Can stock investors benefit from corporate bond market data? Yes. In fact, equity portfolios constructed using bond momentum signals may outperform their traditional equity price momentum counterparts.

But as our study demonstrates, the signal design is critical.

Momentum Spillover

The momentum spillover effect describes the signal that a company’s bond momentum sends about its future stock returns and is attributed to information asymmetry in the financial markets.

There are several reasons why bond market data might have unique insights for equity investors:

- Institutional investors with advanced expertise and access to more and better data dominate the bond markets relative to their equity counterparts. This may give the bond markets an informational advantage.

- Since bonds have more predictable future cash flows, their prices may better reflect their fundamental value.

- Low liquidity and high transaction costs may insulate bond markets from speculation and short-term volatility.

Bond Momentum Design

Harvesting the momentum spillover premium requires an appropriately designed bond momentum signal. Unlike stock momentum, bond momentum has no single definition. According to the academic literature, bond momentum signals take three forms:

- Total Return Bond Momentum reflects the aggregated trailing total return of all of a company’s outstanding bonds.

- Excess Return Bond Momentum describes the difference between the bond total return and duration matched risk-free bond total return.

- Spread Change Bond Momentum is the negative value of the spread change.

In “Momentum in Corporate Bond Returns,” Gergana Jostova et al., examine Total Return Bond Momentum and identify a strong momentum effect in non-investment-grade bonds. But ranking stocks based on bond total return, or interest rate and spread return, may be ill-advised since the former is a systematic factor driven by sovereign interest rate dynamics. As a result, the interest rate exposure of a company’s debt can significantly influence Total Return Bond Momentum. That is why we focus here on Spread Change Bond Momentum and Excess Return Bond Momentum.

Applying Bond Momentum to an Equity Portfolio

Our bond dataset is based on the Russell 1000 stock universe and starts in 2003, shortly after the launch of the Trade Reporting and Compliance Engine (TRACE) fixed-income database. We mapped corporate bond securities to their stocks using a common company ID. As of December 2022, about 60% of Russell 1000 firms representing 86% of the index’s total market cap have bond data coverage.

We computed market-value-weighted excess bond returns and spread changes for all debt-issuing companies with a trailing three-month lookback window and built factor-mimicking portfolios by sorting stocks into quintiles (Q1 to Q5) based on their bond momentum scores. The first chart presents the performance summary of equally weighted and market-cap weighted Q1 to Q5 factor portfolios, along with a Carhart momentum factor portfolio for comparison purposes .

Both bond momentum signals outperformed traditional equity momentum on an equal- and market-cap-weighted basis and had higher information ratios. Furthermore, Spread Change Bond Momentum eclipsed Excess Return Bond Momentum with higher Q1 annualized returns and Q1 to Q5 return spreads.

Hypothetical Bond Momentum Portfolio Performance Summary

(Russell 1000, 2003 to 2022)

| Portfolio | Excess Return Bond Momentum | Spread Change Bond Momentum | Equity Momentum | ||||||

| Annualized Return | Excess Return | Information Ratio | Annualized Return | Excess Return | Information Ratio | Annualized Return | Excess Return | Information Ratio | |

| Equally Weighted Portfolio | |||||||||

| Q1 | 12.2% | 1.9% | 0.34 | 12.9% | 2.7% | 0.41 | 11.5% | 1.3% | 0.24 |

| Q2 | 12.5% | 2.3% | 0.44 | 12.6% | 2.4% | 0.47 | 11.3% | 1.1% | 0.28 |

| Q3 | 12.6% | 2.4% | 0.47 | 12.1% | 1.9% | 0.40 | 12.0% | 1.7% | 0.36 |

| Q4 | 11.3% | 1.1% | 0.25 | 11.1% | 0.9% | 0.23 | 11.4% | 1.2% | 0.25 |

| Q5 | 11.1% | 0.9% | 0.20 | 10.9% | 0.7% | 0.19 | 12.9% | 2.7% | 0.29 |

| Q1–Q5 | 1.1% | – | – | 2.0% | – | – | –1.4% | – | – |

| Market Cap Weighted Portfolio | |||||||||

| Q1 | 10.0% | –0.2% | 0.04 | 10.5% | 0.3% | 0.10 | 9.3% | -0.9% | -0.11 |

| Q2 | 10.9% | 0.7% | 0.17 | 11.4% | 1.2% | 0.29 | 11.3% | 1.1% | 0.26 |

| Q3 | 10.6% | 0.4% | 0.11 | 10.7% | 0.5% | 0.11 | 10.7% | 0.5% | 0.14 |

| Q4 | 10.1% | –0.1% | –0.02 | 9.4% | –0.8% | –0.13 | 9.3% | -0.9% | -0.12 |

| Q5 | 8.8% | –1.4% | –0.24 | 7.6% | –2.6% | –0.36 | 10.5% | 0.3% | 0.13 |

| Q1–Q5 | 1.2% | – | – | 1.9% | – | – | –1.2% | – | – |

The data contained herein does not represent the results of an actual investment portfolio but reflects the hypothetical historical performance. Past Performance is not indicative of future results.

Analysis

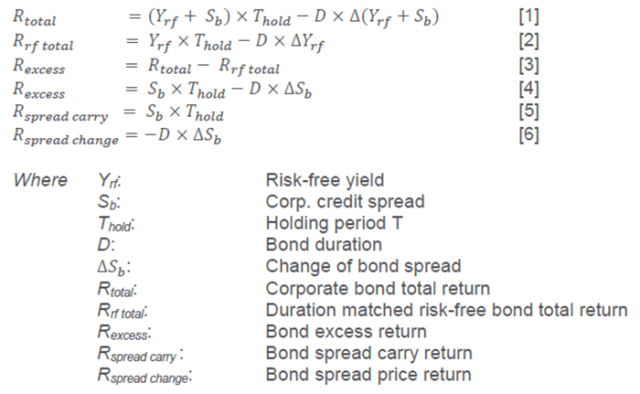

That Spread Change Bond Momentum outperforms Excess Bond Momentum is no coincidence. There are some fundamental explanations for this outcome. Using basic bond math, we decompose bond excess return into spread carry return and spread price return in Equations 1 to 6 below. Spread carry return is a function of spread level while spread price return is driven by spread change. Spread change is the only component that directly captures company-specific market sentiment.

We also applied Fama–Macbeth regressions to further evaluate the two bond momentum signals. Specifically, we ran cross-sectional regressions each month using one-month forward stock returns as independent variables and common stock factors plus bond momentum as dependent variables. The model outputs are presented in the following table.

Stock Return and Bond Momentum Factors: Cross-Sectional Analysis, 2003 to 2022

| Model 1 | Model 2 | Model 3 | Model 4 | |

| Intercept | 0.0103 [3.46] | 0.0103 [3.44] | 0.0106 [3.56] | 0.0105 [3.52] |

| Market | 0.0024 [1.49] | 0.0024 [1.47] | 0.0024 [1.45] | 0.0024 [1.46] |

| Size | 0.0006 [1.59] | 0.0006 [1.55] | 0.0006 [1.70] | 0.0007 [1.85] |

| Value | –0.0004 [-0.53] | –0.0004 [-0.48] | –0.0004 [-0.49] | –0.0004 [-0.50] |

| ROE | 0.0001 [0.04] | 0.0002 [0.06] | 0.0001 [0.02] | –0.0001 [-0.02] |

| Low Vol | 0.0133 [1.55] | 0.0126 [1.49] | 0.0122 [1.46] | 0.0122 [1.45] |

| Momentum | 0.0034 [0.85] | 0.0029 [0.75] | 0.0026 [0.67] | 0.0028 [0.71] |

| Excess Return Bond Momentum | 0.0357 [1.71] | –0.0072 [-0.25] | ||

| Spread Change Bond Momentum | 0.1957 [2.54] | 0.2209 [2.10] | ||

| R^2 | 0.1347 | 0.1382 | 0.1381 | 0.1403 |

The data contained herein does not represent the results of an actual investment portfolio but reflects the hypothetical historical performance. Past Performance is not indicative of future results

Model 1 is a baseline Fama–French three-factor model plus return on equity (ROE), Low Volatility, and Momentum. Model 2 expands on Model 1 by adding Excess Return Bond Momentum as an independent variable. Model 3 uses Spread Change Bond Momentum as the additional variable, while Model 4 includes both bond momentum signals as explanatory variables.

The outputs from Model 2 and Model 3 indicate that both bond momentum signals can increase the explanatory power of the baseline model, or Model 1. When included as a stand-alone variable, Spread Change Bond Momentum shows higher statistical significance than Excess Return Bond Return, and when both signals are included, Spread Change Bond Momentum better predicts future stock returns.

Conclusion

The more widely available bond data becomes, the more academics and practitioners will apply it to equity signal research. Based on our analysis of the corporate bonds of US large-cap stocks, a well-designed bond momentum signal that effectively captures market sentiment can help achieve significant equity alphas, and as our backtest and cross-sectional analysis show, Spread Change Bond Momentum is the most effective way to harvest this momentum-spillover premium.

Further Reading

Bittlingmayer, G., and Shane Moser. “What Does the Corporate Bond Market Know?” The Financial Review.

Chan, Louis K. C., Narasimhan Jegadeesh, and Josef Lakonishok. “Momentum Strategies.” Journal of Finance.

Dor, Arik Ben, and Zhe Xu. “Should Equity Investors Care about Corporate Bond Prices? Using Bond Prices to Construct Equity Momentum Strategies.” The Journal of Portfolio Management.

Gebhardt, William R., Soeren Hvidkjaer, and Bhaskaran Swaminathan. “Stock and Bond Market Interaction: Does Momentum Spill Over?” Journal of Financial Economics.

Israel, Ronen, Diogo Palhares, and Scott A. Richardson. “Common Factors in Corporate Bond Returns.” Journal of Investment Management.

Gergana Jostova, Stanislava Nikolova, Alexander Philipov, and Christof W. Stahel. “Momentum in Corporate Bond Returns.” Review of Financial Studies.

Lee, Jongsub, Andy Naranjo, and Stace Sirmans. “CDS Momentum: Slow-Moving Credit Ratings and Cross-Market Spillovers.” The Review of Asset Pricing Studies.

Wiltermuth, Joy J. “Electronic Trading in U.S. Corporate Bonds Is Finally Taking Off. But It’s Still Early Days, Says This Investor.” MarketWatch.

If you liked this post, don’t forget to subscribe to the Enterprising Investor.

All posts are the opinion of the author. As such, they should not be construed as investment advice, nor do the opinions expressed necessarily reflect the views of CFA Institute or the author’s employer.

Image credit: ©Getty Images/ atakan

Professional Learning for CFA Institute Members

CFA Institute members are empowered to self-determine and self-report professional learning (PL) credits earned, including content on Enterprising Investor. Members can record credits easily using their online PL tracker.