With Trump tariffs feeding fears of a US economic slowdown and concerns rising about an AI-fuelled stock market bubble, now may not seem like a good time to invest.

Perhaps it’d be best to keep your financial powder dry? To wait until things calm down and the world feels a little more stable?

That makes perfect, intuitive sense – until you step back and look at the bigger picture.

In the long run, equities go up

The bigger picture looks something like this: the most reassuring chart in investing…

Data from JST Macrohistory, The Big Bang, and MSCI. August 2025. Real total returns in GBP.

The chart shows inflation-adjusted, World stock market returns surging through 125 years of upheaval, transformation, and occasional catastrophe.

Anyone who remained invested throughout that period would have earned 6% per year on average (over and above inflation).

That’s despite suffering the massive financial shocks that periodically interrupt the rise of equities.

The World’s worst stock market crash was the 52% real terms decline that unfolded during the 1973-74 Oil Crisis.

World War One and the Dotcom Bust inflicted similarly large losses.

But each setback was temporary. Progress resumed, just as it did after the Global Financial Crisis and Covid.

Investing is one damn thing after another

But what about now? Doesn’t the incessant drumbeat of uncertainty and looming peril suggest it would be better to stay on the sidelines for a while?

Time will tell. But the world is always troubled.

Here’s a catalogue of threats that menaced investors in the years that followed the Global Financial Crisis:

- 2010 – Greek bailout, The Flash Crash

- 2011 – EU debt crisis, double dip recession, US debt downgrade

- 2013 – The Taper Tantrum, US government shutdown

- 2015 – Chinese stock market crash

- 2016 – Brexit referendum, Trump election, Fed rate hike jitters

- 2018 – US-China trade war, quantitative tightening

- 2019 – Inverted US yield curve, Great Stagnation alarm

- 2020 – Covid, running out of Netflix shows in lockdown

- 2021 – Covid, Evergrande liquidity crisis, global energy crisis

- 2022 – Inflation surges, Russia invades Ukraine, the energy crisis deepens, global downturn

- 2023 – The collapse of Silicon Valley Bank triggers financial contagion fears, stagflation warnings

- 2024 – US-China tensions, S&P 500 overvaluation disquiet, US election uncertainty

- 2025 – Trump tariffs and trade disruption, asset bubble anxiety, government debt concerns

Despite all that, World equities grew 251% in real terms from 2010 to 2024, and the market reached new highs in 2025.

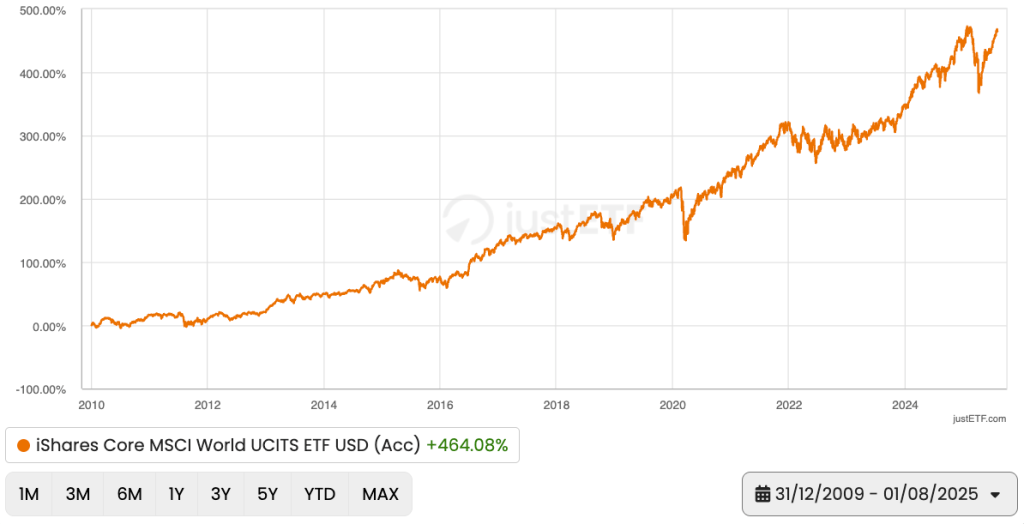

Here’s how that looks if you bought and held a World equities ETF from 2010 until the time of writing:

Data from JustETF. August 2025. Nominal total returns in GBP.

(Note: the ETF chart shows nominal returns. The real return measures how much your wealth has grown after stripping out the impact of inflation.)

The World equities real return averaged almost 9% a year over this period. In other words, the past 15 years has been an incredible time to invest – even though you had to endure constant worries and some painful downturns to profit.

Stock market returns are often earned the hard way.

Pain is why you are paid

It’s because equities have proven resilient over time that long-term investors stay in the market, regardless of short-term wobbles.

Trying to predict the perfect entry point often means missing out on growth because there is never a ‘safe’ time to invest.

Indeed, many of the market’s biggest opportunities have followed its most dramatic falls.

Prices rocket when investors eventually realise they overreacted to the last shock.

But human psychology guarantees you’ll fail to grasp those moments if you don’t upgrade your mental firmware from the basic Fear & Greed 1.0 package.

Greed sucks us into rising markets. Think 19th Century Gold Rush or 21st Century Crypto Bubble. We’re like moths to the money flame.

Then we get burned. Fear takes over and instructs us to: “Freeze! Just chill for a while. Let’s wait and see what happens.”

And then all of a sudden the market marches on without us. We miss most of the rally…

…until eventually greed overwhelms our fear again. Dragging us back into the action, because nobody wants to miss the last train to Fat Stacks City.

This is the chimp version of scissors, paper, stone. Greed beats fear. Fear beats greed. We flip-flop in time to the market’s beat, but out of tune with the opportunity.

Playing the market this way only increases the risk of buying high and selling low.

But wading in when your instincts scream “Danger! Danger!” will increase your odds of buying low and selling high.

As Warren Buffett puts it: “be fearful when others are greedy and greedy when others are fearful.”

Is now a good time to invest?

Now is as good a time as any to invest because for the vast majority of people it’s time in the market that counts, not timing the market.

In retrospect, the historic traumas charted above proved brief downward squiggles on the great graph of historical returns.

Progress is not inevitable, of course. But we shouldn’t lament the lack of guarantees either.

Uncertainty is the gunpowder that propels our future returns. It’s exactly because of the risk of loss that investors demand the prospect of higher returns from equities.

No-one gets paid for betting on a sure thing. But buying a stake in the continued progress of humanity – and its main engines of productivity – has paid off for the past 300 years.

If you believe we’re not done for yet then owning a diversified portfolio of equities is a wise investment, alongside other useful asset classes.

Use techniques like pound cost averaging to work your way into the market gradually and to benefit from the dips.

Check out our guide on passive investing to develop a strategy that works for you.

Take it steady,

The Accumulator

p.s. This article updates an older version from a few years back. We’ve left the existing comments below, as they provide interesting perspective and context as time goes by. But please do check the dates before replying.