Tom Lee’s Ethereum-centered treasury firm, Bitmine Immersion, has announced its stock repurchase program to buyback up to $1 billion of the company’s common stock.

Summary

- The Ethereum-focused treasury and mining company, Bitmine Immersion, is buying back $1 billion worth of its common shares.

- A day after the buyback plan was announced, the stocks dipped by 8.86%.

According to the official press release, the new stock buyback plan would allow Bitmine Immersion to repurchase its shares in the open market and negotiate transactions based on current conditions. On July 29, the company’s board of shareholders approved the plan to repurchase $1 billion of common shares.

However, investors did not seem too happy about the shares buyback. This was proven by the stock price falling by 8.86% in the past 24 hours, following news of the shares buyback plan. On July 30, BMNR shares for the Las Vegas-based company stood at a value of $32.

This marks a major downturn compared to just a month ago, when the stock soared nearly 700% to $135 per share. The surge was believed to be fueled by the company’s decision to adopt an Ethereum (ETH) treasury company.

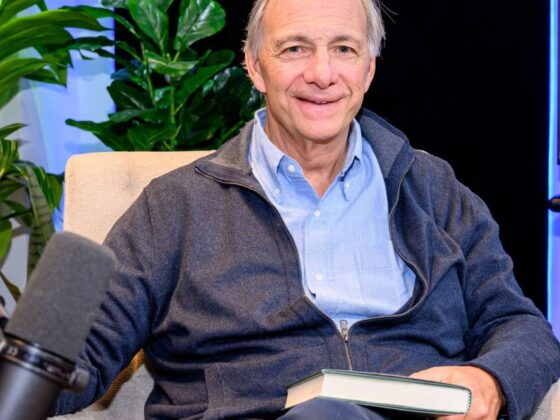

Despite the downturn in shares, Bitmine’s Chairman Thomas “Tom” Lee seemingly dismissed the notion that shareholders were disappointed by the buyback decision.

“I think the decline in the shares just coincides with the share registration — those shares are now registered and available for trading today,” said Lee in an interview with Bloomberg.

In his statement written on the official press release, he said the buyback was necessary for the sake of the company’s sustainability, rather than simply purchasing more Ethereum for the company’s reserves. As of July 30, the company holds around 625,000 ETH in its reserves.

“In our road to achieving ‘the alchemy of 5%’ of ETH, there may be times when the best expected return of our capital is to acquire our own shares,” continued Lee.

Bitmine’s shift to an Ethereum treasury

On June 30, small-scale crypto mining company Bitmine Immersion shifted from its initial Bitcoin (BTC) treasury strategy to an Ether-centered one. This shift was marked by two major corporate decisions from the company. First, the firm initiated a significant $250 million private placement for Ethereum.

Second, the company appointed Fundstrat founder Tom Lee as the new chairman for Bitmine, citing his experience in managing Ethereum funds as the reason why he was chosen.

After announcing that the company would raise capital to add more ETH to its balance sheet, the stock surged by nearly 700%, zooming past its all-time high. At the moment, the company holds a market cap of $3.59 billion.