I decided to do a mid-month update so that the updates will not lag too far behind. I would usually do this when I remember, or when I have the time so they can have a three month lag.

You can review my past spending logs by going to the personal notes section of investment moats here in the future.

How I Group My Spending.

One of the reasons for publishing the spending is to show people just how spending should be. Some would wonder if it is consistent or erratic, high or low. If you are interested, you see it, and you form your own tale about it.

You will be able to tune in to a spending profile of someone who is single, older, a fully paid up home. If you spend more than this, then you can ponder why is that and what you think about it. If you spend less than this, then you can ponder why and what do you think about it.

I group my spending based around a few technical grouping:

- Flexible or Inflexible: There are some spending that we can be more flexible with. The spending tends to fluctuate over time. There are some spending that is more inflexible. The impact of this is felt more if you are retrench from work, wish to take a hard pivot in your life or career, planning for financial security or future retirement. A more inflexible spending would require your planned income stream to be more conservative while you can take some more risk if you have flexibility in your spending.

- Finite or Ongoing: There are some spending that will stop at some point but there are some spending that we don’t see it stopping objectively. Finite spending are insurance premiums, mortgage, allowance for kids, allowance for parents etc. Ongoing spending is a certain kind of transport spending.

- Role or Responsibility: What am I currently? Am I a worker? A husband? Or a Son? Some of the spending are group this way so that we are able to see just how much we are spending on something. Some of these responsibility will go away. For example, you spend on some travels, clothes, pay income tax because you are a worker. But if you are planning for a non-working phase of life, would you wish to know how much that you spend today can be peeled away.

In a way, this works for me because I always have an eye from the Financial Independence planning perspective. You might not, and you have your own reasons.

I hope that your way of grouping have some sensibility to it and helps you in your own way.

This is the spending for the month of June, not this month. Illustrations can be found on Instagram here.

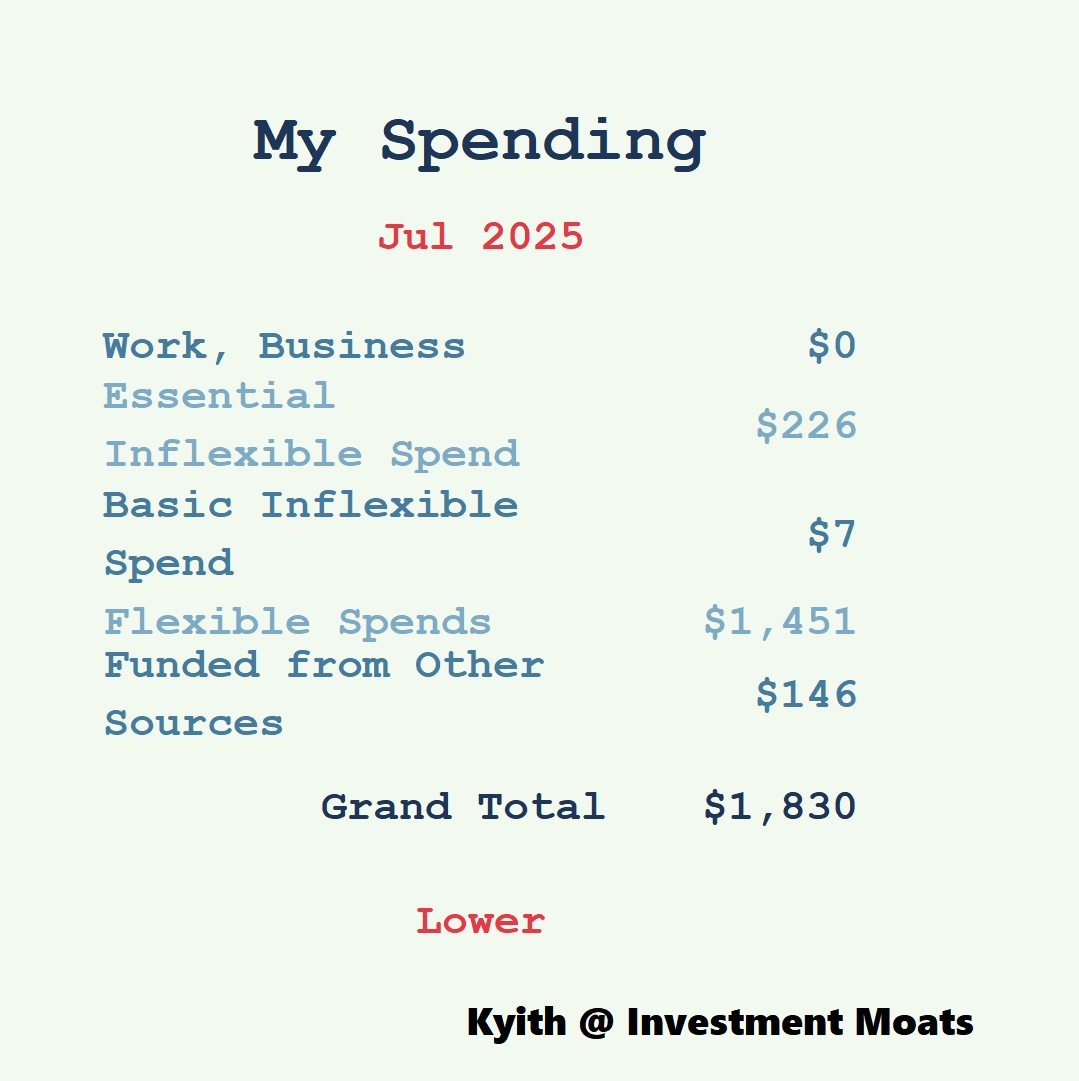

Spending in July got back to normal. I been spending my time doing more homely activities so this explains the lower spending.

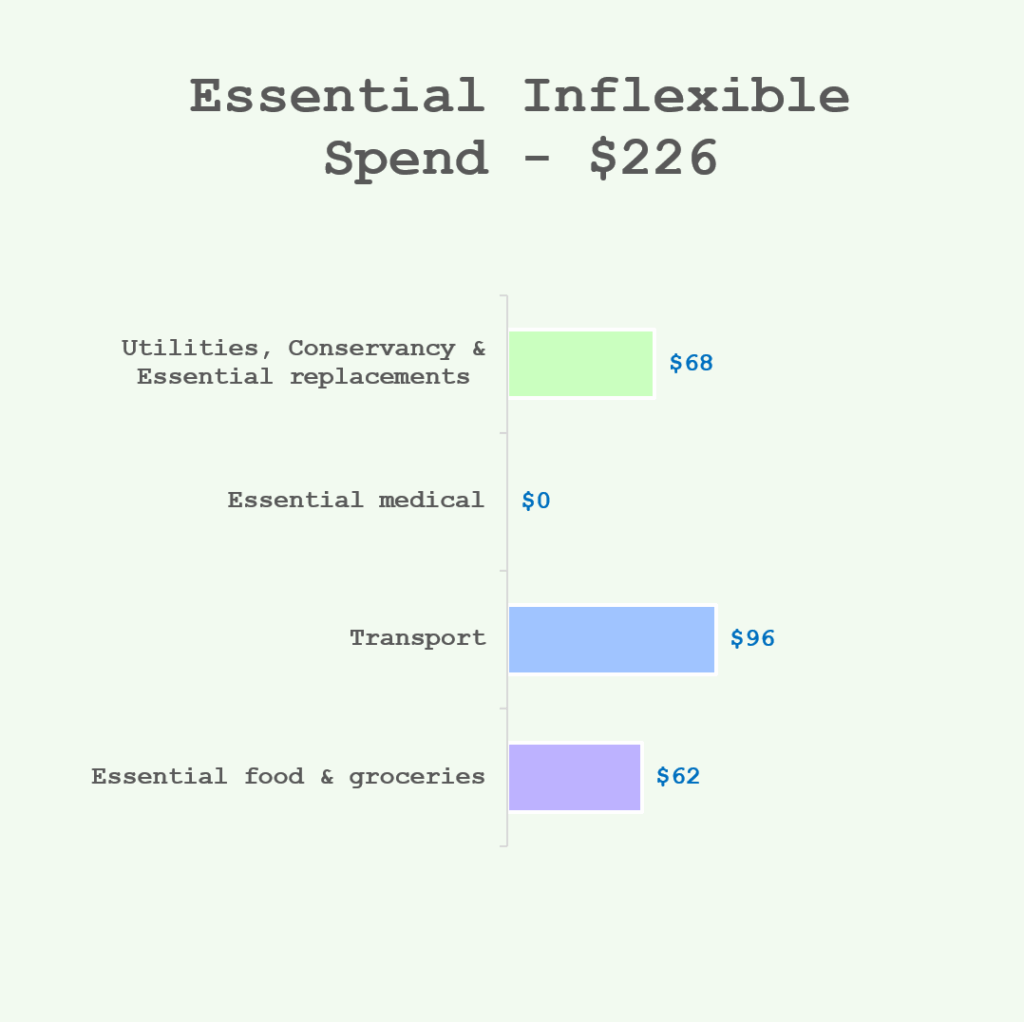

The Essential Inflexible Spend

I wrote about my essential inflexible spend here in this note: What kind of lifestyle would I need to buy for myself?

I group and track this set of rather inflexible spending to be reflective about how realistic is the numbers as part of the notes written above. The income stream from my Daedalus Income Portfolio is meant to pay for this spending as well.

The food spending is lower because of a few reasons:

- Eating food left over from Providend events. There will usually be food left over from events so some of the interested staff will pack up and have them for the night. If not too many are interested, then usually that ends up in my stomach.

- CDC Supermarket vouchers means the groceries bills are lower.

July happen to be the month were we see 50% off my conservancy fees.

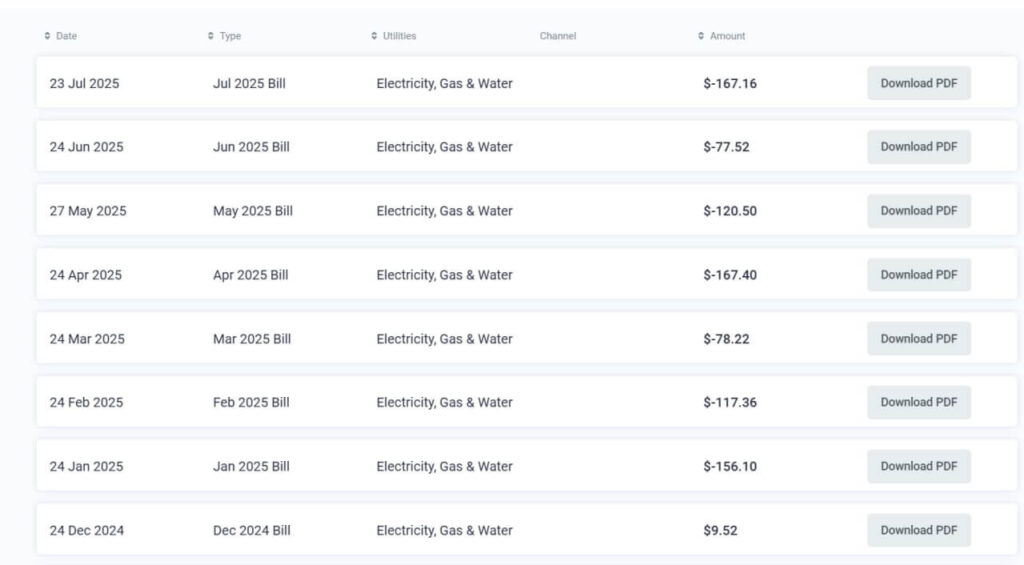

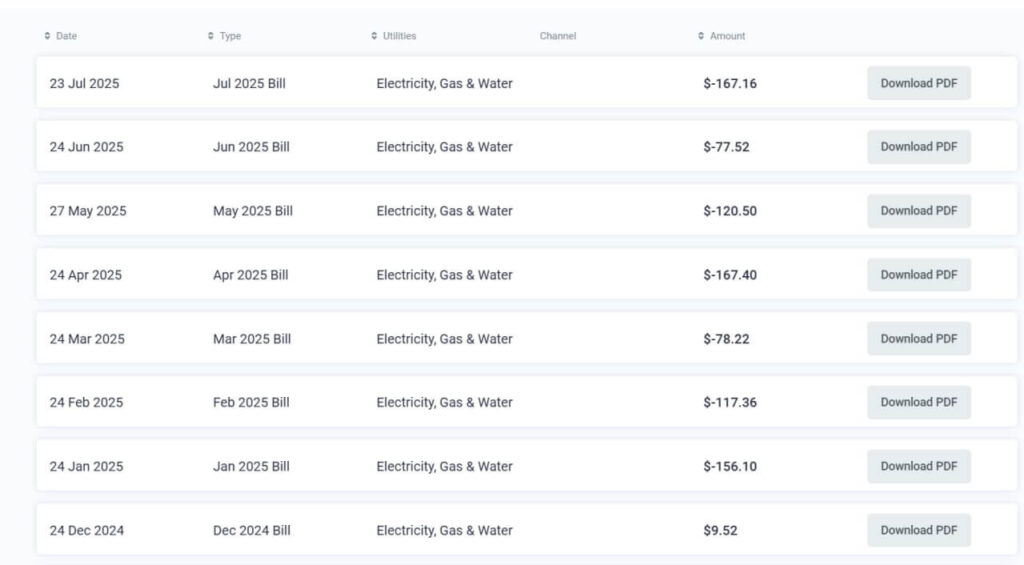

I thought the utilities look very low still so I decide to login to SP Group to take a look:

Turns out my usual $40 a month utility spending is so low that after the Government’s U-save deduction, which can be carried to the next month, I haven’t been paying any utility bills for the last 7 months of the year.

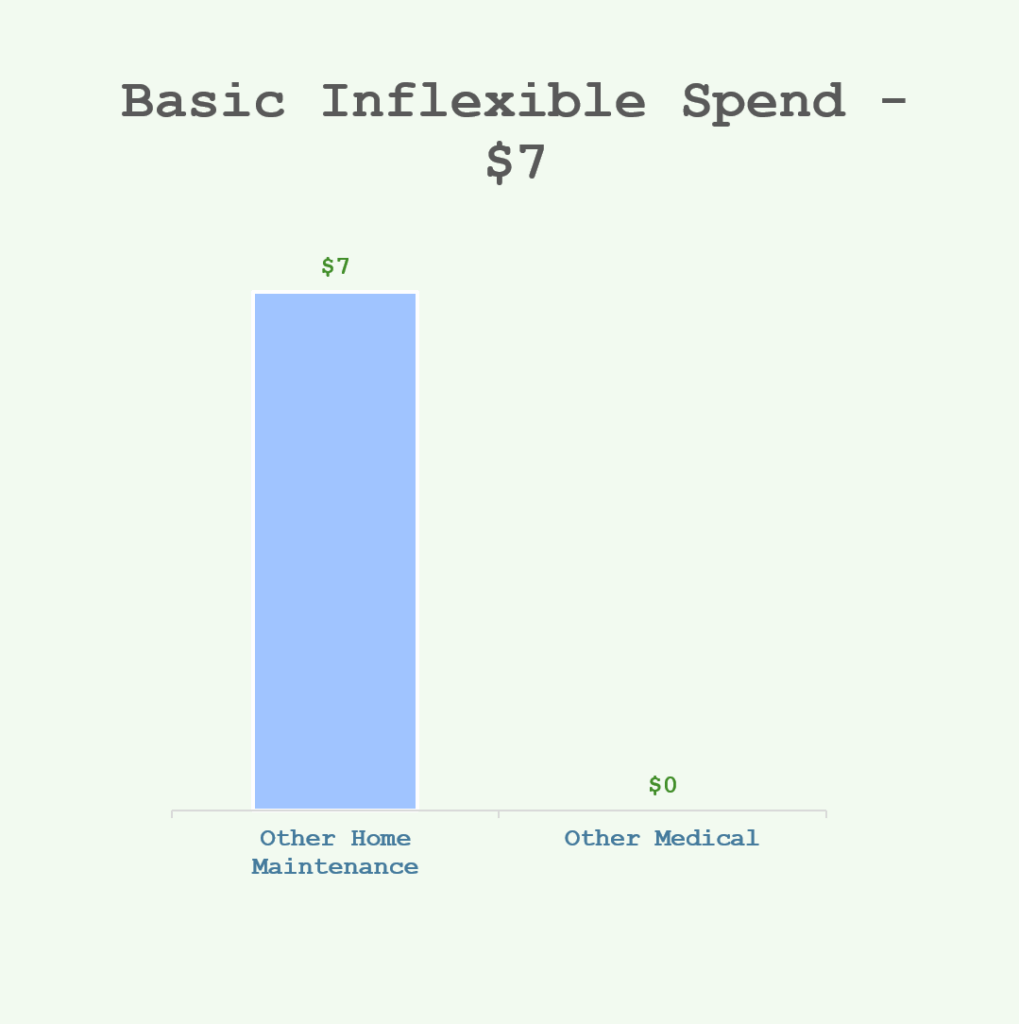

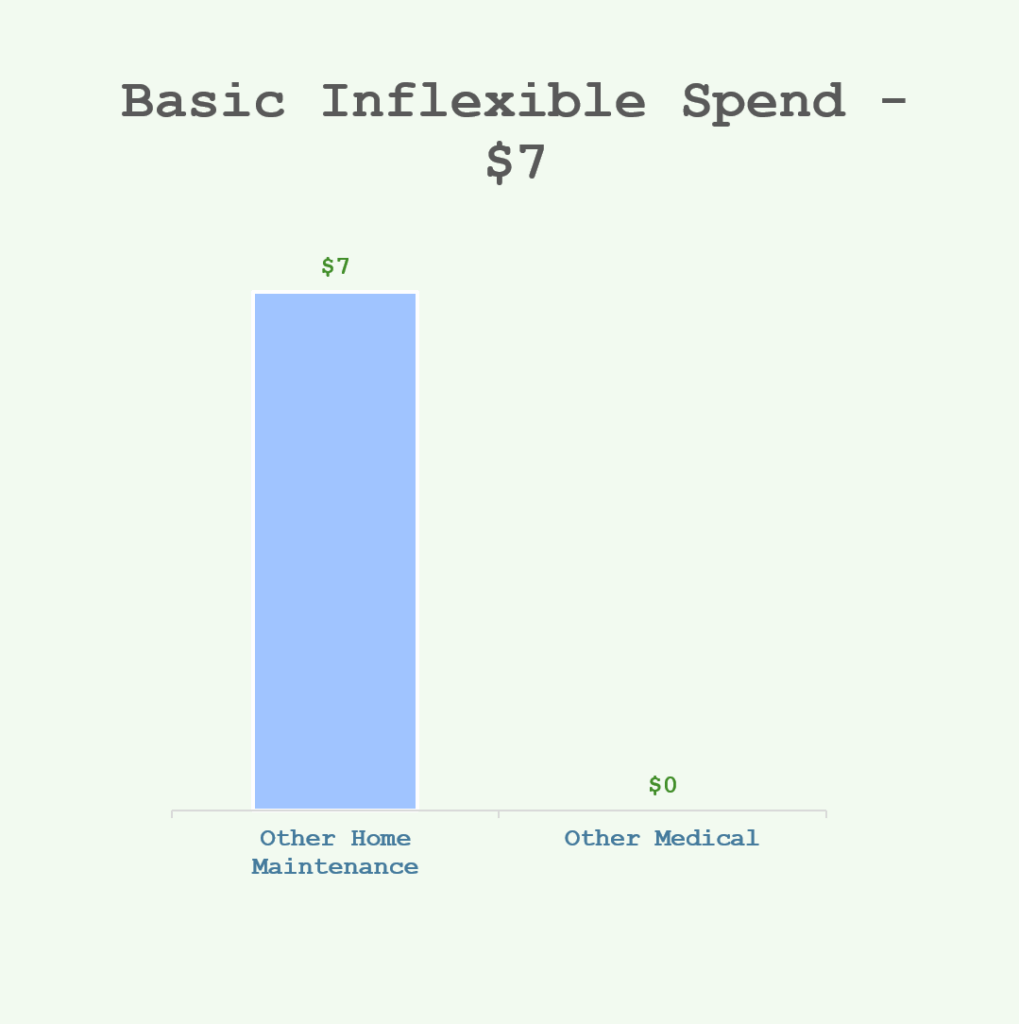

The Basic Inflexible Spending

The difference between the basic and the essential is that.. its less essential. You can probably think of something that you can at least be slightly more flexible… but actually not too flexible about that would make life more sane.

You want to renovate your place every 10 years or replace something right? You want to try and make life easier on an ongoing basis right? You want to take better care of your health right? Some of you will have strong opinions about some areas, more than others. To you the spending can be rather inflexible, but if you touch your heart, you know you can cut if the conditions are really bad.

If it fits those it ends up here.

This is also eventually what Daedalus Income Portfolio need to provide.

I describe this spending in this note: Aside from my most essential spending needs, I need $5,160 yearly for my basic needs. I would set aside $174,000 to provide income for it.

Nothing much was spent in the month here.

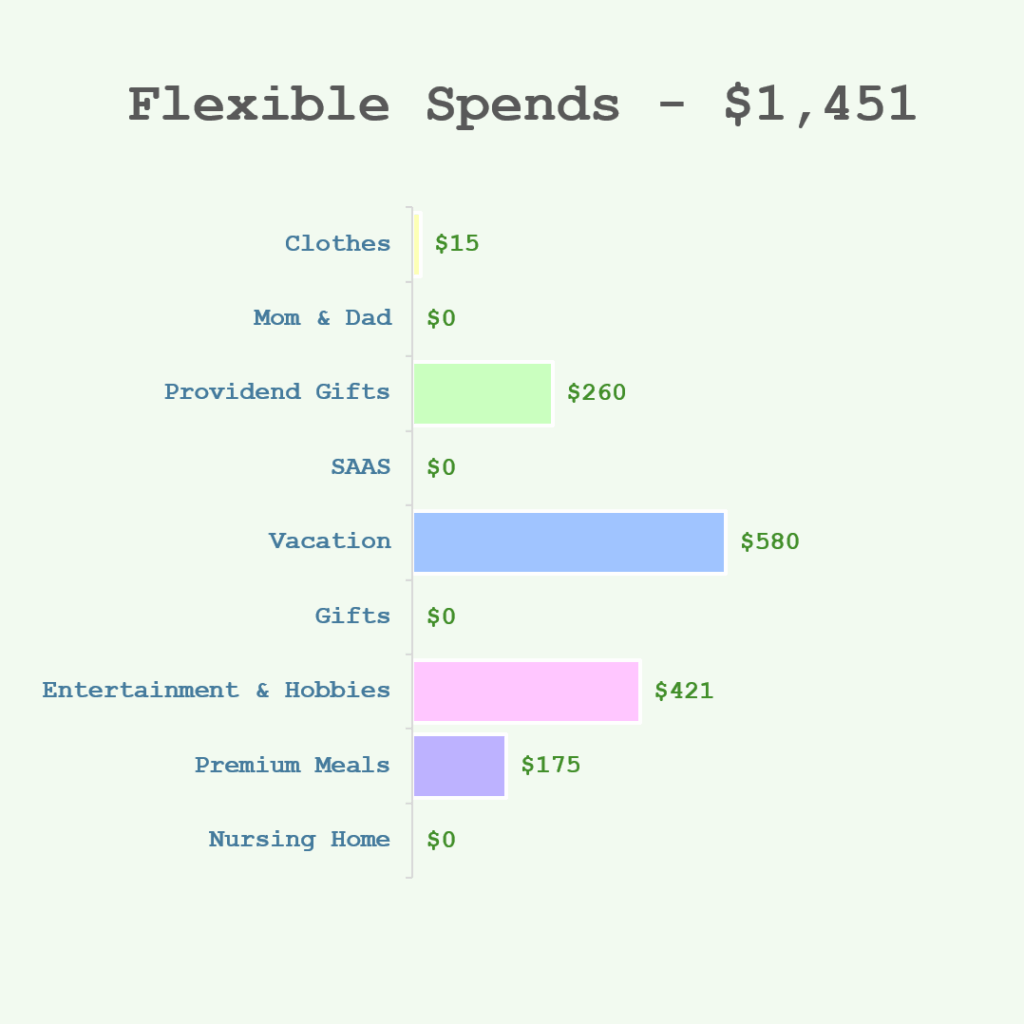

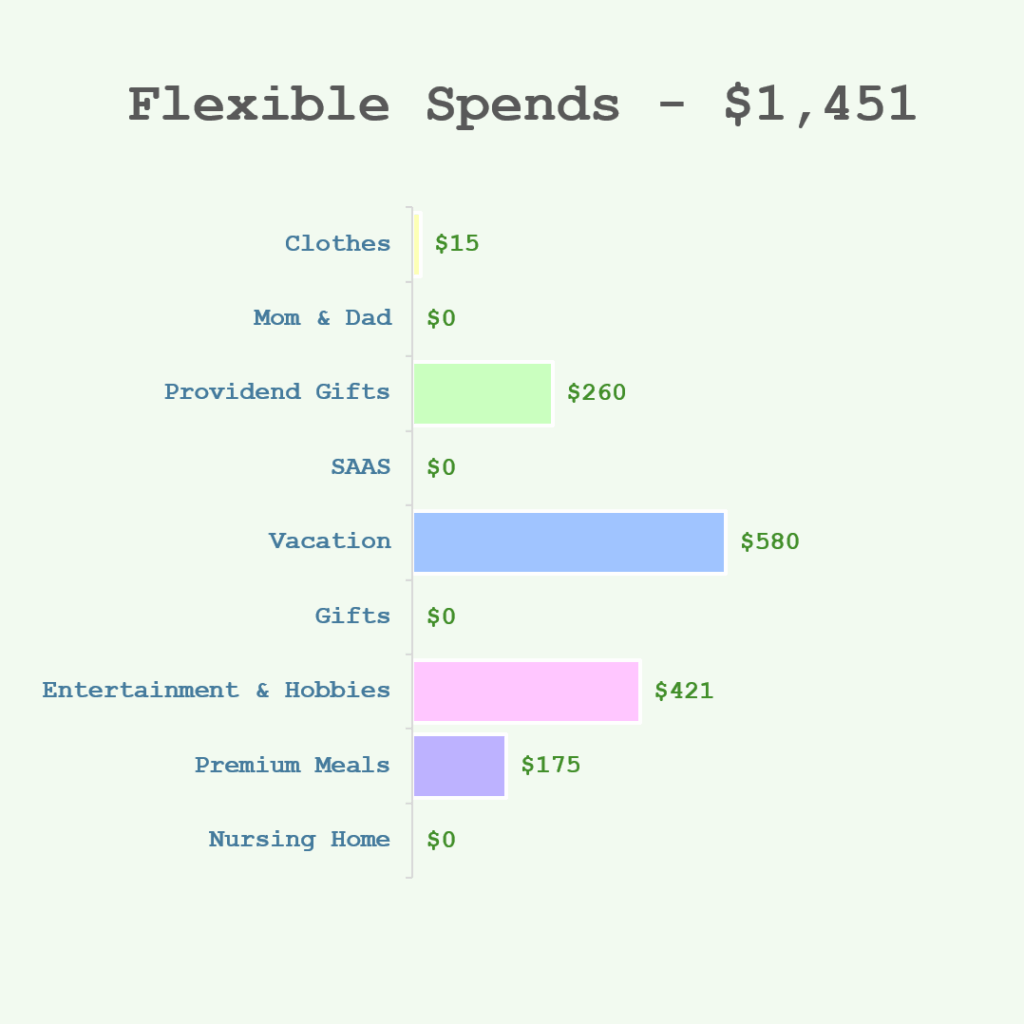

The Flexible Spends

I would group most of my spending that are flexible into one big pot. Realistically, this is the spending that make life interesting.

Realistically, we can be more flexible with these spends as well.

I find this spending to be less important for long term retirement planning but you might hold a different opinion. I do think that if you wish to enjoy something, maybe you would also want to work for it. But there are some sub-accounts that allow me to tune in to them.

The spending for this month is higher than that in the past. I paid for the hotel and flight ticket for an upcoming trip to Bangkok, which explains the $580.

I bought a DJI Action 4 for about $235. I kind of wasn’t that satisfied with the OSMO Pocket 3 because it is so delicate that I had to handle with care so I decide to try it out. Went to AliExpress to buy some Lens protection, screen protector and Telesin Mini Quick Selfie Stick. Everything came up to $256.

Also bought an A2 Extreme 512GB SD Card for $76.

I got pissed that I had to be pre-occupied with some of the plants given to me not having enough light so I bought 5 x Flower pot stand so that the flower ports can have sun and I don’t have to think about them! Cost me $21 bucks.

I bought a 1TB Western Digital SSD for $60 to be use more for external storage backup. I have a lot of backup with magnetic disc but thought it will be much faster if I have a SSD. The price, the storage size and the speed made this a good buy.

I also bought a pair of Sennheiser Replacement Earpad for $6 from AliExpress because our Head of Investments Chye Hsern gave me a pair of old Sennheiser wireless headphones he don’t want. The earpad fitted well.

The only problem is the headphones broke down 4 days later. Fxxk.

In July, I have the privilege to have meals with the following people:

- Samantha

- Stephen Chen

- Huiling, Sean and Eileen

The meals with them came up to a total of $145.

I got to thank Stephen for buying but also gifting me this Cudy AX3000 Travel Router.

Although I have two GL Inet travel router I guess having one more small, powerful router is no harm.

Providend Gifts will mainly be the spending in the office.

I spent $32 on Mori Mori Yogashi this month. There is also about $24 worth of Munchi Min Jiang Kueh.

For the most part, I spent $166 on Peanut butter and Red Bean Shio Pan from Gokoku Japanese Bakery.

Basement 1 of Guoco Tower in Tanjong Pagar.

Lena introduced this to me and many colleagues told me it is very life-changing (especially the peanut butter one).

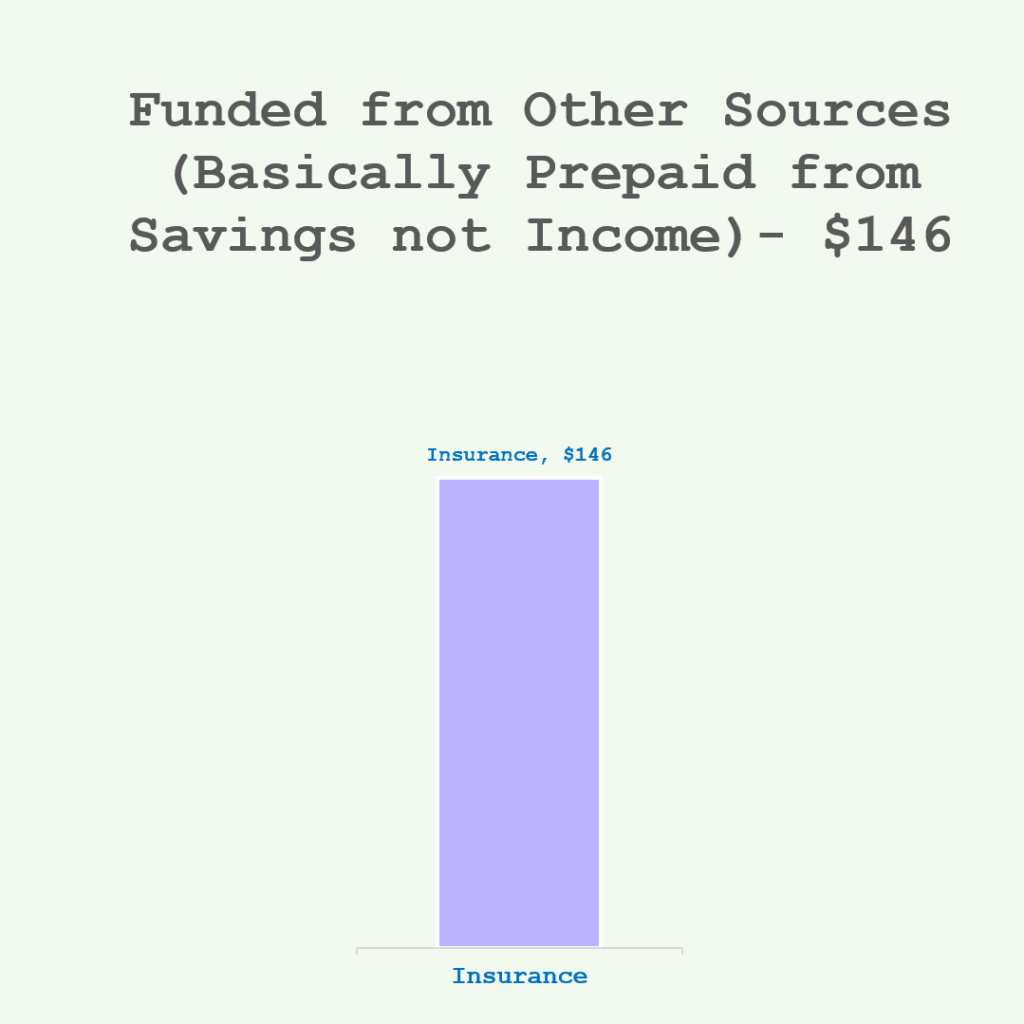

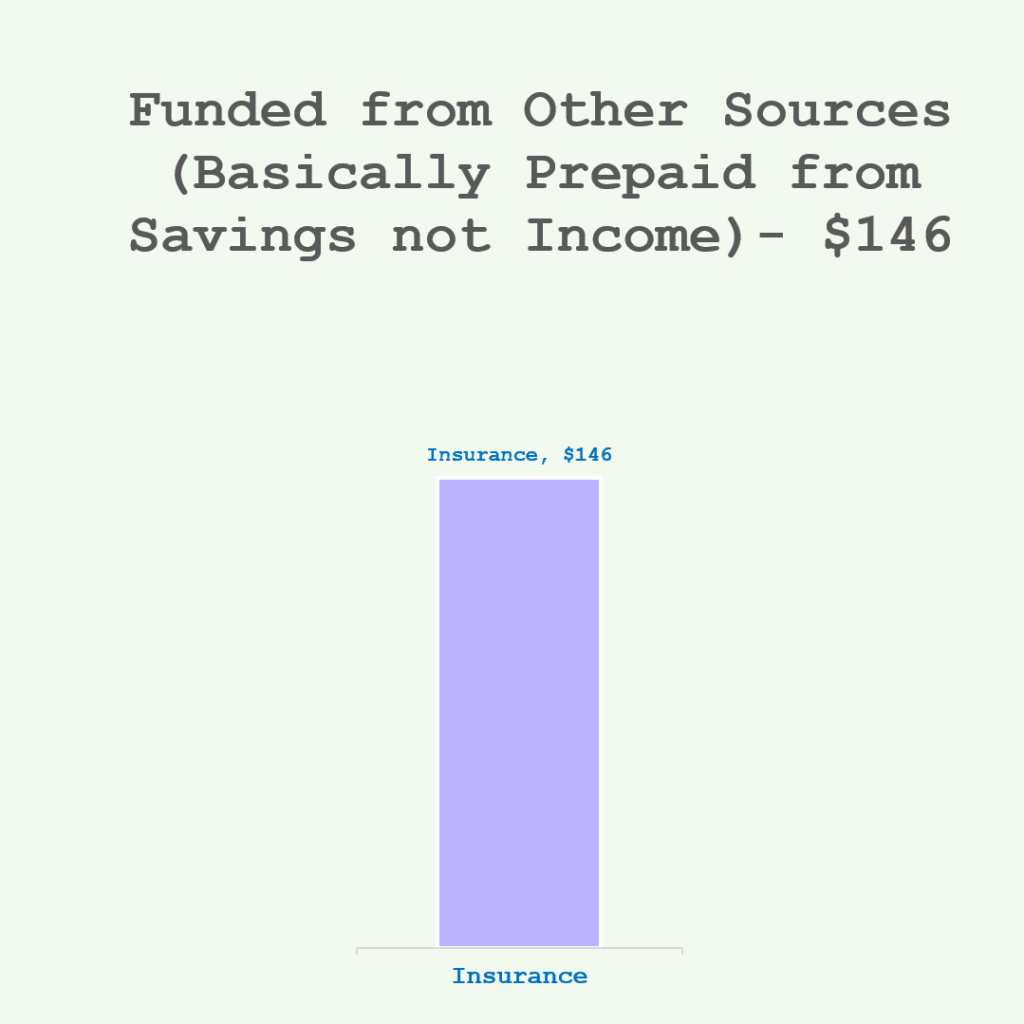

Spending Funded from Other Sources

These are spending that comes from sinking fund/saving groups that we capitalized.

This would be mainly for my real insurance protection needs. You can read more about them here: Cutting My F.I. Capital Needs for Insurance Premiums from $131,366 to $58,132 by Prepaying for It.

If I capitalized this spending, I take it out from my recurring spend. A few line items of my insurance are really finite. Term insurance is. My $50,000 Limited Whole Life is. My health insurance is in my inflexible essential spend above, which I have plan as part of my expenses even if I am not spending it today (so as to shore it up for the later years).

Spending on Work

I don’t have a lot of responsibilities like a lot of other people. Spending on work is a way to track those spending that is directly attributed to work. If I stop working this goes away.

If you want to trade these stocks I mentioned, you can open an account with Interactive Brokers. Interactive Brokers is the leading low-cost and efficient broker I use and trust to invest & trade my holdings in Singapore, the United States, London Stock Exchange and Hong Kong Stock Exchange. They allow you to trade stocks, ETFs, options, futures, forex, bonds and funds worldwide from a single integrated account.

You can read more about my thoughts about Interactive Brokers in this Interactive Brokers Deep Dive Series, starting with how to create & fund your Interactive Brokers account easily.