Bitcoin options markets are showing a low volatility expectation, something that has actually preceded sharp price action in the past.

Bitcoin Options ATM IV Has Been Going Down Recently

In its latest weekly report, on-chain analytics firm Glassnode has talked about the latest trend in the Bitcoin Options At-The-Money Implied Volatility.

Implied Volatility (IV) refers to an indicator that measures how volatile BTC is expected to be in the future, based on the pricing of Options contracts. At-The-Money (ATM) IV, the version of the metric of interest here, specifically calculates this expectation for the contracts that have their strike price closest to the asset's current spot price.

The “strike price” is the predetermined price at which the holder of an options contract can choose to buy (in the case of a call or bullish bet) or sell (put or bearish bet) the underlying asset.

Now, here is the chart shared by the analytics firm that shows the trend in the Bitcoin Options ATM IV for all expiry timeframes:

As displayed in the above graph, the Bitcoin Options ATM IV has been following a downtrend since a while now, indicating the traders aren't expecting near-term volatility.

If the past is anything to go by, though, BTC could go against these traders. “Historically, such subdued volatility expectations have often preceded sharp market moves, making them a potential contrarian indicator,” explains Glassnode.

From the chart, it's visible that such a contraction in Bitcoin Options ATM IV also occurred back in 2023 and what followed back then was a bull rally for the cryptocurrency. It now remains to be seen whether volatility in either direction would also follow this compression.

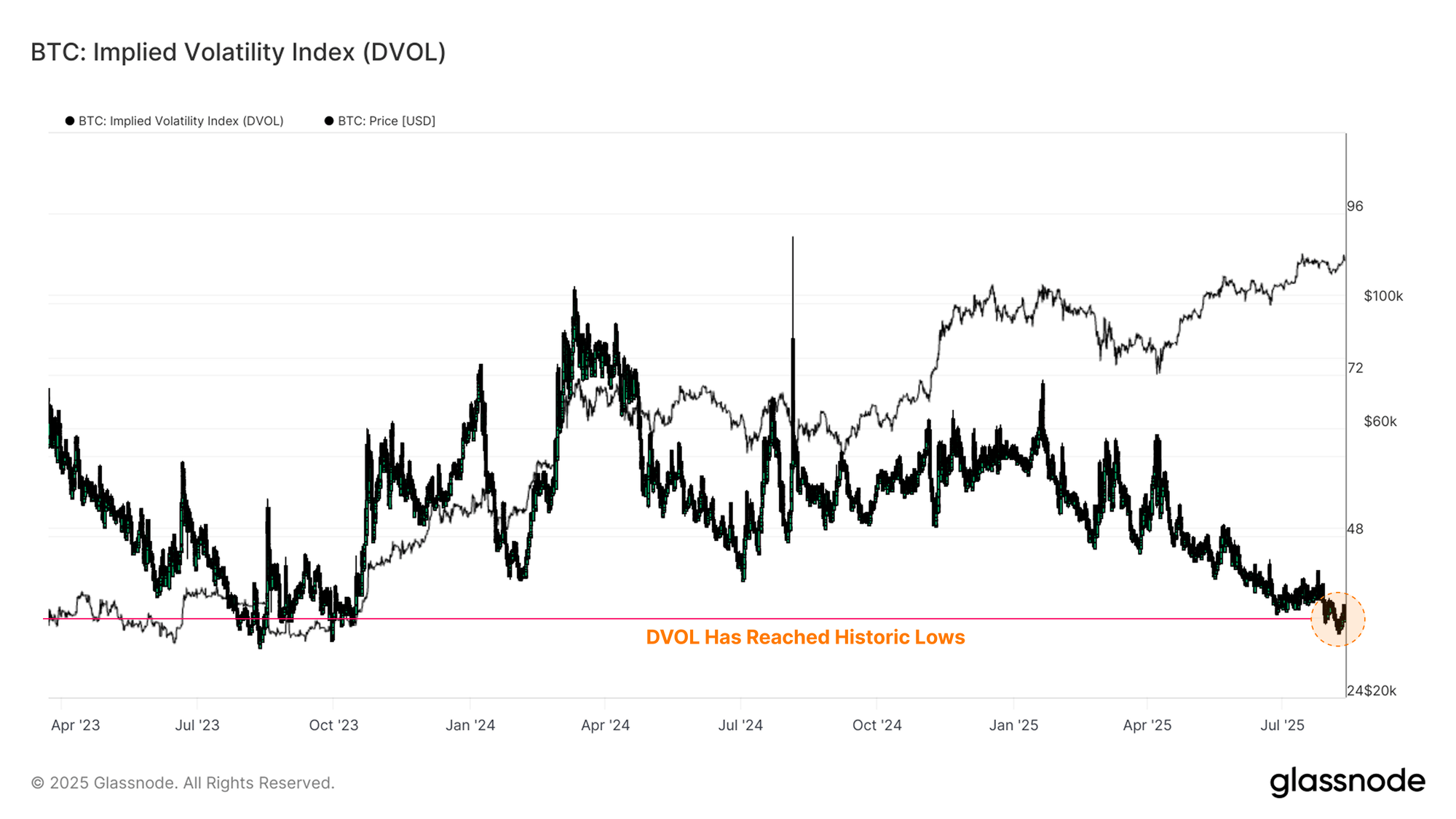

ATM contracts aren't the only one expecting low volatility. According to the report, Deribit‘s DVOL index, which tracks a 30-day IV measure for all strike prices, has dropped to historically low levels recently.

As is apparent in the chart, the Bitcoin DVOL has been going down in the last few months. The index is currently at lows so extreme that only 2.6% of trading days have witnessed a lower value. The analytics firm explains:

Such levels often reflect market complacency and limited demand for hedging against large moves. While these conditions can persist, they leave the market exposed to sudden volatility spikes if a catalyst emerges, as past cycles have shown through sharp, disorderly price swings when risk is rapidly repriced.

BTC Price

At the time of writing, Bitcoin is trading around $121,600, up 5% over the last week.