Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

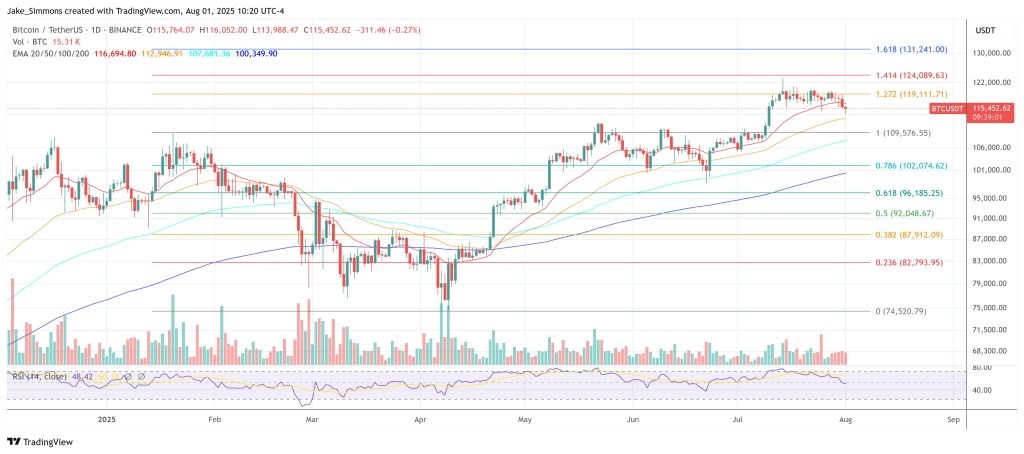

Bitcoin’s latest push towards $120,000 fizzled into a stall-out that now resembles a “failed breakout zone,” according to market analytics firm Swissblock. In a July 31 thread, the firm said “momentum has failed to ignite,” arguing that realized-profit flows and an overwhelming share of coins sitting in profit have turned every bounce into an opportunity for supply to meet price.

Profit-Taking Cools Bitcoin Rally

Swissblock framed the setback as a pause rather than a breakdown. “Profit-taking is rising—but not as intense as late 2024,” the firm wrote, adding that the effect through July was “enough to cap upside and trigger consolidation.” The tone is cooling, not capitulatory: “Selling pressure is visible, but not extreme—think cooling, not capitulation.” That diagnosis hinges on on-chain readings of realized profit—an input that tends to expand into rallies as long-held coins are spent into strength—and a market structure in which bids are absorbing supply rather than being overwhelmed by it.

Related Reading

The most striking datapoint in the thread is breadth of profitability: “96% of supply is in profit,” Swissblock noted, citing Glassnode. That ratio is historically consistent with late-cycle euphoria, but it is also mechanically self-limiting; when nearly all holders are in the green, latent sell pressure rises because “unrealized gains are tempting sellers.” As Swissblock put it, “Strong holders remain. But unrealized gains are tempting sellers. Until demand returns, each bounce invites supply.” The firm contends the broader trend “is intact—but momentum needs a reset.”

Beyond on-chain realized flows, the firm’s composite fundamentals read neutral with improving liquidity. “BTC fundamentals are strong and stable,” Swissblock wrote, pointing to a Bitcoin Fundamentals Index reading of 60 (neutral), “Network Growth is cooling,” and “Liquidity is recovering.” That mix typically favors range behavior over directional surges—“a consolidation-supportive environment,” as the post put it—in which Bitcoin “can grind sideways longer—until it’s ready to break with conviction.” The implication is that the market’s “failed breakout” risk reflects timing rather than trend reversal: positioning and liquidity are not aligned yet for a sustained continuation.

Related Reading

The cross-asset context is equally nuanced. “Altseason is active—but under stress,” Swissblock wrote, observing that while “$ETH continues to outperform BTC structurally, holding up better in this pullback,” most altcoins are sagging, with “only 5% of top 100 showing positive impulse.” That thinning rotation underlines the selectivity of risk appetite and the fragility of momentum outside of the largest names. Historically, that pattern often precedes a decisive move in Bitcoin that either recharges the rotation or breaks it.

Swissblock’s concluding assessment leans cautiously constructive. “Profit-taking is fading and selling pressure is being absorbed. BTC is preparing for breakout—but momentum needs to align.” Until that alignment arrives, the firm expects a grind: bids continue to meet supply from profitable holders, realized profits moderate, and liquidity improves in the background. If and when Bitcoin flips momentum back to positive, Swissblock argues, the spillover could be forceful: “While BTC grinds sideways, watch for the moment it flips—ETH and altcoins will likely explode upward when it does.”

In short, today’s dip to $115,000 looks less like an outright rejection than a test of the market’s ability to digest profits and reset momentum without damage to the underlying uptrend. With 96% of supply in profit and breadth compressed, the next impulse likely hinges on whether liquidity and demand can reassert themselves before profit-taking reaccelerates. For now, Swissblock’s message is clear: the breakout will need to be earned, not assumed.

At press time, BTC traded at $115,452.

Featured image created with DALL.E, chart from TradingView.com