By ATGL

Updated July 30, 2025

In the high-stakes world of trading, managing risk effectively can mean the difference between success and failure. Traders—both seasoned and new—continually seek methods to safeguard their investments while maximizing returns. One pivotal tool in this quest is position sizing, which plays a critical role in both managing trade risk and preserving trading capital.

Understanding position sizing begins with recognizing the influences that determine how much of a security you can safely trade. This article explores strategies like Fixed Dollar Amount, Percentage of Equity, and the Kelly Criterion—each with optimal applications for day traders, swing traders, and long-term investors. Mastering position sizing is not just a technical skill—it’s a foundation for effective trading risk management.

We’ll also highlight common pitfalls, helping you tailor strategies to your unique style. Whether you’re refining your current approach or implementing new practices, this comprehensive guide will help you integrate smart position sizing into your trading strategy.

What Is Position Sizing in Trading?

Position sizing refers to determining how much of your trading capital to allocate to a single trade. This decision is vital for traders at all levels, as it helps align trading strategies with risk tolerance and account size. Done correctly, position sizing protects your account from significant losses and contributes to long-term sustainability.

Several elements affect this calculation: account size, market volatility, risk tolerance, and trade setup. Understanding and managing these ensures your trades are appropriately scaled. While methods may vary, mastering the fundamentals of position sizing is essential to all investment strategies.

What Really Affects Your Position Size? Key Trading Factors

When determining position size, several key factors must be considered. Each one shapes how a trader decides the capital to risk.

- Account Size: Defines the total funds available. Larger accounts can endure higher absolute risk, but sound risk management remains essential.

- Market Volatility: Volatile conditions mean greater price swings. Adapting position size to volatility is key to avoiding oversized losses.

- Risk Tolerance: This personal limit dictates how much loss you can mentally and financially tolerate. Stay within your comfort zone to avoid emotional decision-making.

- Trade Setup: Your entry price, stop-loss level, and profit target influence ideal sizing. A well-planned setup ensures calculated exposure.

These factors collectively build a framework for trading risk management. Balancing them allows traders to make informed decisions and develop robust trading strategies.

Popular Position Sizing Strategies (And When to Use Them)

Choosing the right position sizing approach helps handle market volatility and protect your capital. Let’s look at three widely used strategies:

Fixed Dollar Amount

This straightforward strategy involves risking a set dollar amount per trade. It’s ideal for beginners or traders with smaller accounts. By capping potential losses, this method offers consistency and helps enforce discipline in risk management.

Percentage of Equity

This dynamic strategy allocates a fixed percentage (e.g., 1–3%) of your equity to each trade. It adjusts with account growth or decline, helping maintain proportional risk and encouraging sustainable investment strategies.

Kelly Criterion

A mathematically driven method that calculates optimal trade size based on expected return and win probability. Best for experienced traders, the Kelly Criterion can enhance returns but increases exposure to market volatility if misapplied. Precision and statistical understanding are required.

How to Calculate Position Size

Accurate position size calculation is key to preserving capital and managing risk.

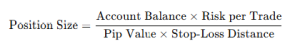

Basic Position Size Formula

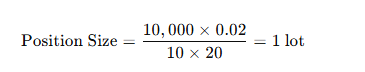

Example Calculation

- Account Balance: $10,000

- Risk per Trade: 2% ($200)

- Pip Value: $10

- Stop-Loss: 20 pips

This formula ensures that each trade aligns with your risk profile and stop-loss placement—crucial for all forms of trading risk management.

Mastering Risk Starts with Position Sizing – Here’s Why

Position sizing is your first line of defense in volatile markets. It works in conjunction with your stop-loss and risk/reward ratio to:

- Define acceptable risk levels

- Cap losses when trades go wrong

- Ensure consistent application of your trading strategy

Key Elements to Track:

| Element | Description |

|---|---|

| Account Size | Total funds available |

| Risk Per Trade | % or $ amount you’re willing to lose |

| Stop-Loss Order | Predefined exit to limit potential loss |

Mastering position sizing arms you to face market volatility with confidence and discipline.

Are You Making These Position Sizing Mistakes?

Even experienced traders make mistakes in this critical area. Avoid the following:

- Ignoring Risk Tolerance: Leads to overexposure and emotional trading.

- No Stop-Loss Orders: A sure path to large, unexpected losses.

- Overlooking Volatility: Not adjusting trade size to current market volatility results in disproportionate risk.

- Miscalculating Position Size: Poor math or guesswork skews your intended risk.

- Not Scaling with Account Size: Trade size must reflect your current capital base.

Avoiding these errors is foundational to consistent, successful swing trading risk management.

Tailoring Position Sizing to Your Trading Style

Position sizing isn’t one-size-fits-all. It must be adapted based on whether you’re a day trader, swing trader, or long-term investor.

Day Traders

Trading within a single day demands precision. Risk per trade is typically 1–2% of capital, with tight stop-losses to control fast-moving positions. Small, consistent gains and capital preservation are the focus.

Swing Traders

Swing trading involves holding positions for days to weeks. Position sizes may be slightly larger (1–3%), with stop-losses based on technical indicators like ATR. Proper sizing helps mitigate risks over longer holding periods.

Long-Term Investors

For long-term investors, position sizing emphasizes capital protection. Smaller percentage allocations per trade help weather extended drawdowns. Tools like the Kelly Criterion or Optimal f are beneficial here.

Each approach highlights the need to align position size with your overall trading strategy and time horizon.

Put Smart Position Sizing to Work in Your Strategy

Smart position sizing is a core component of every sound trading risk management plan. It answers the fundamental question: How much should I risk on this trade?

Key Takeaways

- Position sizing determines trade size relative to risk tolerance.

- Popular methods include Fixed Dollar, Equity %, and Kelly Criterion.

- Calculation requires knowing your account size, stop-loss, and desired risk.

- Tailor your approach to your style—day, swing, or long-term.

By incorporating smart position sizing into your overall trading strategy, you strengthen your ability to navigate uncertainty, reduce drawdowns, and pursue sustainable growth.

Ready to refine your trading and risk management?

Consider joining Above the Green Line membership for exclusive tools and insights that support smarter decisions and enhanced swing trading risk management.

Related Articles