Ethereum-focused (ETH) blockchain firm BTCS Inc. has unveiled plans to raise up to $2 billion through share sales to expand its cryptocurrency holdings. The move was disclosed in a recent S-3 registration statement filed with the US Securities and Exchange Commission (SEC).

BTCS To Accumulate More Ethereum?

According to a recent S-3 filing with the US financial watchdog, US-based digital assets firm BTCS is eyeing a raise of $2 billion through share sales in a bid to grow its digital assets portfolio and expand operations.

Specifically, BTCS aims to sell common shares across multiple offerings, subject to a total offering cap of $2 billion. In the official SEC filing, the company remarked:

We intend to use the net proceeds from the sale of the securities by us to provide additional funds for purchasing digital assets, working capital, and other general corporate purposes.

In addition to the S-3 filing, BTCS submitted a separate filing for the resale of more than five million shares of common stock related to prior convertible notes and warrants. The firm expects to generate up to $12 million from this offering.

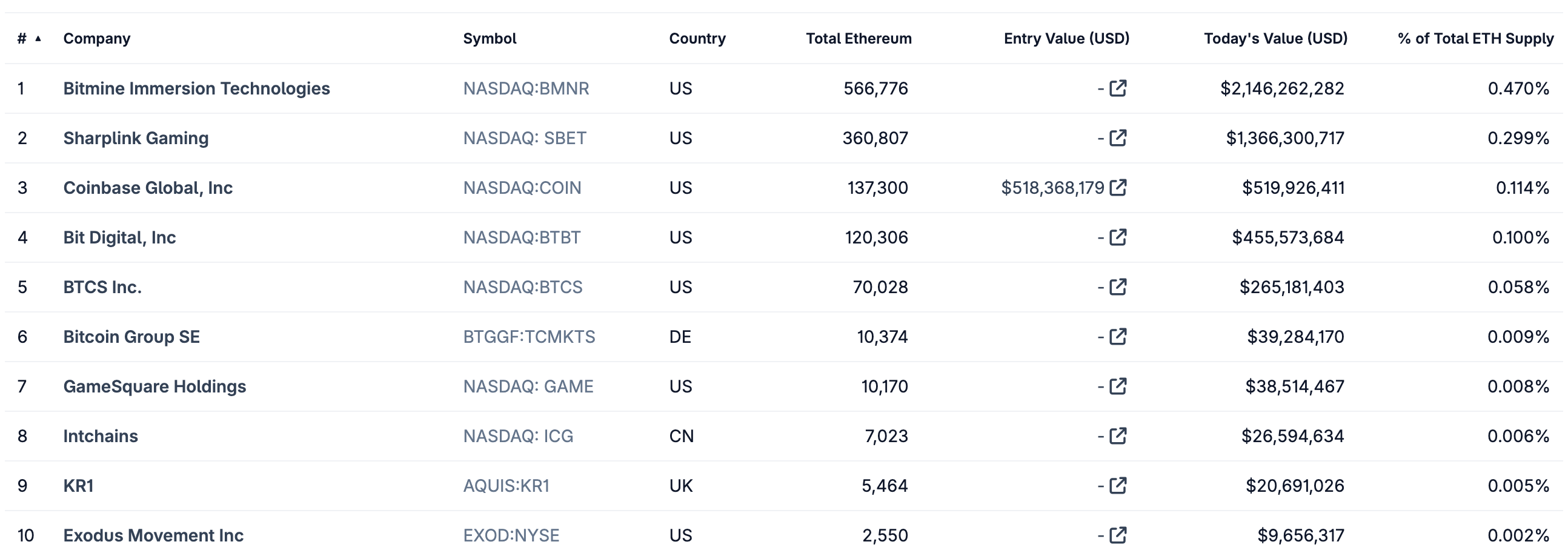

BTCS has been steadily increasing its ETH reserves throughout 2025. Most recently, it purchased 14,420 ETH, bringing its total holdings to 70,028 ETH – currently valued at around $275 million.

According to data from CoinGecko, BTCS ranks fifth among publicly-traded companies with the largest ETH treasuries. BitMine Immersion Technologies tops the list, holding 566,776 ETH on its balance sheet.

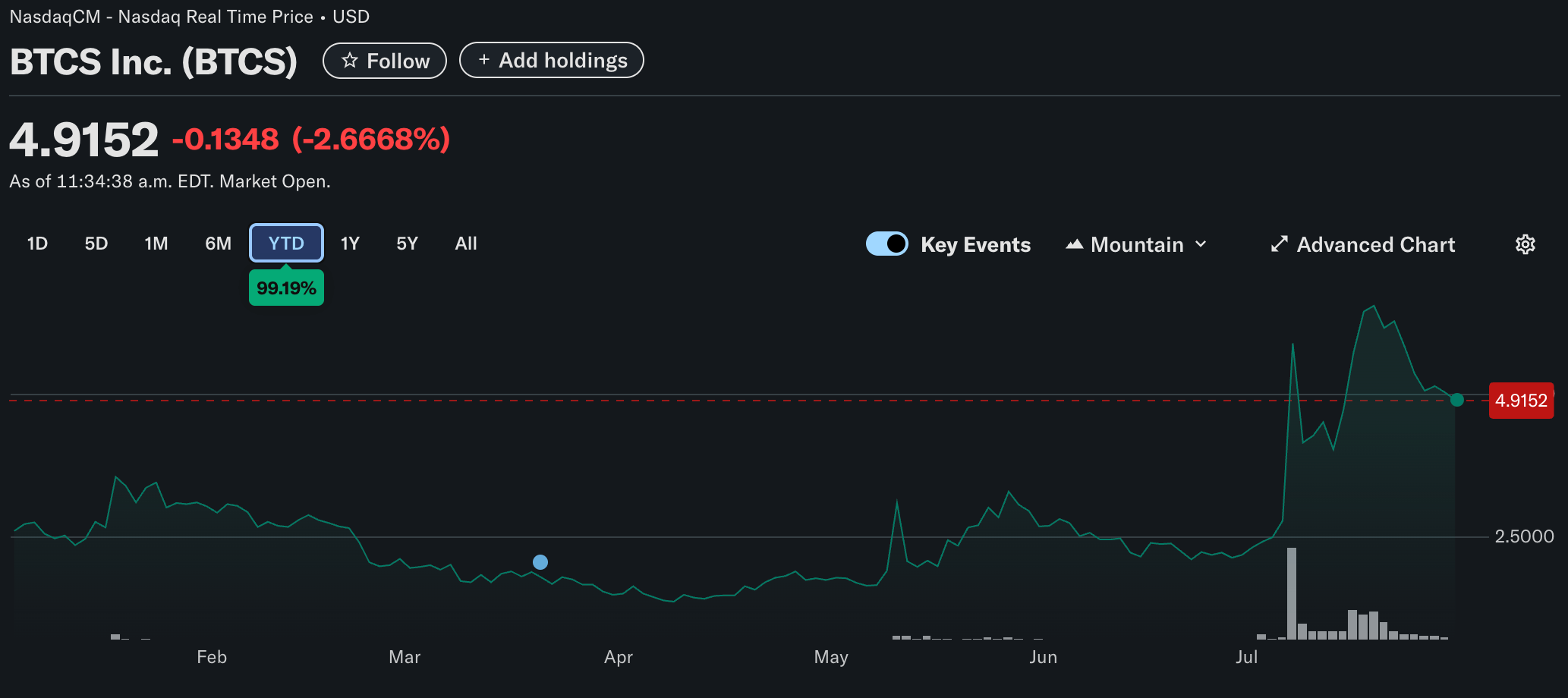

At the time of writing, BTCS shares recorded a slight pullback, trading 2.6% lower at $4.91. However, the Nasdaq-listed firm is still up almost 100% on a year-to-date (YTD) basis.

ETH Accumulation In Full Force

While previous years saw corporate giants like Strategy (formerly MicroStrategy), Tesla, and Coinbase amassing Bitcoin (BTC) reserves, 2025 is shaping up to be the year of Ethereum accumulation.

Another Nasdaq-listed firm – SharpLink Gaming – recently acquired 79,949 ETH, expanding its total digital assets reserves to 360,807 ETH. This came after the firm had disclosed plans to spend as much as $5 billion to buy more ETH.

Similarly, Bit Digital bought 19,683 ETH last week, using net proceeds from its recently concluded $67.3 million share offering. Another publicly-traded company, GameSquare invested $5 million in ETH as part of corporate treasury strategy.

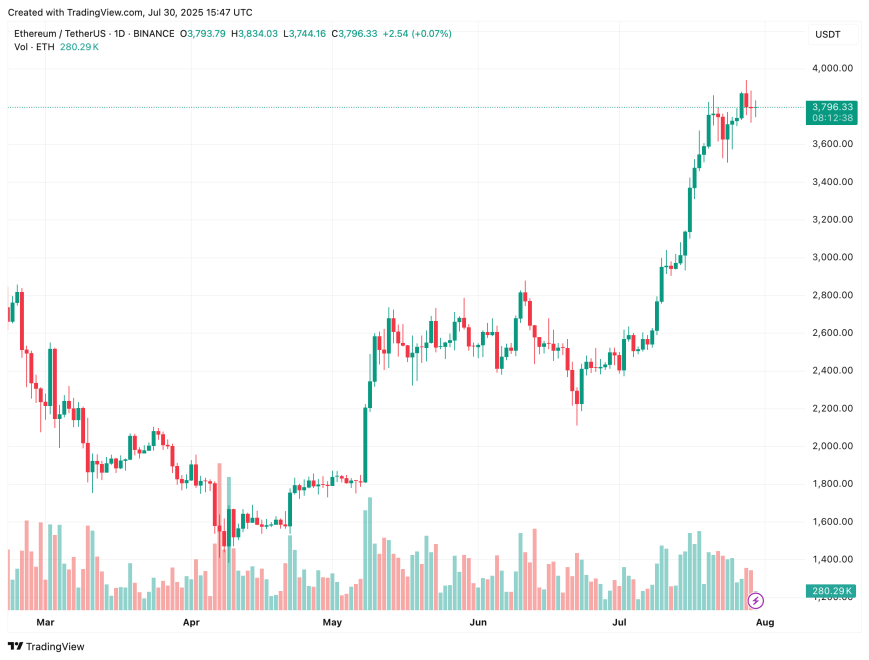

Meanwhile, inflows attracted by spot Ethereum exchange-traded funds (ETFs) continue to increase, recently eclipsing even those recorded by their BTC counterparts. At press time, ETH trades at $3,796, up 0.8% in the past 24 hours.

Featured image from Unsplash.com, charts from Yahoo! Finance, CoinGecko, and TradingView.com

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.