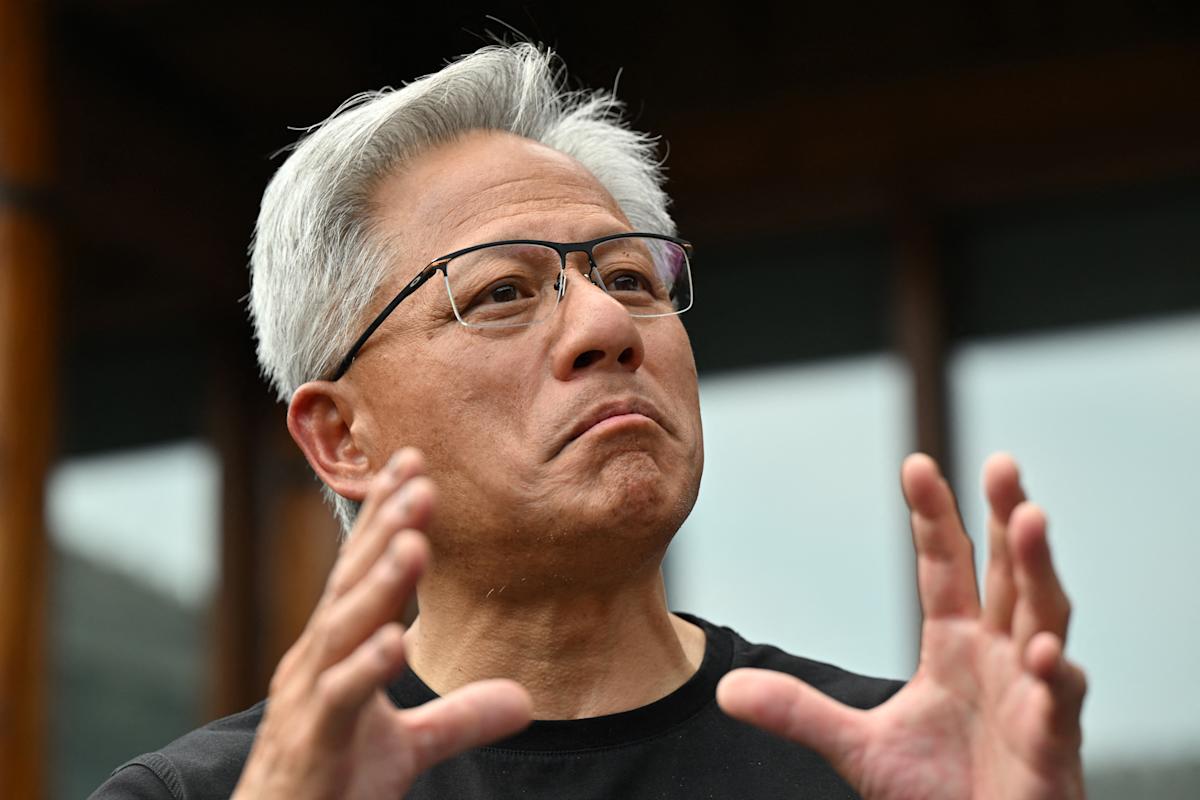

Stocks ended the week in rally mode after Federal Reserve Chair Jerome Powell opened the door for a September interest rate cut.

In the week ahead, earnings from Nvidia (NVDA) will see the world's largest company and AI leader test a summer rally that has stocks back near record highs.

After slump earlier in the week, a massive surge following Powell's comments in Jackson Hole left the Dow Jones Industrial Average (^DJI) at a record high and other indexes roaring. The S&P 500 (^GSPC) rose 0.3% on the week, while the Nasdaq Composite (^IXIC) slipped 0.5%. The Dow gained 1.5%.

Nvidia's quarterly earnings release after the bell on Wednesday will be the week's key event, with updates on inflation, GDP growth, home sales, and consumer sentiment featuring on an economic calendar that will be busier than the earnings calendar.

Outside of Nvidia, reports from Dell (DELL), Dick's Sporting Goods (DKS), Best Buy (BBY), Dollar General (DG), and Abercrombie & Fitch (ANF) will serve as the corporate highlights.

During what was likely his final speech at the Jackson Hole Symposium as Fed chair, Jerome Powell told the audience the “shifting balance of risks may warrant adjusting our policy stance.” For investors, the words “may warrant” became a green light on rate cuts next month.

Markets rallied in kind.

In his speech, Powell highlighted that “downside risks to employment are rising,” while “a reasonable base case is that the effects [of tariffs on inflation] will be relatively short-lived.”

JPMorgan's chief US economist, Michael Feroli, told clients in a note on Friday Powell's comments indicated the “door to a September cut opened wider.” And market pricing suggested as much — investors were placing 85% odds on Friday that Fed will cut interest rates by a quarter of a percentage point at its September meeting, per the CME FedWatch Tool.

These rate cut hopes will be put to the test on Friday with the release of the Personal Consumption Expenditures (PCE) index, the Fed's preferred inflation measure.

Economists expect annual “core” PCE — which excludes the volatile categories of food and energy — to have clocked in at 2.9% in July, up from the 2.8% seen in June. This would mark the highest annual increase since February. Over the prior month, economists project “core” PCE at 0.3%, unchanged from June.

“Tariff-related price pressures are broadening across the goods sector and appear to be spilling over into the services sector,” wrote economists at Wells Fargo in a note.