Bitcoin is holding firm above the $115,000 level after several days of trading below it, signaling renewed strength in the market. The bullish tone is building as Ethereum posts massive gains and altcoins begin to show strong moves over the past few days. For some analysts, this could be the start of the long-awaited altseason; for others, it’s simply the rest of the market catching up to Bitcoin’s earlier rally.

Related Reading

Top analyst Axel Adler noted that Bitcoin’s price is now trading close to its all-time high, with the BTC Z-Score (Price, 30/365) sitting around +1.5σ above its one-year norm. This reading is well below the +2.5σ level typically associated with overheating, suggesting that while momentum is strong, it is not yet at extreme levels. The current environment offers a favorable backdrop for potential upside, with room for the market to expand further before reaching overheated conditions.

With altcoins gaining traction and Ethereum’s rally adding fuel to the market’s optimism, the coming days could determine whether this is a sustainable breakout or just another phase of consolidation before the next major move.

On-Chain Activity Still Lags Behind Price

According to Adler, Bitcoin’s current market setup is showing a positive backdrop but with some important caveats. Adler points out that the Adjusted Price Divergence (APD) remains negative near −1.5 after rebounding from local lows around −2. This metric suggests that Bitcoin’s price is still outpacing on-chain activity, although the gap between the two is narrowing. In other words, while price momentum is firm, the network’s transactional activity and usage haven’t yet fully caught up.

This discrepancy creates an interesting dynamic for the market. Adler explains that the bias still favors price, meaning momentum is being driven more by investor positioning and sentiment than by on-chain fundamentals. For the rally to gain more structural support, a healthier setup would see APD move toward zero. This could happen in one of two ways: either network activity increases significantly while price moves sideways or posts modest gains, or Bitcoin’s price cools off to better align with current usage levels.

Importantly, Adler warns against interpreting APD moving toward zero as a direct buy or sell signal. Instead, it represents a sign of normalization — a point where market price and underlying network fundamentals are better aligned. For now, Bitcoin’s technical and macro backdrop remains bullish, but sustained long-term growth will likely require the network to catch up with price action.

Related Reading

Bitcoin Price Holds Key Support Near $115K

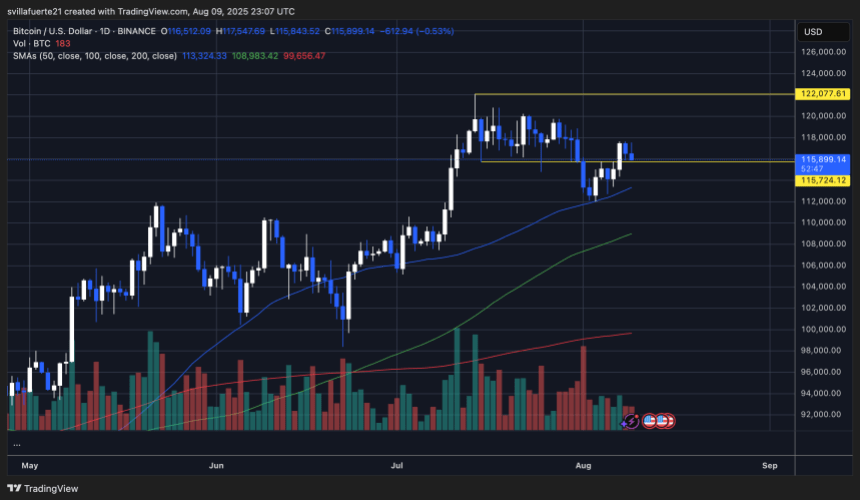

Bitcoin is consolidating above the $115,724 support level after a brief dip below it earlier this month. The daily chart shows price stabilizing just above the 50-day simple moving average (SMA), currently near $113,324, which has acted as a strong dynamic support throughout the recent uptrend. The short-term structure remains bullish, with BTC trading inside a range between $115,724 support and the $122,077 resistance level.

Volume has tapered off slightly since the early August rebound, suggesting the market is in a wait-and-see mode before a potential breakout. A decisive close above $118,000 could invite another test of the $122,077 resistance, a key level that has capped upside attempts multiple times. If broken, this could open the door toward new all-time highs.

Related Reading

On the downside, losing $115,724 would shift focus to the 100-day SMA at $108,983 as the next major support. Until then, the higher-lows pattern suggests buyers are defending the mid-$115K zone aggressively.

Featured image from Dall-E, chart from TradingView