Today in crypto, BitMine’s Ether holdings have surged to $6.6 billion, yet its stock is down 14% over the past week, the NFT market cap dropped 12% to $8.1 billion as Ether’s price took a tumble, and Thailand will allow tourists to use crypto for payments.

BitMine stock struggles as ETH holdings surge

BitMine Immersion Technologies’ strong pivot into Ether hasn’t boosted its stock, with shares tumbling 14% over the past week, per Google Finance data. Now the world’s largest corporate holder of Ether, BitMine’s slump highlights that crypto bets don’t always yield quick wins for public companies.

Still, the firm is doubling down. Chairman Tom Lee said the strategy is driven partly by institutional demand, and last week BitMine unveiled plans to raise $24.5 billion to expand its Ether holdings.

Ether exchange-traded funds have drawn strong demand, with inflows hitting $2.8 billion last week and pushing year-to-date totals above $11 billion.

Corporate and institutional demand has propelled Ether more than 50% higher over the past month. Last week, ETH came within striking distance of its November 2021 all-time high of around $4,870 before pulling back.

NFT market cap drops by $1.2 billion as Ether rally loses steam

The non-fungible token (NFT) market lost more than $1.2 billion in value in less than a week as Ether’s rally slowed, according to sector data.

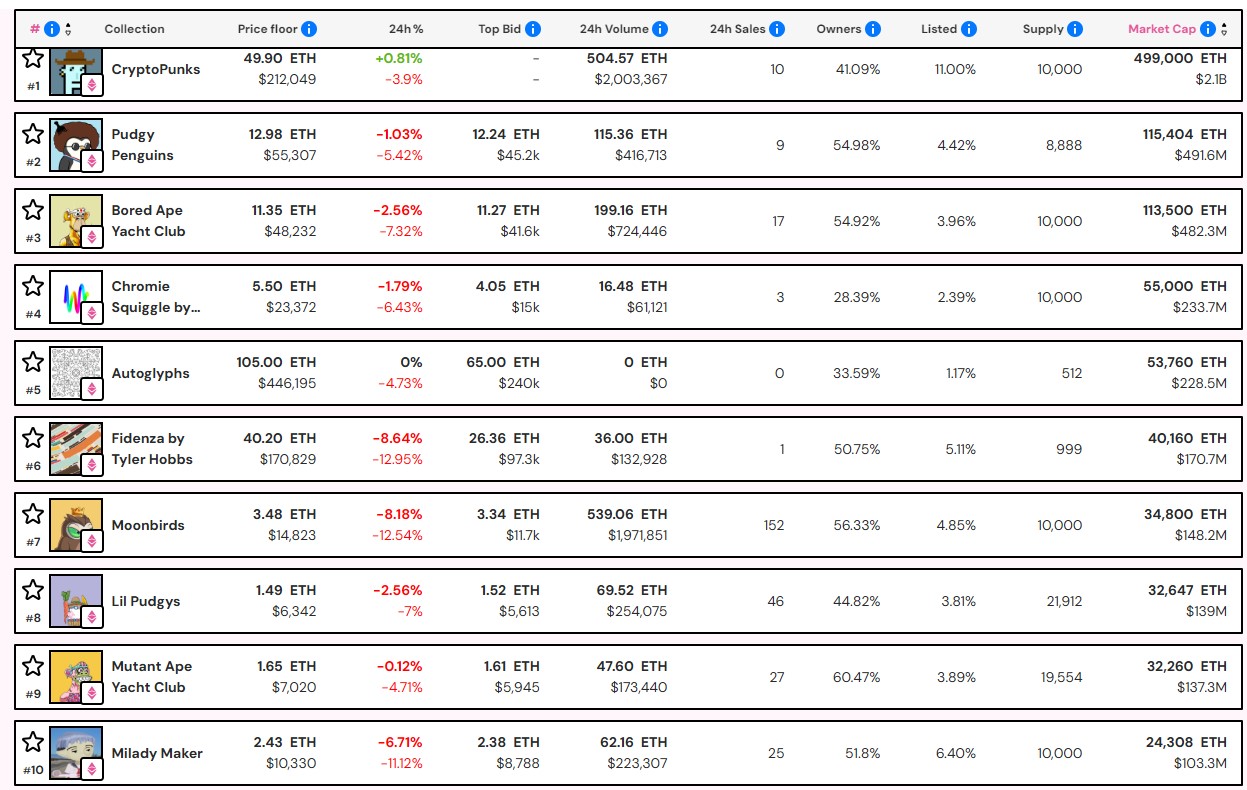

On Monday, NFT Price Floor data showed that the total valuation of NFT collections had dropped to $8.1 billion, a 12% decline from Wednesday’s NFT market cap of $9.3 billion, which had surged 40% since July.

NFTs losing $1.2 billion in valuation in less than a week coincided with a 9% drop in Ether (ETH) prices. At the time of writing, Cointelegraph data showed ETH traded at $4,260, down from a high of about $4,700 on Wednesday.

Many NFTs are minted on the Ethereum network. With valuations and sales denominated in ETH, bullish or bearish momentum in the crypto asset often translates into increased or decreased value in the NFT sector. As ETH went down 4% in the last 24 hours, a majority of the top 10 collections also showed declines in value.

While it continued to be the top collection by market capitalization, CryptoPunks saw about $300 million wiped from the collection’s value.

At the time of writing, data showed it was worth $2.1 billion, down 12% from its 2.4 billion market cap on Wednesday.

Thailand plans to launch crypto payment sandbox for tourists

The Thai government is planning to announce a nationwide regulatory sandbox to allow visitors to convert crypto into local currency for electronic payments in a bid to boost tourism, local newspaper The Nation reported on Saturday.

The scheme, known as TouristDigiPay, is expected to go live on Monday and allows users to exchange crypto for Thai baht and make electronic payments through providers regulated by the country’s central bank and Securities and Exchange Commission.

Tourists in Thailand will be eligible to use the service after undergoing Know Your Customer due diligence checks and opening an account with a digital asset business. There will also be safeguards including monthly spending limits and a block on direct cash withdrawals.

The scheme is a direct response to a slowdown in foreign visitors. Thailand had 16.8 million tourists in the first half of 2025, down from 17.7 million in the year-earlier period, with a 24% drop in tourists from East Asia and a 34% fall in visitor numbers from China.