Key Points

- The U.S. gross national debt has reached $37,004,818,000,000 as of August 11, 2026, hitting the milestone years ahead of pre-pandemic forecasts.

- Heavy pandemic borrowing and new tax and spending legislation have accelerated debt growth, adding $1 trillion roughly every five months.

- Economists warn rising debt could increase borrowing costs, slow wage growth, and limit federal budget flexibility.

The United States’ gross national debt has surpassed $37 trillion, marking an all-time high and raising concerns about the speed of borrowing and its economic consequences.

The Treasury Department’s daily financial report released Tuesday recorded the total at $37,004,818,000,000. This milestone arrived years sooner than expected, with the Congressional Budget Office’s (CBO) pre-pandemic estimates projecting it wouldn’t occur until after fiscal year 2030.

The rapid rise reflects massive borrowing over the past six years. Federal spending surged in response to the Covid-19 pandemic, with emergency stimulus measures, unemployment expansions, and business aid programs passed under both the Trump and Biden administrations. The pace has remained brisk as new tax cuts and spending packages continue to push the debt higher.

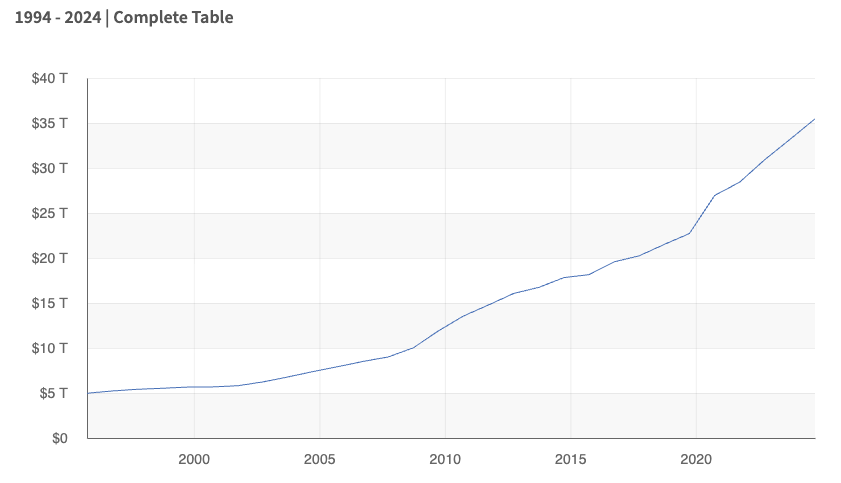

Just 30 years ago, the national debt was below $5 trillion, and today, new spending bills add $5 trillion at once. You can see the ballooning growth in the chart below:

Would you like to save this?

Pandemic Borrowing and New Legislation Fuel The Rise

The pandemic period marked one of the largest increases in government borrowing in modern history. Lockdowns, job losses, and business closures required massive fiscal intervention to prevent a collapse in household income and demand. According to CBO data, roughly $10 trillion was added between 2020 and 2023 alone.

A big issue, though, is that this trend did not reverse with the end of pandemic emergency measures.

Earlier this year, President Donald Trump signed the One Big Beautiful Bill Act, estimated by the CBO to add $4.1 trillion to the debt over the next decade. The law maintained lower tax rates, extended certain personal tax cuts, but also approved increased defense and infrastructure spending.

The Increase Is Accelerating

The latest figures highlight just how quickly trillion-dollar increments are being reached.

The U.S. hit $34 trillion in January 2024, $35 trillion in July 2024, and $36 trillion in November 2024. That means the debt is now growing by $1 trillion every five months, more than 2x faster than the average over the past quarter century.

At this rate, it's estimated that another trillion in debt will be added in roughly 173 days. Economists warn that sustained acceleration could push annual interest payments above spending on key federal programs within a few years.

What This Means For Average Americans

Rising national debt can affect everyday Americans in multiple ways. The Government Accountability Office (GAO) outlines several risks, including higher interest rates on mortgages, auto loans, and business borrowing, slower wage growth as companies have less capital to invest, and inflationary pressures on goods and services.

The debt’s trajectory will force difficult budget trade-offs. More federal dollars will be required to service interest payments, leaving less for programs like Social Security, Medicare, or infrastructure investment.

It's important for Americans to realize that, just like a household budget, the debt has to be repaid. The government just borrows via Treasury Bonds, which pay out interest. The government “earns income” through tax dollars, and spend it through spending measures and repaying the debt.

In the last year, nearly $8 trillion in bonds had to be “rolled over” – meaning instead of repaying them with tax dollars, we borrowed more money to repay the debt. Think of it like taking a new personal loan to repay the auto loan… because you couldn't afford the payments otherwise. It's not a good thing.

The end result is that Americans will either face higher taxes in the future, or spending will have to be cut (meaning less services and benefits for Americans) – or a combination of both.

What Will Happen In The Future?

The debate over the national debt is unlikely to subside. While many average Americans want fiscal restraint, politicians typically don't have the stomach to raise taxes or cut government programs.

What is clear is that the $37 trillion figure is more than a symbol – it’s a sign of how far economic realities have shifted since pre-pandemic forecasts.

With the pace of trillion-dollar jumps accelerating, the question is less whether the debt will continue to grow, and more whether politicians can manage its consequences before interest costs consume a much larger share of the budget.

Editor: Colin Graves

The post U.S. National Debt Reaches Record $37 Trillion appeared first on The College Investor.