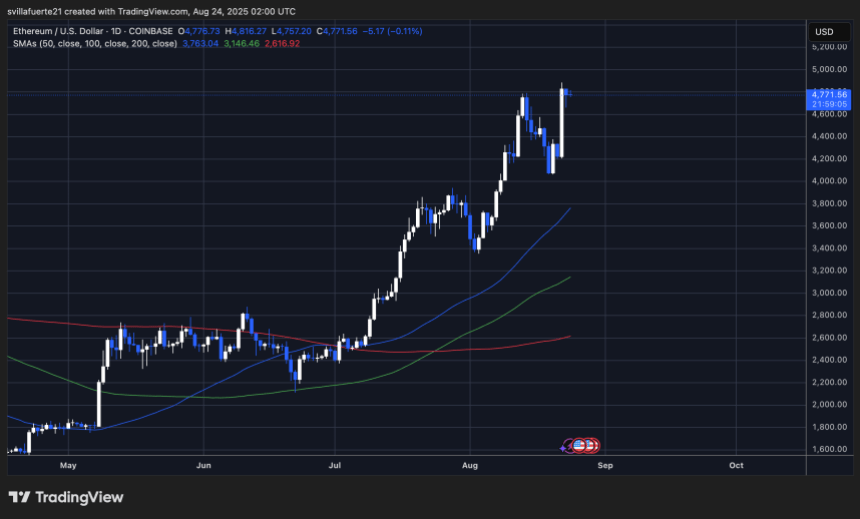

Daily Chart Signals Critical Moment

Ethereum’s daily chart shows ETH trading at $4,771, holding steady after a volatile rally that tested new all-time highs last week. The chart reflects a clear bullish structure, with ETH establishing higher highs and higher lows since mid-July. The 50-day moving average sits well below the current price at $3,763, while the 100-day and 200-day averages are at $3,146 and $2,616, respectively. This wide gap signals strong momentum, but it also highlights how extended the market has become in the short term.

The recent surge, which saw ETH briefly dip below $4,200 before bouncing back aggressively, shows strong buyer demand at lower levels. The recovery candle indicates that bulls quickly absorbed selling pressure, pushing ETH into a tight consolidation just under the psychological $5,000 barrier. Breaking this level convincingly could open the door to rapid continuation into uncharted price territory.

Related Reading

However, volatility remains elevated. Sharp moves often follow such strong expansions, and retracements toward support at $4,500 or even $4,200 cannot be ruled out. Traders will be watching for sustained closes above $4,800 as confirmation of bullish continuation, while a failure to defend key supports could trigger a deeper correction.

Featured image from Dall-E, chart from TradingView