How much Bitcoin is left to mine?

Bitcoin’s total supply is hardcoded at 21 million BTC, a fixed upper limit that cannot be altered without a consensus-breaking change to the protocol. This finite cap is enforced at the protocol level and is central to Bitcoin’s value proposition as a deflationary asset.

As of May 2025, approximately 19.6 million Bitcoin (BTC) have been mined, or about 93.3% of the total supply. That leaves roughly 1.4 million BTC yet to be created, and those remaining coins will be mined very slowly.

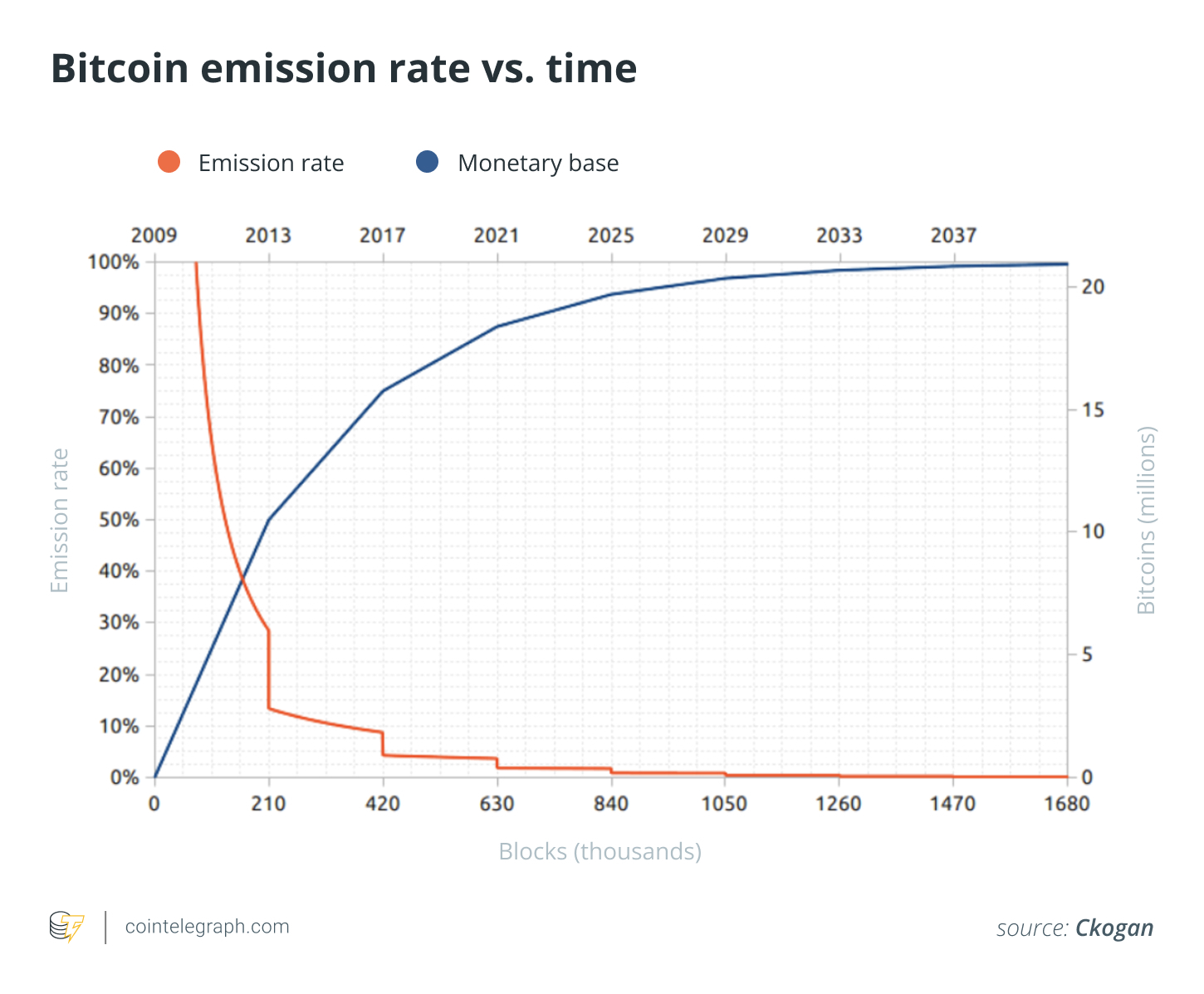

The reason for this uneven distribution is Bitcoin’s exponential issuance schedule, governed by an event called the halving. When Bitcoin launched in 2009, the block reward was 50 BTC. Every 210,000 blocks — or approximately every four years — that reward is cut in half.

Because the early rewards were so large, over 87% of the total supply was mined by the end of 2020. Each subsequent halving sharply reduces the rate of new issuance, meaning it will take over a century to mine the remaining 6.7%.

According to current estimates, 99% of all Bitcoin will have been mined by 2035, but the final fraction — the last satoshis — won’t be produced until around the year 2140 due to the nature of geometric reward reduction.

This engineered scarcity, combined with an immutable supply cap, is what draws comparisons between Bitcoin and physical commodities like gold. But Bitcoin is even more predictable: Gold’s supply grows at around 1.7% annually, whereas Bitcoin’s issuance rate is transparently declining.

Did you know? Bitcoin’s supply curve is not terminal in the traditional sense. It follows an asymptotic trajectory — a kind of economic Zeno’s paradox — where rewards diminish indefinitely but never truly reach zero. Mining will continue until around 2140, by which point over 99.999% of the total 21 million BTC will have been issued.

Beyond the supply cap: How lost coins make Bitcoin scarcer than you think

While over 93% of Bitcoin’s total supply has been mined, that doesn’t mean it’s all available. A significant portion is permanently out of circulation, lost due to forgotten passwords, misplaced wallets, destroyed hard drives or early adopters who never touched their coins again.

Estimates from firms like Chainalysis and Glassnode suggest that between 3.0 million and 3.8 million BTC — roughly 14%-18% of the total supply — is likely gone for good. That includes high-profile dormant addresses like the one believed to belong to Satoshi Nakamoto, which alone holds over 1.1 million BTC.

This means Bitcoin’s true circulating supply may be closer to 16 million-17 million, not 21 million. And because Bitcoin is non-recoverable by design, any lost coins stay lost — permanently reducing supply over time.

Now compare that to gold. Around 85% of the world’s total gold supply has been mined — approximately 216,265 metric tons, according to the World Gold Council — but nearly all of it remains in circulation or held in vaults, jewelry, ETFs and central banks. Gold can be remelted and reused; Bitcoin cannot be resurrected once access is lost.

This distinction gives Bitcoin a kind of hardening scarcity, a supply that not only stops growing over time but quietly shrinks.

As Bitcoin matures, it’s entering a monetary phase similar to gold: low issuance, high holder concentration and increasing demand-side sensitivity. But Bitcoin takes it further; its supply cap is hard, its loss rate is permanent, and its distribution is publicly auditable.

This may lead to several outcomes:

- Increased price volatility as available supply becomes more limited and sensitive to market demand

- Higher long-term value concentration in the hands of those who remain active and secure in their key management

- A premium on liquidity, where actually spendable BTC trades at a higher effective value than dormant supply.

In extreme cases, this could produce a bifurcation between “circulating BTC” and “unreachable BTC,” with the former gaining greater economic significance, particularly in times of constrained exchange liquidity or macroeconomic stress.

What happens when Bitcoin is fully mined?

There’s a popular assumption that as Bitcoin’s block rewards shrink, the network’s security will eventually suffer. But in practice, the mining economy is far more adaptive — and much more resilient — than that.

Bitcoin’s mining incentives are governed by a self-correcting feedback loop: If mining becomes unprofitable, miners drop off the network, which in turn triggers a difficulty adjustment. Every 2,016 blocks (roughly every two weeks), the network recalibrates mining difficulty using a parameter known as nBits. The goal is to keep block times steady at around 10 minutes, regardless of how many miners are competing.

So, if Bitcoin’s price drops, or the reward becomes too small relative to operating costs, inefficient miners simply exit. This causes difficulty to fall, lowering the cost for those who remain. The result is a system that continually rebalances itself, aligning network participation with available incentives.

This mechanism has already been tested at scale. After China banned mining in mid-2021, Bitcoin’s global hashrate dropped by more than 50% in a matter of weeks. Yet the network continued to function without interruption, and within a few months, the hashrate fully recovered, as miners resumed operations in jurisdictions with lower energy costs and more favorable regulations.

Critically, the idea that lower rewards will inherently threaten network security overlooks how mining is tied to profit margins, not nominal BTC amounts. As long as the market price supports the cost of hash power — even at 0.78125 BTC per block (post-2028 halving) or lower — miners will continue to secure the network.

In other words, it’s not the absolute reward that matters, but whether mining remains profitable relative to costs. And thanks to Bitcoin’s built-in difficulty adjustment, it usually does.

Even a century from now, when the block reward approaches zero, the network will likely still be protected by whatever combination of fees, base incentives and infrastructure efficiency exists at that time. But that’s a distant concern. In the meantime, the current system — hashrate adjusts, difficulty rebalances, miners adapt — remains one of the most robust elements of Bitcoin’s design.

Did you know? On April 20, 2024, following the launch of the Runes protocol, Bitcoin miners earned over $80 million in transaction fees within a single day, surpassing the $26 million earned from block rewards. This marked the first time in Bitcoin’s history that transaction fees alone exceeded the block subsidy in daily miner revenue.

The future of Bitcoin mining: Energy consumption

It’s a common misconception that rising Bitcoin prices will drive endless energy use. In reality, mining is constrained by profitability, not price alone.

As block rewards shrink, miners are pushed toward thinner margins, and that means chasing the cheapest, cleanest energy available. Since China’s 2021 mining ban, hashrate has migrated to regions like North America and Northern Europe, where operators tap into surplus hydro, wind and underutilized grid energy.

According to the Cambridge Centre for Alternative Finance, between 52% and 59% of Bitcoin mining now runs on renewables or low-emission sources.

Regulations are reinforcing this trend, with several jurisdictions offering incentives for clean-powered mining or penalizing fossil-fuel operations.

Moreover, the idea that higher BTC prices will always mean higher energy use misses how Bitcoin self-regulates: More miners raise difficulty, which compresses margins, capping energy expansion.

Renewable-based mining brings its own challenges, but the dystopian future of endlessly expanding fossil-fueled hash power is increasingly unlikely.