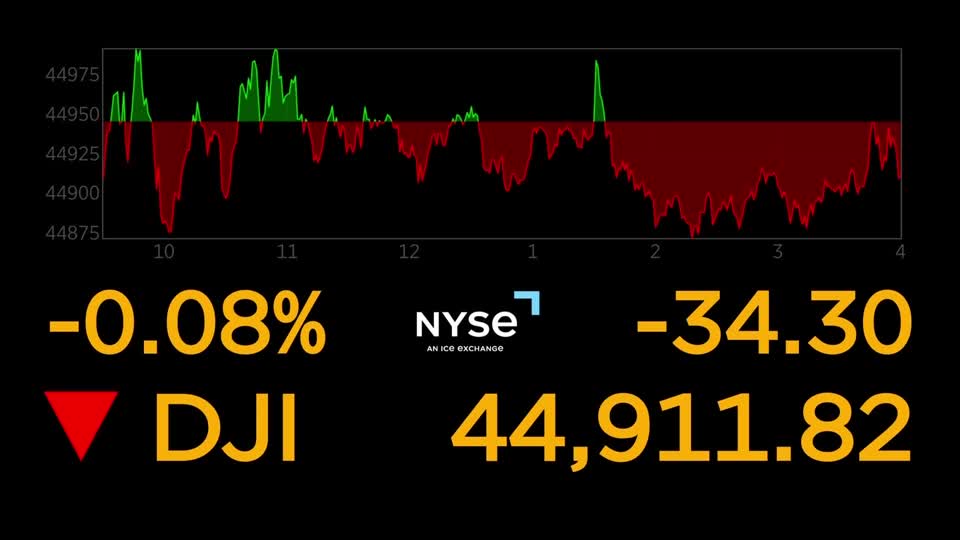

STORY: Wall Street's main indexes finished little changed on Monday, with the Dow making the biggest move – down less than a tenth of a percent – while the S&P 500 and Nasdaq closed essentially flat.

Stocks struggled for direction amid ongoing discussions at the White House over the war in Ukraine, said Clark Geranen, chief market strategist at CalBay Investments.

“I think the markets right now are so uneven just because of the anticipation of some of the geopolitical talks that we're having. So right now, President Trump has President Zelenskiy and they're meeting with some other European Union leaders based off of President Trump's talking with President Putin last week. And so right now, I think we're just in a wait and hold period, seeing what exactly is going to come of this and to see if we can actually make any progress on the war between Russia and Ukraine.”

Investors also awaited a raft of corporate earnings reports from major retailers for more signs about the state of the economy, and the Federal Reserve's annual symposium in Jackson Hole later this week.

Stocks on the move Monday included Intel, which fell more than three-and-a-half percent after a Bloomberg report said the Trump administration is in talks to take a 10% stake in the chipmaker.

:: Dayforce Handout

Shares of Dayforce soared 26% after a report said private equity firm Thoma Bravo was in talks to acquire the human resources management software firm.

And solar stocks including SunRun and First Solar gained more than 11% and 9%, respectively, after the U.S. Treasury Department unveiled new federal tax subsidy rules for solar and wind projects, which were less strict than investors had feared.