Key takeaways

-

A crypto inheritance plan is vital because losing private keys or seed phrases can permanently make assets like Bitcoin, Ether and NFTs unrecoverable.

-

A strong inheritance plan includes asset inventories, secure access instructions and a trusted executor, ensuring heirs can safely and legally access holdings.

-

Privacy must be protected using encrypted files, sealed documents or decentralized identity tools rather than exposing sensitive details in public wills.

-

Balancing custodial and non-custodial solutions helps secure assets while simplifying transfers, avoiding mistakes like storing everything on exchanges or sharing keys insecurely.

If you hold digital currencies like Bitcoin (BTC) and Ether (ETH), it is essential that you create a clear and well-thought-out inheritance plan to prevent your crypto from going down the drain once you are not around.

Unlike traditional bank accounts, cryptocurrencies are controlled entirely by private keys and seed phrases (regardless of whether they’re stored in hot or cold wallets), and losing these keys means the assets become permanently unrecoverable. Each year, cryptocurrency worth millions of dollars is lost due to forgotten passwords, misplaced wallets or heirs unsure how to proceed with crypto assets.

Traditional wills often fail to adequately address digital assets, resulting in possible legal complications or permanent loss. A carefully designed crypto inheritance plan addresses these challenges, ensuring your assets remain secure and accessible to your beneficiaries as you intend.

This article discusses what makes it imperative for you to have a crypto inheritance plan, components of such a plan, ways to protect privacy while planning, crypto death protocols and a lot more.

Why you need a crypto inheritance plan

If you own cryptocurrency, creating a crypto inheritance plan is essential. Unlike traditional bank accounts, cryptocurrencies are often self-custodied, meaning only you hold the private keys or seed phrases. If you pass away without sharing this information, your assets could be lost forever. A digital asset will ensure proper sharing of altcoins and Bitcoin private keys after death.

Around 1.57 million Bitcoin are likely lost, which is approximately 7.5% of the total supply of Bitcoin (it has a fixed upper limit of 21 million BTC). Traditional wills often fail to address cryptocurrency-related requirements, and heirs may lack the technical skills to access or manage digital wallets.

Without clear crypto estate planning, your crypto assets could be unrecoverable, leaving your family with nothing. A well-designed digital asset will ensure secure crypto transfer after death to your loved ones. Your heirs know what assets you hold, how to access them and how to manage them responsibly. Knowing how to pass on crypto is not just about preserving wealth; it is about safeguarding your legacy in a growing digital financial landscape.

Did you know? Crypto estate services offer features such as multisignature recovery, secure identity verification and smart contract-based wills, helping investors ensure their crypto seamlessly goes to their heirs without the chaos of lost access.

Prerequisites for building a secure crypto inheritance strategy

Creating a crypto inheritance plan is essential for protecting your digital assets and ensuring they’re passed on to the right people, with minimal confusion or risk. Because crypto is self-custodied and irreversible, a clear and secure strategy can make the difference between preserving your legacy or losing it forever.

Here are the core foundations you need before designing your crypto inheritance plan:

1. Establish clear legal directives

Start by working with an estate planning attorney who understands both inheritance law and digital assets. Your crypto should be referenced in legally binding documents such as a will, trust or letter of instruction.

Be specific about:

-

What assets are to be inherited

-

Who the beneficiaries are

-

How the assets should be accessed.

These documents help ensure your wishes are legally recognized and reduce the risk of disputes or legal barriers later on.

2. Secure and share private key access responsibly

The biggest challenge in crypto inheritance is key management. Without your private keys or seed phrases, your beneficiaries can’t access your assets, and exchanges can’t help recover them.

Consider these options:

-

Use multisignature wallets that require two or more private keys to approve a transaction.

-

Distribute key parts among trusted family members or advisers using Shamir’s Secret Sharing.

-

Store recovery data in secure, tamper-proof locations (e.g., bank safe deposit boxes, encrypted drives).

Always document how and where to find the keys in a way your heirs can understand.

3. Integrate smart contract automation (where supported)

In some ecosystems, smart contracts can automate inheritance by triggering transfers when predefined conditions are met, such as verifiable death certificates or time delays. While not available on every chain, platforms like Ethereum support programmable logic that can complement legal planning.

Smart contracts should never replace legal documentation. Instead, use them to enforce your intent in a transparent and secure way.

4. Educate your heirs or trusted executors

Even the best inheritance plan can fall apart if your beneficiaries don’t understand crypto. Take time to:

-

Document clear, step-by-step access instructions.

-

Explain wallet tools, basic security and how to avoid scams.

-

Designate a trusted crypto-literate executor to guide the process.

You don’t need to disclose balances today, but education is your safeguard against future confusion, delay or loss.

Did you know? One of the most significant risks in crypto inheritance is forgotten credentials. Proper planning with encrypted backups or secure executors could have preserved crypto worth billions for future heirs.

How to write a crypto will

A crypto will ensures your digital assets are securely transferred to your beneficiaries while maintaining privacy and legal compliance. By carefully documenting your assets and instructions, you can minimize risks and establish next-of-kin crypto access.

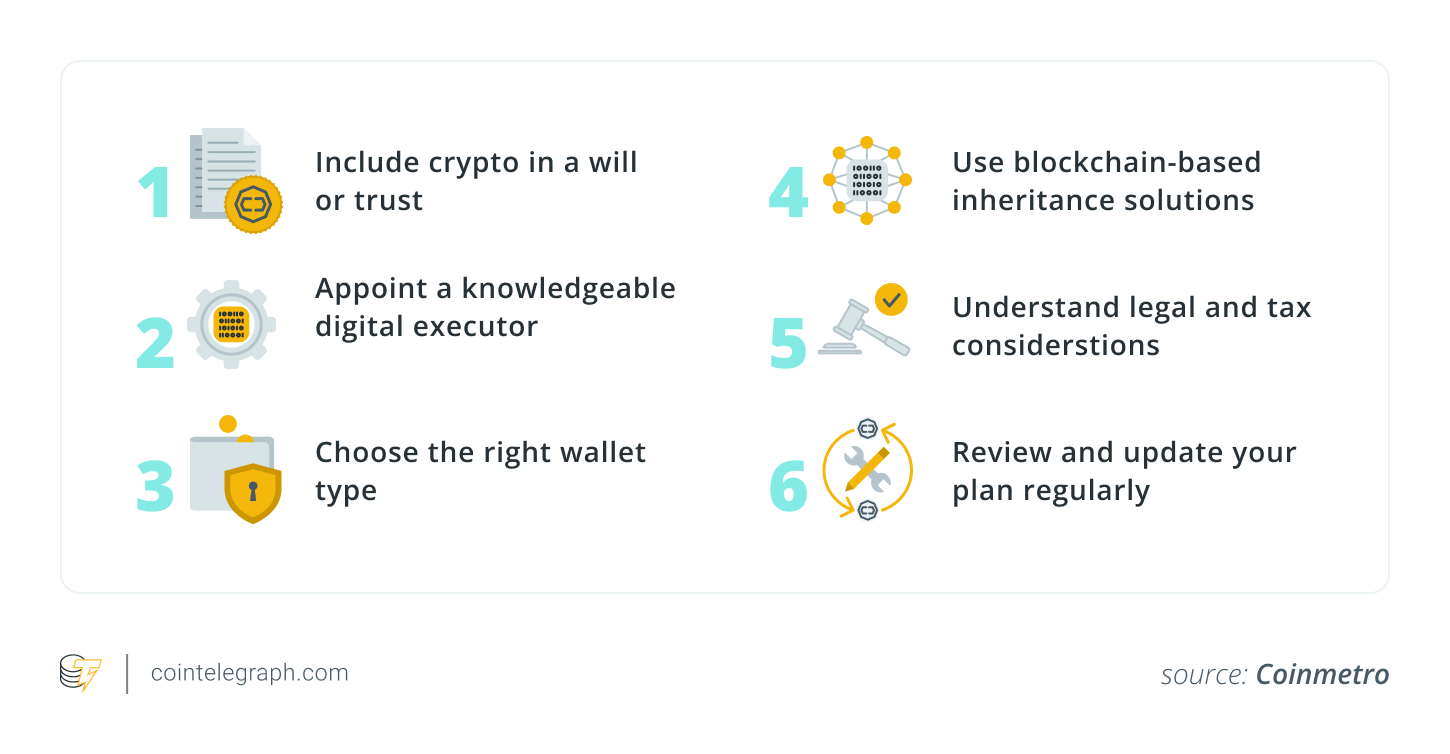

Here are a few general steps you can follow to create a crypto will:

-

Compile a detailed inventory: List all digital holdings, including hardware and software wallets, exchange accounts, non-fungible tokens (NFTs) and decentralized finance (DeFi) investments, to provide a clear overview of your assets.

-

Secure sensitive information: Avoid including private keys in the will. Store them in encrypted files or hardware wallets, referencing access instructions in the document.

-

Provide clear access instructions: Include detailed steps for accessing your digital assets within the will, ensuring beneficiaries can retrieve them securely.

-

Appoint a tech-savvy executor: Choose a trusted individual familiar with cryptocurrency or set up a trust to manage and execute the transfer process effectively.

-

Ensure legal compliance: Verify that the will aligns with local inheritance and tax laws to prevent disputes or legal complications.

-

Incorporate a digital asset memorandum: Consider adding a memorandum to outline specific instructions for your digital assets, enhancing clarity and security.

-

Use specialized services: Explore crypto inheritance services to provide additional security and streamline the transfer process for your beneficiaries.

-

Update regularly: Review and revise the will periodically to reflect changes in your assets or updates to legal requirements, ensuring ongoing accuracy.

You also need to take into account inheritance tax on Bitcoin and other crypto assets while setting up your crypto inheritance plan.

How to protect privacy while planning crypto inheritance

Preparing for the future is essential, but safeguarding your privacy during the process is equally important. When creating a digital asset will, sharing sensitive information can lead to risks.

Here is how to protect your personal and digital information while ensuring posthumous crypto recovery:

-

Avoid including sensitive details in public wills: Do not list private keys, wallet addresses or access codes in public legal documents. Instead, acknowledge the existence of digital assets without disclosing specifics.

-

Use sealed letters or encrypted files: Provide critical access information through sealed envelopes or encrypted documents, ensuring only trusted individuals can access it when needed.

-

Explore decentralized identity tools for secure access: Use decentralized identifiers (DIDs) or verifiable credentials to safely manage and transfer access rights across platforms, ensuring long-term security.

Why you need to regularly review and update your crypto inheritance plan

A cryptocurrency inheritance plan requires ongoing attention, not a one-time setup. As digital assets and personal circumstances evolve, regular updates aligning with your crypto legal advice are crucial to keep your plan accurate and effective.

Here are a few reasons why you should review and update your crypto estate planning at regular intervals:

-

Cryptocurrency values and holdings may shift: The value of digital currencies can change significantly, and you may buy or sell assets over time. Periodic reviews ensure your plan reflects your current portfolio.

-

Wallets and exchanges may become outdated: Technology advances quickly, and some wallets or crypto exchanges may close, lose relevance or stop supporting specific tokens. Ensure your instructions remain practical and up to date.

-

Revise the plan after major life events: Events like marriage, divorce or the birth of a new heir may affect your intended beneficiaries or asset distribution. Update your digital asset will after such events to keep it legally and personally relevant.

Did you know? Crypto enthusiasts sometimes set up “dead man’s switches.” These systems automatically transfer funds if the owner doesn’t log in for a set time. While ingenious, they must be paired with legal documents to avoid disputes and accidental early triggers.

Crypto inheritance plan: Custodial vs. non-custodial wallets

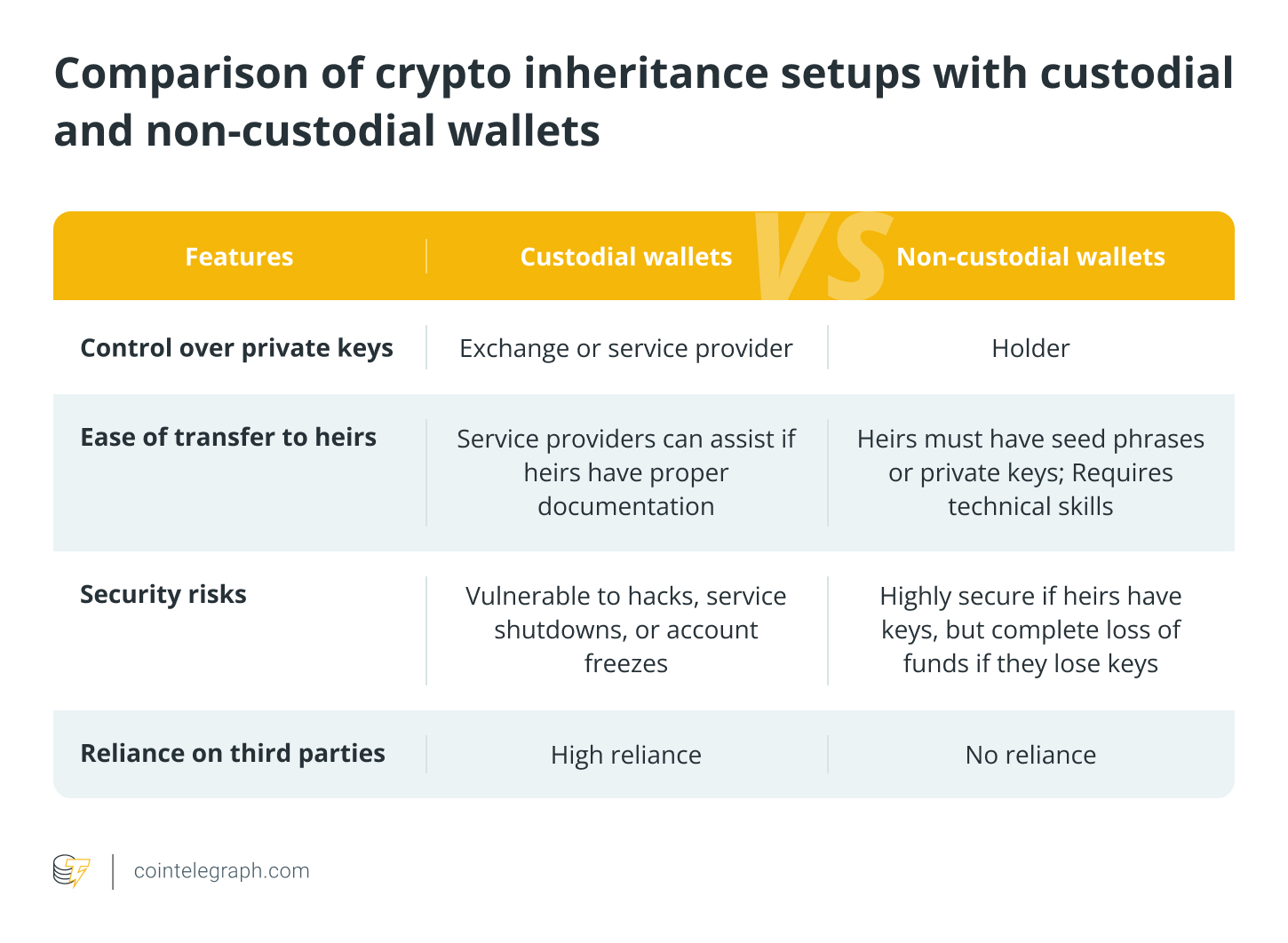

Establishing a cryptocurrency inheritance plan requires understanding the distinction between custodial and non-custodial wallets.

Custodial wallets are managed by third parties, such as exchanges, which hold the private keys. While this might simplify access for the heirs with proper documentation and support, it also carries risks, including hacks, account freezes or service termination.

On the other hand, non-custodial wallets offer users complete control by storing private keys locally. While excellent for long-term security, they demand meticulous planning. If heirs misplace the seed phrase or lack technical expertise, assets may become inaccessible.

For inheritance, a balanced strategy is optimal. Non-custodial wallets are securer and provide full control, while custodial services lead to easier transfers.

Comparison of crypto inheritance setups with custodial and non-custodial wallets

How to avoid common crypto inheritance mistakes

Setting up a cryptocurrency inheritance plan is essential, but certain errors can compromise its efficacy. Avoiding these mistakes helps ensure your assets remain secure and accessible when needed.

Here are a few mistakes you should avoid when setting up a crypto inheritance plan:

-

Including seed phrases in wills or unsecured documents: Listing private keys or seed phrases in public or unprotected documents risks theft or misuse. Instead, use encrypted storage or secure, offline methods.

-

Not training heirs: Even with thorough documentation, heirs unfamiliar with cryptocurrency may struggle to access or manage assets. Provide clear instructions regarding wallets and transfers.

-

Relying heavily on centralized exchanges: Exchanges may face closures, hacks or account freezes, making them unreliable for long-term storage. Opt for self-custody solutions or trusted multisignature wallets for enhanced security.

Crypto estate planning: Safeguarding your digital wealth

A clear and secure digital asset will provides confidence by removing uncertainty for both asset holders and their heirs. For holders, it ensures all their digital assets, including BTC, altcoins, NFTs or DeFi holdings, are not lost due to forgotten keys, inaccessible wallets or heirs’ lack of technical expertise.

With a crypto inheritance plan, records of assets, access instructions and other legal documents protect your legacy and prevent conflicts.

For beneficiaries, it simplifies the process of accessing assets, sparing them the stress of navigating a complex tech landscape they aren’t familiar with. The plan ensures a smooth transfer of wealth by using secure storage, trusted executors and legally compliant documents.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.