Ethereum is now at the center of market attention as Bitcoin fails to confirm a breakout above its all-time highs. While BTC’s momentum stalls, altcoins are struggling to extend their strength, leaving Ethereum in a decisive position. Trading above $4,400, ETH is now less than 10% away from reaching new record highs.

Bulls remain confident in a continuation of the uptrend. Analysts argue that accumulation trends and strong on-chain activity point to further gains ahead. Exchange reserves continue to decline, while OTC desks show thinning liquidity, suggesting demand is outpacing available supply. This combination has historically preceded sharp upward moves.

However, risks are also growing as the market enters a new phase. With Bitcoin showing weakness near its highs, Ethereum’s ability to decouple and push forward will determine the direction of altcoins broadly. Some analysts view this as the beginning of a true altseason, while others warn that failure to sustain momentum could trigger a correction.

Ethereum MVRV Ratio Signals Potential Short-Term Pullback

According to top analyst On-Chain Mind, Ethereum’s MVRV ratio is moving into the +3σ to +4σ zone, a range that has historically marked overheated conditions and led to short-term pullbacks. This suggests that profit-taking pressure is likely to surface between $4,600 and $5,200, creating a critical test for ETH in the days ahead.

Despite these risks, Ethereum remains strong, less than 10% away from new all-time highs, and many analysts believe a breakout could still materialize. Some expect consolidation as short-term holders lock in gains, while others view the current setup as the prelude to Ethereum pushing decisively beyond its previous highs.

Institutional accumulation continues to accelerate, with large players treating ETH as both an investment and a strategic asset. Meanwhile, legal clarity across key jurisdictions has reduced uncertainty, creating a more stable environment for long-term adoption. At the same time, exchange supply has been steadily declining, signaling conviction among holders and reducing potential selling pressure.

If Ethereum breaks through resistance levels despite its overheated MVRV, it could spark a powerful continuation rally, potentially leading the broader altcoin market. However, if profit-taking dominates, a pullback would not weaken the bullish trend but instead set the stage for healthier continuation later.

Technical Details: Key Levels To Hold

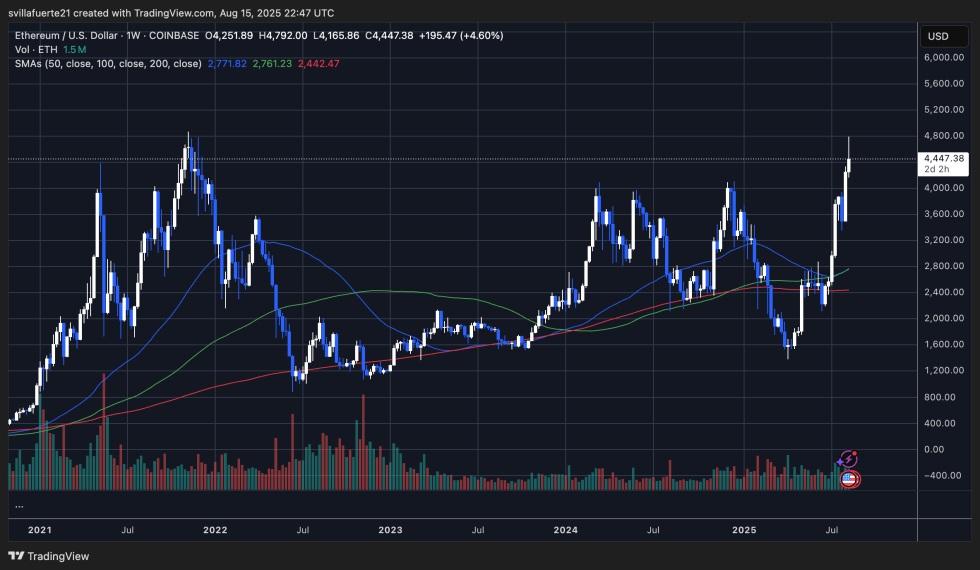

Ethereum is showing remarkable momentum on the weekly chart, now trading at $4,447 after hitting a recent peak at $4,792, just below its 2021 all-time high. The price has surged above the 50, 100, and 200-week moving averages, with the 50-week SMA ($2,771) crossing decisively above the longer-term averages. This alignment confirms a strong bullish structure that historically precedes extended rallies.

Volume has also expanded notably during this rally, reflecting strong demand and conviction from buyers. The breakout from the $3,600–$3,800 resistance zone has been followed by sharp upward momentum, showing that bulls remain firmly in control. However, Ethereum is now approaching historically significant resistance near $4,800–$4,900, where sellers could attempt to cap gains.

If ETH manages a weekly close above $4,800, the path toward fresh all-time highs above $5,000 becomes increasingly probable. On the other hand, failure to hold above current levels could trigger a healthy correction back to the $4,200–$4,000 support zone, where the 50-week SMA is now acting as a cushion.

Featured image from Dall-E, chart from TradingView

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.