Key Points

- Roughly 28% of college degrees show negative lifetime returns on investment after accounting for cost, time, and earnings potential.

- Many families face shortfalls after financial aid, with many turning to loans to bridge gaps of $100,000 or more.

- Degrees in engineering, computer science, and nursing are more likely to justify high costs while others may not deliver the same financial return.

As tuition climbs and aid packages shrink, many families are staring down a six-figure shortfall when sending their kids to college. That many not be all in one year – but a gap of $25,000 per year adds up.

Sticker prices at private universities regularly exceed $70,000 per year, while even out-of-state public institutions can top $50,000 annually when including room and board. Subtract scholarships and federal aid, and middle-income families are often left trying to fill a gap that stretches past $100,000.

It’s not just a financial challenge, it’s a value test. When does borrowing or spending that kind of money for an undergraduate degree make sense? According to recent data, the answer depends largely on what a student studies and whether they graduate on time.

A new report from the Foundation for Research on Equal Opportunity (FREOPP) analyzed more than 41,000 bachelor’s degree programs. It found that just under three-quarters showed a positive return on investment over a graduate’s lifetime. But about 12,936 programs (28 percent) did not. That means, no matter what, one-in-four students is likely to see a negative return on their college financial investment.

And when it gets up to whether spending $100,000 in worth it, even fewer programs make the cut…

Would you like to save this?

What's A Degree Worth?

College is a financial investment, and should be treated as such. You're going to spend money (likely a lot of money), and you probably have the expectation to earn it back in the future. That's called return on investment, or ROI.

According to the study, the median return on investment (ROI) for a bachelor’s degree program is $160,000. That number, however, masks wide variation. Engineering and computer science degrees often deliver lifetime returns of $500,000 or more, making a $100,000 up-front cost financially justifiable.

Degrees in education, psychology, and the arts often come in far lower. A student paying $100,000 for a degree with a $50,000 expected return over their career is effectively spending more than they’ll get back. FREOPP’s analysis adjusts for demographics, family background, academic ability, and expected earnings without college to produce its estimates.

Students who graduate late also see sharply lower ROI. A five-year graduate sees median returns drop to $275,000, while taking six years cuts that number further to $245,000. Delayed entry into the workforce, added tuition costs, and forgone wages all weigh on the math.

And remember, only two-thirds of students graduate college within 6 years. Meaning there's a one-in-three chance you'll never finish.

You can run our College ROI Calculator to see if what you're planning to spend has the potential for a positive ROI.

How To Cover The Financial Aid Gap

So, how are families expected to cover a $100,000 financial aid gap? Assuming you still believe there is a positive ROI, there are some options.

Some families begin saving early through 529 plans, using tax-advantaged growth to prepare for large future costs. Others delay retirement contributions or tap into home equity. In a growing number of cases, students themselves take on side gigs or part-time jobs while in school to limit the need for borrowing.

Student loans are also in play. Federal student loans are an option, but freshman can only qualify for $5,500 themselves. Parents can also borrow parent PLUS loans, with new caps next year of $20,000 per year (or $65,000 in total per student).

Then there are private student loans. While they offer lower interest rates to well-qualified borrowers, they lack many of the protections built into federal student loans, such as income-driven repayment plans or student loan forgiveness programs. For families shut out of need-based aid but unable to cover costs out of pocket, private loans can feel like the only option.

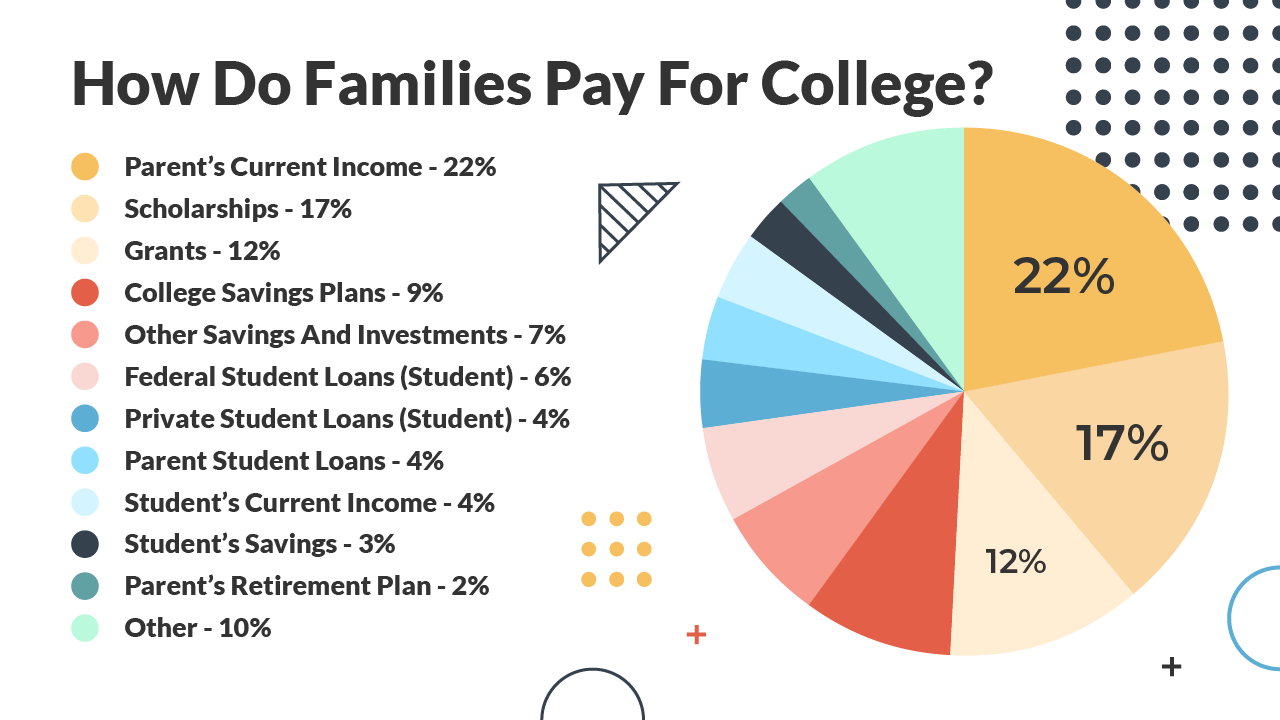

Many families take a hybrid approach: using all types of funds to pay for college.

Weighing The Trade-Offs

There’s no single path through the college affordability maze, and the answers differ based on a family’s resources and a student’s career goals. But one message is clear: the era of blindly assuming that any college degree is worth any price is over.

Families need to assess outcomes with the same scrutiny they’d bring to any six-figure investment. That means looking past marketing materials and asking hard questions about graduation rates, post-college earnings, and whether the academic program aligns with a career that can support the cost.

You can use free tools like College Scorecard to see graduation rates, student loan borrowing statistics, and more.

For some majors and institutions, the numbers still add up. For others, a different college, a lower-cost path, or a rethinking of whether to enroll at all may be the smarter move. A degree can still unlock economic mobility,, but only when the price aligns with the payoff.

Don't Miss These Other Stories:

Editor: Colin Graves

The post When Does A $100,000 Degree Make Sense? appeared first on The College Investor.