Recently, I was a guest on the ChooseFI podcast, Episode 543, to talk about the Middle-Class Trap, a term Scott Trench and I have coined on the BiggerPockets Money Podcast, to describe a scenario someone on the path to FIRE (Financial Independence, Retire Early) might find themselves on if they’re not careful.

The crux of the Middle-Class Trap is: You do everything right, max out your 401(k), dutifully pay down (or off) your mortgage—perhaps you go so far as to contribute to HSA and Roth IRA accounts. You find yourself at your FI number and make plans to retire early, but upon further inspection, you can’t actually access those funds without paying fees and/or high interest rates.

How Did I Get Here?

The conventional FI wisdom is to contribute to your tax-advantaged accounts to get your company match, then max out Roth IRA and HSA, then go back and continue with tax-advantaged accounts to the end of your investing dollars or until it’s maxed, and then move to after-tax brokerage accounts.

The problem here is that many people’s investing dollars run out before they get to their after-tax brokerage accounts. Or, to quote one respondent, “My 401(k) just comes out of my paycheck super easy; taxable takes more work that I’m not as good about.”

Chatting about it with my husband, he had this to say:

“In my case, when I started working, I wasn’t earning enough to max out my 401(k). At the time, my salary as a software developer was a healthy $36,000 (hey, it was 25 years ago!). 401(k) limits were $10,500.

Of course, the time in our life when you’re making the least amount of money is at the start of your career. Also, I was saddled with college loans. It took a decade of work before I had enough left over after maxing out my 401(k) to think about significant contributions to a post-tax account.

Therefore, my 401(k) had a massive head start. And by the time I could contribute healthy amounts to an after-tax account, I was making good money ($95,000/year), so the incentives were much higher to max out my 401(k) to cut my taxable income ($16,500).”

Of course, to be better about after-tax investing, you could set it up with HR to send a set amount to your brokerage account every paycheck. You’d also have to set up automatic investing with your brokerage; otherwise you’d find yourself in a similar-but-different position of having the money there, but not invested in anything.

The Middle-Class Trap ISN’T a Problem!?

As a response to this episode, Sean Mullaney, The FI Tax Guy, and a CPA, wrote this article, sharing why he felt the Middle-Class Trap doesn’t exist and isn’t a problem for people on the path to FI.

Now, Sean and I are friends, so this article isn’t an attack on me—it’s a healthy discussion (in the form of a rebuttal) between people who are really just trying to bring light to situations (and solutions) so that if you DO identify with the Middle-Class Trap, you can start working on a financial change.

One very important point to note (and Brad brought it up in Episode 543) is that while your home equity IS part of your net worth, it should NOT be part of your FI number. I think a lot of FIRE Community peeps conflate these two numbers. I know I frequently do. But if you’re planning on retiring early, AND continuing to live in your home, your FI calculation should NOT include that home equity.

Further, I’d argue that if you are planning to move from your current home and downsize into something else, you should take a look at the real estate market where you hope to retire. With the run-up in home valuation over the last few years, you could be looking at selling your current home only to take on a similar—or even larger—mortgage payment due to the rising interest rates. If you’re paying cash for the new home, this matters less but will also take a good chunk of your equity, so make sure to factor that in.

10% Penalty Isn’t a Barrier to Early Retirement

In another point Sean makes, he says, “The 10% Early Withdrawal Penalty Is No Bar to Early Retirement.”

I think Sean forgets who he’s talking to. These are the same people who are vigorously debating 50 basis points on an investment account. They’re not going to drop 10% on fees to access their money.

Effective Tax Rate

Sean does bring up an excellent point about the effective tax rate, and this is something that I am “aware” of but always forget. I also feel like I represent the more “average” FIRE adherent in that I’m not formally trained in this like a financial planner would be. The tax code is confusing on purpose, and I feel the different tiers of taxation are NOT designed to clear things up.

The Effective Tax Rate means the ACTUAL rate of tax you pay, once you take into account the amount of taxes paid on your income that falls into the 10% bracket, the taxes paid at 12%, etc.

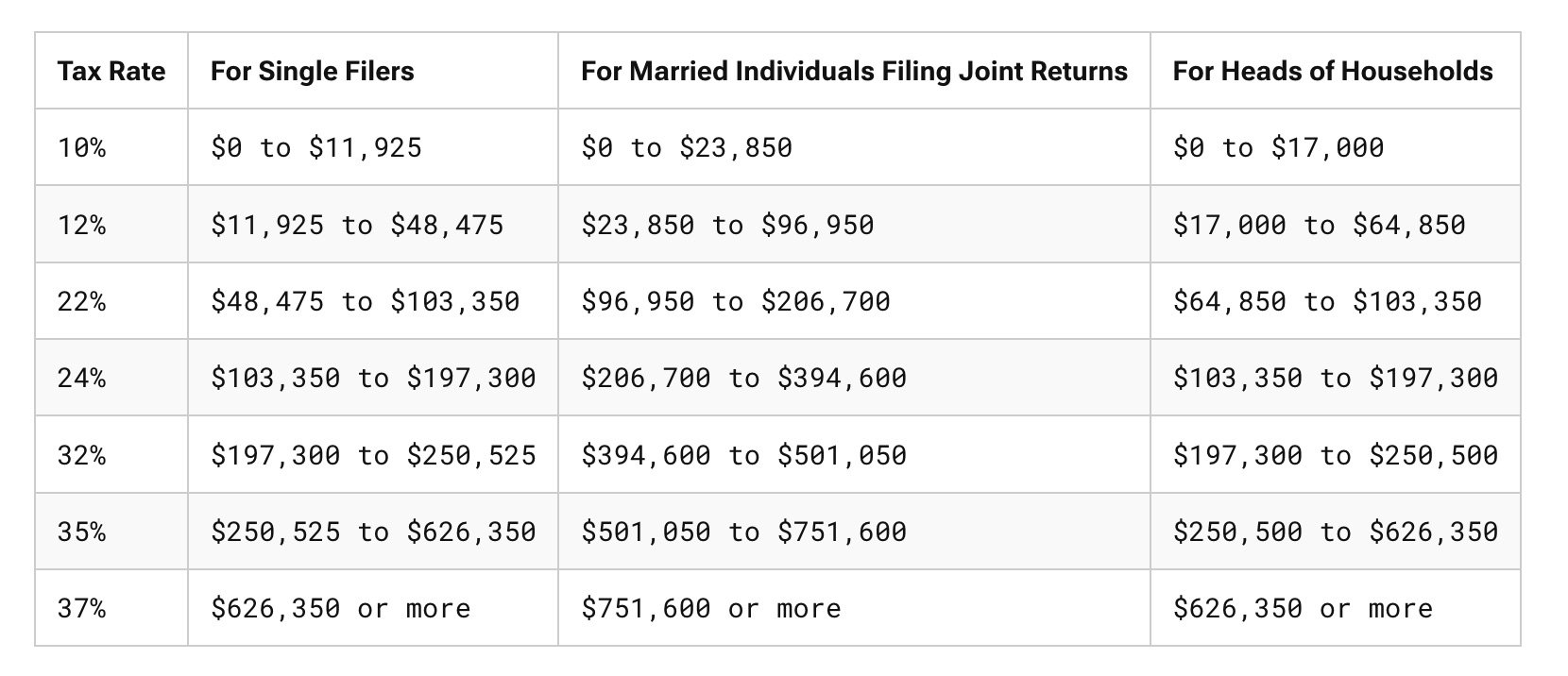

The federal tax brackets chart shows the tax rate you’ll pay on any set income range, depending on your filing status.

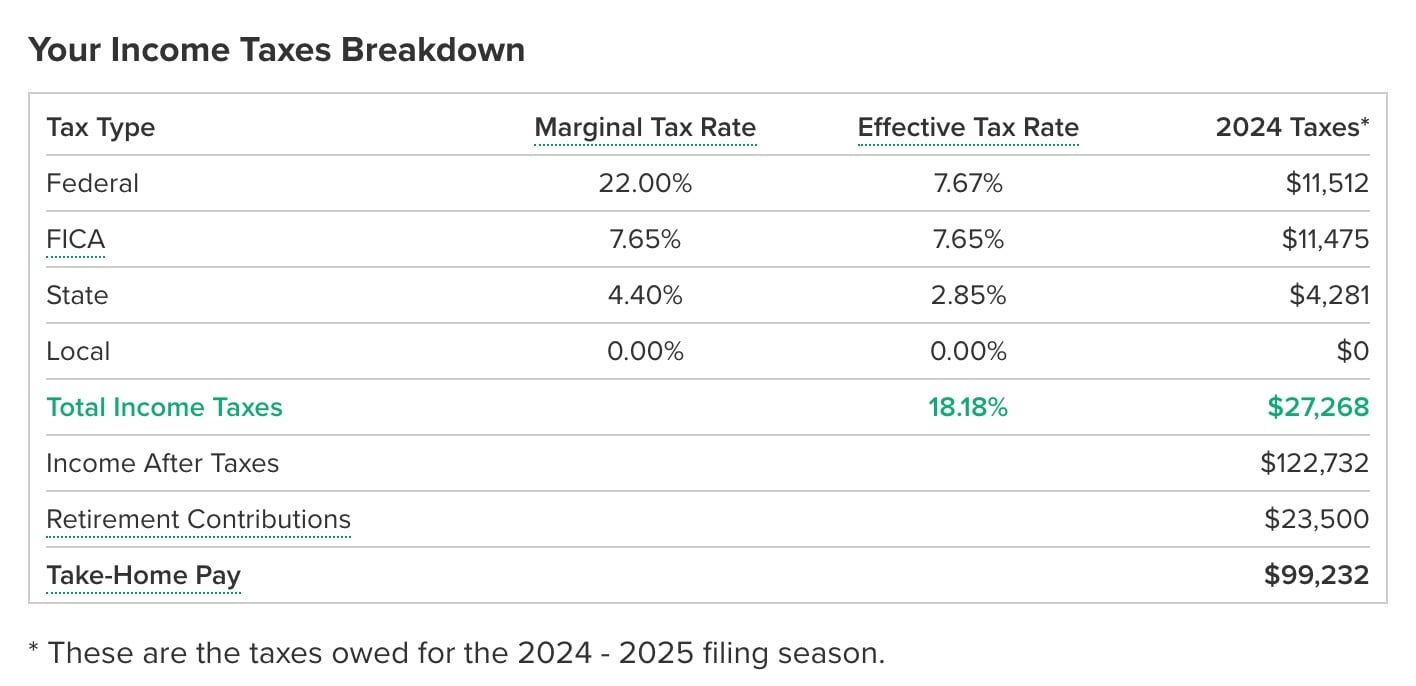

Smart Asset has an excellent Effective Tax Rate Calculator that will give you a down-and-dirty estimate of your taxes owed. I ran a quick hypothetical, and on $150,000 in income, filing in Colorado and maxing out your traditional 401(k), your take-home income for the year is just over $99,000, and your effective tax rate is 18%.

Here is how the taxes shake out:

“I Don’t Have Enough Left Over”

I will argue the point made by one of the respondents in the ChooseFI group: After maxing out the 401(k), paying bills, and doing all the things, there isn’t a whole lot left over to put into an after-tax brokerage. Remember, these FI people might also be maxing out an HSA ($8,550) and a Roth ($7,000). If so, we’re now at $83,600, but we still haven’t paid for anything for daily life yet.

We’re at $6,900/month. Let’s start paying some bills.

I tracked my spending in 2022 at www.biggerpockets.com/mindysbudget, and reality shows my spending to be $6,500/month on average. (Which is absolutely NOT what I thought my spending was, and I encourage everyone to track their spending in real time for a few months to determine your ACTUAL spending, not what you THINK you’re spending.)

That doesn’t leave a whole lot left over to put into an after-tax brokerage account if I were this fictional person in the example above—about $400/month.

The Argument for Brokerage Accounts Anyway

And while Sean (and Brad and Chris) all espoused the tax benefits of the traditional 401(k), paying 10% penalties to get your money is 10% PLUS paying income tax on the withdrawals—income tax brackets start at $1 income. Compare that to the capital gains tax rates that apply to brokerage accounts but don’t start until $96,701—AND keep in mind that’s just the GAIN.

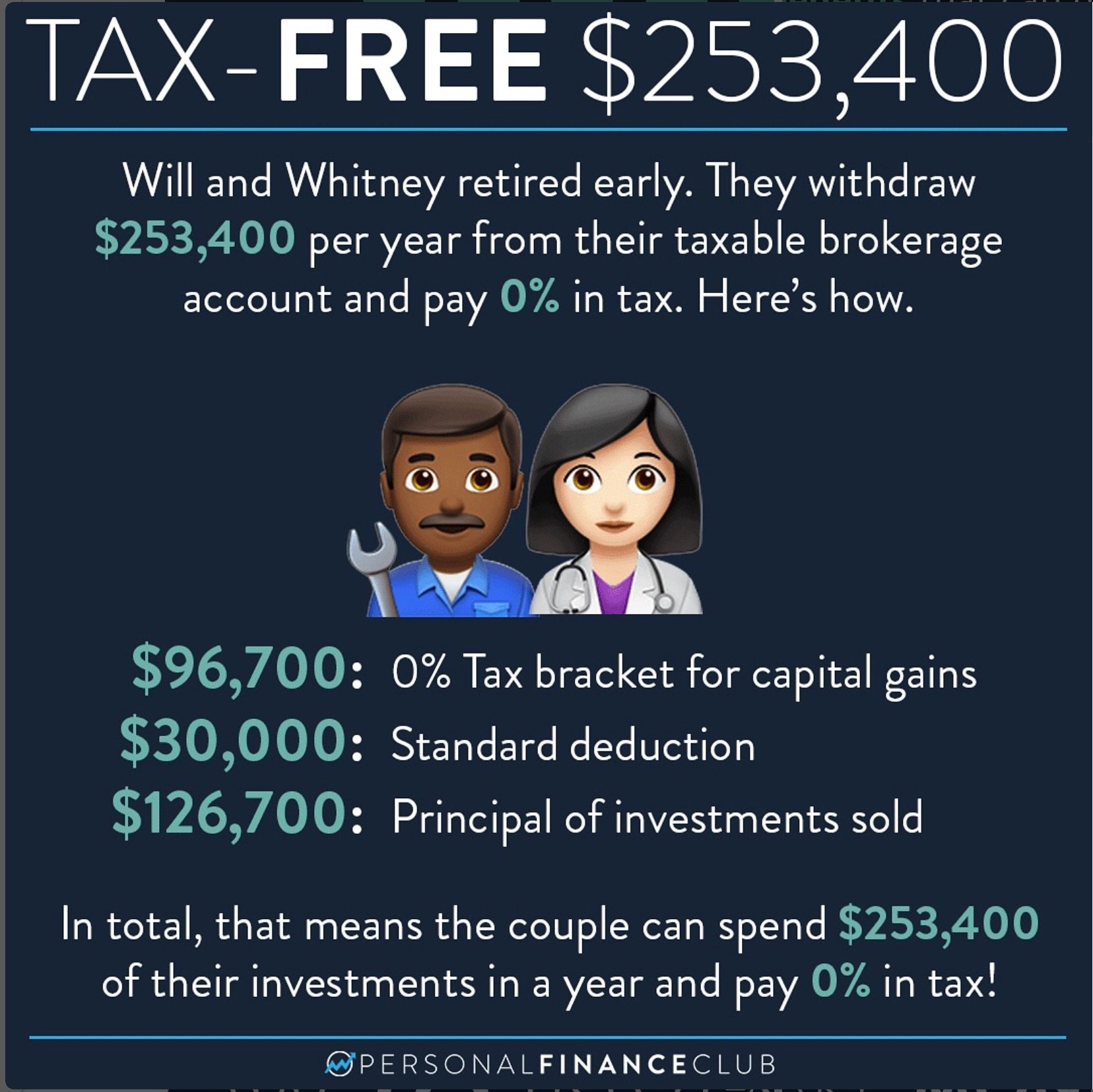

My friend Jeremy Schneider over at Personal Finance Club made this EXCELLENT graphic to show just how powerful the brokerage account can be—and how you can access up to $253,400 TAX-FREE!

I reached out to Jeremy to ask him to break this down further, and he did not disappoint. He said:

“There are special tax brackets set by the federal government for capital gains. Capital gains are when you sell stuff for a profit, like the investments you hold in a regular brokerage account. In 2025, the lowest capital gains tax bracket is 0% for single filers with up to $48,350 in income and married filers with up to $96,700 income. That means if you retire early and find yourself with no other income, you can ‘realize’ up to that much in capital gains each year and pay ZERO federal tax.

Additionally, the married filing jointly standard tax deduction for 2025 is $30,000. So you get to subtract that amount from any income before you apply the tax bracket. That means you can actually realize up to $126,700 in gains and still pay ZERO federal tax. ($126,700 – $30,000 standard deduction = $96,700, which all falls in the 0% capital gains bracket.)

Furthermore, you don’t pay tax on any PRINCIPAL of your investments. For example, if you invested $10,000 and it grows to $15,000, and then you sell and spend the money, you would only be on the hook to pay tax on the gain of $5,000, not the full amount of $15,000. The example in this post assumes Will and Whitney’s investments have doubled when they sell, meaning they wouldn’t owe capital gains tax on the $126,700 of principal, giving them a total of $253,400 they can spend in a year and pay zero tax.

Of course, this is for long-term capital gains—meaning investments you’ve held for MORE than one year. Regular income tax applies to short-term capital gains—investments held for less than one year.”

It’s Important When It Happens to YOU

One point I brought up in Episode 543, and want to restate here, is that I have 100+ emails in my inbox from listeners of the BiggerPockets Money Podcast who identify with the Middle-Class Trap and are looking for a way out of it.

When it’s happening to you, it kind of doesn’t matter that you’re “in the minority” of people with this issue. You’re 100% of your own personal experience.

Scott and I didn’t start talking about the Middle-Class Trap to cause an inter-podcast war. We brought it up to get our listeners to start thinking about where their money is going. To start directing it on purpose so they can reach early retirement and actually retire, because they’ve got money in the correct buckets.

Sean mentioned the 72T option, which Scott and I also brought up in our episode, How to Avoid the Middle-Class Trap. This option, once initiated, requires you to take essentially the same distribution for at least five years, or until you reach age 59½, whichever comes first, but these distributions are penalty-free.

Not tax-free—you still pay income tax on the distribution. And while 72T can be started at any age, the younger you are when you start, the longer you have to take this money. Uncle Sam wants his money!

Another option—but only available to people age 55 or older—is the Rule of 55, which allows for penalty-free withdrawals so long as you’ve separated from the company you have your 401(k)/IRA with, and have reached age 55. You can get another job, but if you roll over your 401(k)/IRA to the new company, your withdrawals must stop.

There ARE options available to you, but only if you know to ask about them.

Verbal Numbers Are Hard to Follow

During Episode 543, I was spouting out numbers from actual Finance Friday guests to try to illustrate my point, and Sean helpfully put them all into a chart in his article so you can follow along. I think Sean’s summary of these four scenarios is spot on: “Persons A, B, and D are not in the Middle-Class Trap. Rather, they are in a situation where they need to work longer…”

Ultimately, this is where our Finance Friday guests frequently find themselves: not as FI as they thought they were.

Which I think goes back to the top: Your home equity is part of your net worth, but should not be included in your calculations when determining how much you have for retirement.

I’m so happy this discussion that Scott and I started sparked so much conversation in our community. All these different points of view only help us all learn.

Thanks to Brad Barrett and Chris Mamula for the conversation and to Sean Mullaney, The FI Tax Guy, for this thoughtful response.

The Money Podcast

Kickstart your personal finance journey with Scott and Mindy as they break down the good, bad, and ugly of people’s personal money stories. From interviews with entrepreneurs and business owners to breakdowns of listener finances, you’ll get actionable advice on how to get out of debt and grow your money.