Ethereum’s growing appeal among institutional players has taken another leap forward as Fundamental Global Inc. (FGF), a Nasdaq-listed company specializing in reinsurance, merchant banking, and asset management, revealed an ambitious $5 billion cryptocurrency strategy in a recent SEC filing. The plan marks a major pivot toward Ethereum investments, signaling increased confidence in the asset’s long-term potential.

The announcement immediately impacted market sentiment. While FGF shares closed the regular session on August 7 at $36.17, down 1.44% for the day, they surged 3.76% after-hours to $37.53 following the news. Investors reacted to the aggressive treasury allocation plan, which positions the company alongside other forward-looking firms adopting Ethereum as part of their corporate reserves.

FGF’s move mirrors the Ethereum Treasury strategy trend recently embraced by Sharplink Gaming, underscoring a growing corporate shift toward integrating ETH into long-term capital strategies. This wave of institutional adoption not only strengthens Ethereum’s position in the crypto market but also reinforces its narrative as a store of value and strategic asset in the evolving financial landscape.

FGF’s $5B Bet On Ethereum Marks Bold Institutional Shift

Fundamental Global has made a landmark move into the cryptocurrency sector, filing an S-3 form with the US Securities and Exchange Commission (SEC) to offer up to $5 billion in securities. According to the filing, the majority of proceeds will be directed toward acquiring Ethereum, while the remainder will cover corporate and operational needs. This represents a major strategic shift for a publicly traded company historically outside the crypto space.

In the filing, FGF outlined its new approach: “We recently initiated an Ethereum (ETH) treasury strategy. ETH is the native token of the Ethereum network. Ethereum is the foundation of digital finance and the settlement layer for the majority of stablecoins, Decentralized Finance (DeFi), and tokenized assets.”

FGF further emphasized its intention to accumulate ETH as a long-term treasury asset, with the goal of growing its overall position and increasing ETH per common share through professional treasury management. The strategy will leverage capital raising activities alongside advanced blockchain-based tools such as staking, restaking, liquid staking, and other DeFi protocols to maximize returns and asset growth.

By positioning ETH as its primary treasury reserve asset, FGF joins a growing list of companies—like Sharplink Gaming—that are embedding Ethereum into their corporate balance sheets. This approach not only diversifies reserves but also aligns the company with one of the fastest-growing sectors in digital finance.

FGF’s commitment reflects a broader institutional recognition of Ethereum’s role as a core blockchain infrastructure asset. As more firms adopt similar treasury strategies, the demand for ETH could see sustained upward pressure, reinforcing its position as a strategic, yield-generating, and value-accreting asset in the corporate treasury landscape.

Price Action Details: Key Levels To Watch

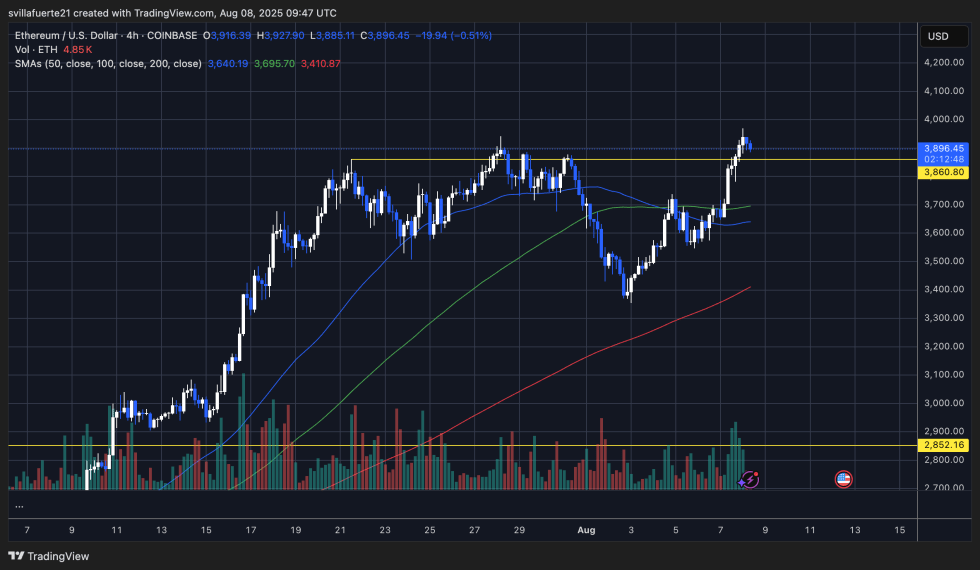

Ethereum (ETH) is showing renewed bullish momentum, as seen in the 4-hour chart, after reclaiming the critical $3,860 resistance level. The breakout came with strong buying volume, pushing prices toward the $3,900 zone. This move follows a sharp recovery from the $3,350 local low earlier in the week, with ETH now trading above its 50-day (blue), 100-day (green), and 200-day (red) moving averages — a structurally bullish setup.

However, the $3,900–$3,920 range is emerging as short-term resistance, where sellers have started taking profits. A decisive close above this level could open the door for a retest of the psychological $4,000 mark, last seen in mid-July. On the downside, immediate support lies at $3,860 — the previous resistance now flipped into a potential demand zone. If this level fails, ETH could revisit the $3,700 region, aligning with the 100-day MA for additional technical confluence.

Volume patterns indicate that buyers remain in control, but the market may need consolidation before another leg up. As long as ETH holds above $3,860, the broader trend favors continuation to the upside, especially with institutional interest — such as Fundamental Global’s $5B Ethereum treasury plan — reinforcing the bullish narrative. A break below $3,860 would weaken this outlook in the short term.

Featured image from Dall-E, chart from TradingView

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

![Security alert [Implementation of BLOCKHASH instruction in C++ and Go clients can potentially cause consensus issue – Fixed. Please update.] Security alert [Implementation of BLOCKHASH instruction in C++ and Go clients can potentially cause consensus issue – Fixed. Please update.]](https://moneyvisa.com/wp-content/uploads/2025/07/Announcing-the-Trillion-Dollar-Security-Initiative-560x420.jpeg)