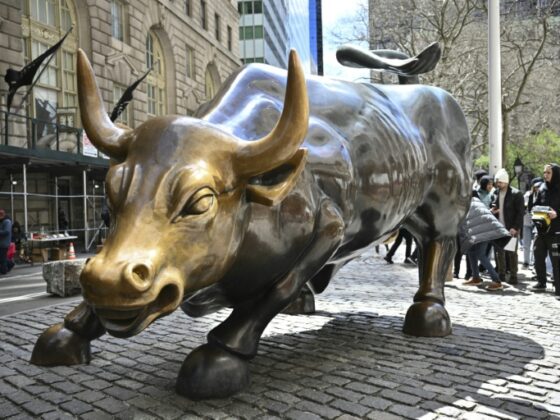

As the U.S. stock market navigates a landscape marked by inflation concerns and tempered expectations for interest rate cuts, investors are keenly observing the performance of major indices like the Dow Jones, S&P 500, and Nasdaq Composite. In such an environment, growth companies with high insider ownership can be particularly appealing as they often signal strong internal confidence in future prospects.

|

Name |

Insider Ownership |

Earnings Growth |

|

Upstart Holdings (UPST) |

12.5% |

93.4% |

|

Prairie Operating (PROP) |

30% |

71.8% |

|

Niu Technologies (NIU) |

37.2% |

92.8% |

|

Hippo Holdings (HIPO) |

12.8% |

52.5% |

|

FTC Solar (FTCI) |

23.2% |

63.1% |

|

Credo Technology Group Holding (CRDO) |

11.5% |

36.4% |

|

Cloudflare (NET) |

10.6% |

45.8% |

|

Chemung Financial (CHMG) |

20% |

77.6% |

|

Atour Lifestyle Holdings (ATAT) |

21.9% |

23.5% |

|

Astera Labs (ALAB) |

12.3% |

37% |

Underneath we present a selection of stocks filtered out by our screen.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Paysign, Inc. offers prepaid card programs, patient affordability solutions, digital banking services, and integrated payment processing for various sectors with a market cap of $296.22 million.

Operations: Paysign's revenue primarily comes from its vertically integrated provider of prepaid card products and processing services, generating $68.54 million.

Insider Ownership: 36.5%

Paysign has experienced substantial insider buying recently, indicating confidence in its growth prospects. Despite a volatile share price, analysts project a significant 64.3% price increase. The company's earnings are expected to grow significantly at 30.5% annually, outpacing the US market average. Recent client expansions have bolstered revenue growth, particularly in the plasma sector, without increasing SG&A expenses. However, profit margins have declined from last year’s figures.

Simply Wall St Growth Rating: ★★★★★☆

Overview: AIRO Group Holdings, Inc. is a multi-faceted advanced Aerospace and Defense company with a market cap of $547.57 million.

Operations: The company's revenue segments include Drones generating $73.72 million, Avionics contributing $7.92 million, and Training accounting for $3.34 million.

Insider Ownership: 18.5%