Shares in Intel popped 5% in pre-market trading on Tuesday, following reports of major investments in the struggling chipmaker.

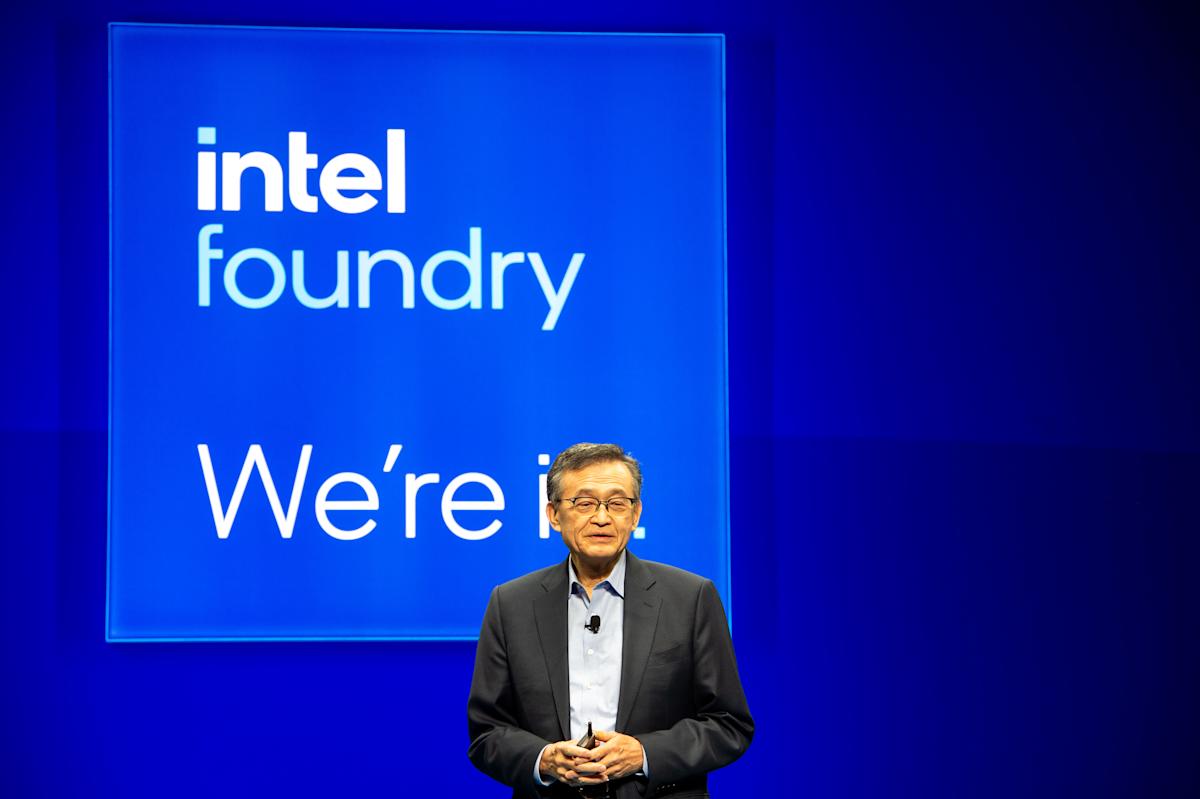

Japanese company Softbank Group (9984.T) announced on Tuesday that it had signed an agreement with Intel to buy $2bn of its common stock.

Masayoshi Son, CEO of SoftBank Group, said: “This strategic investment reflects our belief that advanced semiconductor manufacturing and supply will further expand in the United States, with Intel playing a critical role.”

Meanwhile, Bloomberg reported on Monday that the Trump administration is in talks to take a stake of about 10% in Intel.

Shares in Palo Alto Networks (PANW) jumped more than 5% in pre-market trading on Tuesday, after the US cybersecurity firm's latest quarterly earnings beat expectations.

Palo Alto posted a 16% rise in revenue in the fourth quarter to $2.54bn, compared with estimates of $2.5bn, according to S&P Global Market Intelligence. Earnings per share of $0.95 were also ahead of the $0.89 expected by analysts.

Nikesh Arora, CEO of Palo Alto Networks, said: “We exited fiscal year 2025 with an acceleration in RPO [remaining performance obligations], and surpassed the $10bn revenue run-rate milestone, positioning ourselves well for sustained growth ahead.”

Read more: Stocks that are trending today

For the first quarter of its 2026 fiscal year, Palo Alto guided to total revenue in the range of $2.45bn to $2.47bn, which would represent year-on-year growth of 15%. The company said it expected to report earnings per share of $0.88 to $0.90.

As for the full year ahead, Palo Alto expects total revenue to be in the range of $10.475bn to $10.525bn and earnings per share of $3.75 to $3.85.

Shares in GoodRx (GDRX) soared more than 37% on Monday and were up a further 3.5% in pre-market trading on Tuesday, after the telemedicine platform operator announced a collaboration with Danish pharma giant Novo Nordisk (NOVO-B.CO, NVO).

GoodRx said that all strengths of Ozempic and Wegovy pens were available to eligible paying patients in the US for $499 per month through its platform.

The partnership significantly lowered the price of GLP-1 medications, marking the first time Ozempic has been made available to patients at this self-pay price.

Wendy Barnes, CEO of GoodRx, said: “Demand for GLP-1 medications is at an all-time high, but too many Americans still face barriers accessing them. By partnering with Novo Nordisk, we’re taking a significant step forward in making these innovative brand-name treatments more accessible for millions of people who need them.”