The upcoming Trump-Putin meeting is sparking speculation over a potential deal that could ease sanctions and reshape oil markets.

Ending a Four-Year Oil Bull Run, Hedge Funds Are Now Betting on Renewables

– Hedge funds are increasingly giving up on oil as the most profitable commodity play out there, with a Bloomberg analysis of some 700 funds’ strategies indicating that money managers have been betting against oil throughout 2025.

– Post-COVID recovery was the main engine of hedge funds’ oil craze, further boosted by the Russia-Ukraine war and ensuing sanctions, creating an almost four-year prevalence of long oil positions up until September 2024.

– Renewable energy stocks have outperformed oil since Trump came to office, with hedge funds now betting on AI driving a boom in electricity generation that would need to be satiated by clean energy, hence the industry’s net long on wind stocks even though Trump has called off US federal funding.

– With China actively promoting consolidation in its solar sector and Trump contributing to more than $22 billion cancelled renewable projects in the US, hedge funds believe the clean energy projects of the future will be more transparent and cost-efficient without public funds.

Market Movers

– US oilfield services giant SLB (NYSE:SLB) landed a huge six-well drilling contract in Iraq to increase production at the 4.6 TCf Akkas gas field in the country’s western Anbar governorate, aiming for 100 MMCf/d of output within one year.

– Norway’s state oil firm Equinor (NYSE:EQNR) was forced to delay drilling at the 350 MMboe Rosebank field, UK’s largest undeveloped discovery, after the British government requested additional assessments of Scope 3 emissions.

– Malaysia’s national energy company Petronas plans to expand the share of its international upstream portfolio to 60% over the next decade, up from the 40-45% currently as domestic oil and gas reserves mature.

– Global energy trader Hartree Partners is reportedly in talks to buy French agricultural trader Touton, which has been trading cocoa for 150 years and controls around 10% of the world’s output.

Tuesday, August 12, 2025

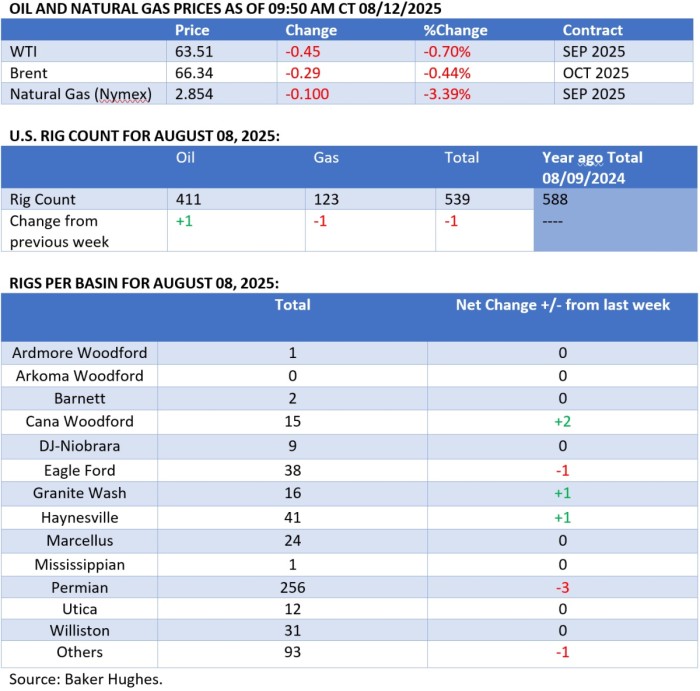

The extension of the US-China trade truce has sparked some upbeat sentiment across the commodity spectrum, however, the impact on oil markets has been fairly muted, with ICE Brent clinging to the $66 per barrel mark. The Trump-Putin summit in Alaska this Friday is set to be the main trendsetter for the upcoming weeks, with a failure to reach a deal most certainly triggering further US pressure on buyers of Russian oil.