The crypto market faced a brutal correction on Monday, with nearly $500 million in liquidations rattling traders across Bitcoin (BTC) and Ethereum (ETH).

According to CoinGlass data, over 115,000 traders were liquidated as Bitcoin slipped to $115,000 and Ethereum plunged toward the $4,200 danger zone. The cascade was fueled by high leverage exposure, creating a domino effect of forced selling across exchanges.

Bitcoin’s sharp drop erased more than $3,000 in value within hours, pulling major altcoins into the red. ETH fell nearly 5%, while Solana (SOL) and Dogecoin (DOGE) each dropped 4–5%.

XRP tested the critical $3 support level, underscoring the market-wide fragility. Interestingly, Chainlink (LINK) bucked the trend, posting a daily 5% gain despite the turmoil.

Ethereum Faces a Liquidation Cliff

Ethereum appears particularly vulnerable if its price breaks below $4,200. Data from Hyperdash shows that more than 56,000 ETH long positions, worth about $236 million, sit at risk of liquidation near $4,170.

Additional liquidation clusters are positioned around $3,940 and $2,150–$2,160, levels that could amplify volatility if triggered.

Andrew Kang, founder of Mechanism Capital, warned that ETH could fall as low as $3,600 if the liquidation cascade continues. He added that overall ETH liquidations across exchanges could reach $5 billion, potentially driving prices even lower before stabilizing.

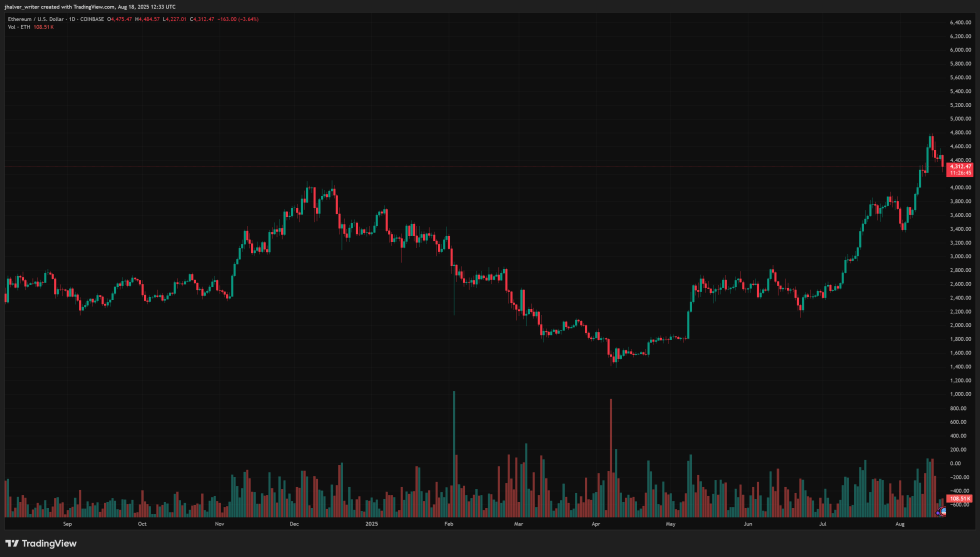

ETH's price losing momentum on the daily chart. Source: ETHUSD on Tradingview

Bitcoin Whale Accumulation or General Market Breakdown?

Despite the sell-off, some analysts argue the crash may be setting up a whale accumulation phase.

Crypto analyst CrypNuevo noted that Bitcoin recently printed a new all-time high before a sudden $1 billion liquidation event, a move he believes was engineered to flush out retail traders. He suggested that one whale absorbed much of the forced selling, signaling that institutional players may be scooping up BTC at discounted prices.

If whales are indeed accumulating, the dip could serve as a springboard for the next rally once leveraged positions reset and selling pressure eases. However, with geopolitical uncertainty and fragile support levels, traders should remain cautious.

The coming days will determine whether Bitcoin stabilizes above $115,000 and Ethereum holds $4,200, or if another wave of liquidations drags the market deeper into correction.

Cover image from ChatGPT, ETHUSD chart from Tradingview

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.