Most investable assets and strategies tend to cluster into two broad groups: productive and scarce.

This is an important concept for the asset-owner-level portfolio construction and asset allocation process, since productive assets and scarce assets tend to have, respectively, concave and convex profiles with respect to the major risk factors.

Practitioners who are aware of the concave and convex nature of productive and scarce assets and strategies can better hedge their risks in deflationary, and — especially — inflationary crises. We suggest that portfolios including both productive and scarce assets can deliver performance similar to the S&P 500 with less risk than portfolios holding only productive assets.

The Nature of Productive and Scarce Assets

The raison d’être of productive assets is to finance, support, and provide the means for productive activities in the economy, in exchange for promised future cash flows. For example, equities promise future dividends, and credit promises future coupons.

The issuance of equity and debt is externally constrained mostly by what the capital markets can bear. Shocks hit these assets with a downward asymmetry, suggesting concave supply curves. The returns of these assets arise from the economic growth they exist to finance.

Scarce assets and strategies, on the other hand, exist for reasons other than financing productive activities. They exist in limited supply or capacity and may or may not promise any regular cash payments.

Examples of scarce assets include gold, some other commodities and natural resources, high-end art, and other collectibles. “Safe” government bonds with low or negative yields, reserve currencies, and some global macro strategies are also scarce assets. The returns of these assets arise from their scarcity, which is often associated with convex supply curves.

How to Quantify Productivity and Scarcity

Since directly modeling — or even conceptualizing — the “supply curves” in many cases may be difficult or impossible, we instead measure the asymmetric risk statistics of observed asset returns. The findings are detailed in our paper, “The Concave and Convex Profiles of Productive and Scarce Assets.”

We use coskewness to measure the convexity of asset returns with respect to a set of major risk factors: inflation, rates, credit, and equity. We also use the standard skewness to measure the “convexity of an asset to itself,” or “auto-convexity.”

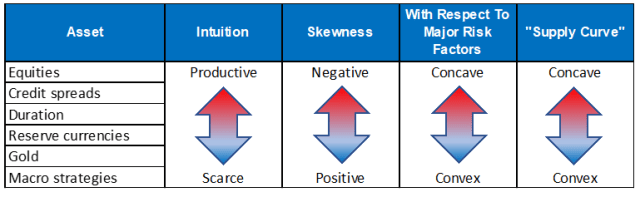

These coskewness and convexity measures tell us the tendency of an asset to appreciate or depreciate when risk factors become volatile. In our paper, we quantify the investable assets’ and strategies’ place in the productive-to-scarce spectrum based on their skewness and coskewness with respect to the major risk factors. Such an overall spectrum is laid out, for top-level asset classes, in Exhibit 1.

Empirically, equities, duration-hedged credit — and more generally “higher beta” and “positive carry” strategies — tend to be concave with respect to the major risk factors, and auto-concave (negatively skewed), belonging in the productive group.

By contrast, “safe” government bonds, gold, the US dollar versus a broad basket, and fast-moving momentum strategies, tend to be empirically convex with respect to the major risk factors, and auto-convex (positively skewed), belonging in the scarce group. We observe that an asset or strategy must have some intuitive economic scarcity to be convex.

Exhibit 1.

Productivity, Scarcity, Convexity, Concavity

Convex or scarce assets and strategies tend to have low beta to equities. But low beta does not guarantee convexity, as we demonstrate empirically in our paper.

The coskewness to inflation risk serves to complement and enrich the traditional set of risk metrics, such as equity beta and bond duration. Though many assets may feature low correlation to inflation, their coskewness may be more significant and persistent, showing large potential losses (or gains, for scarce assets) during periods of macroeconomic instability. Inflation itself is a highly skewed, non-normal process with high-impact tail events.

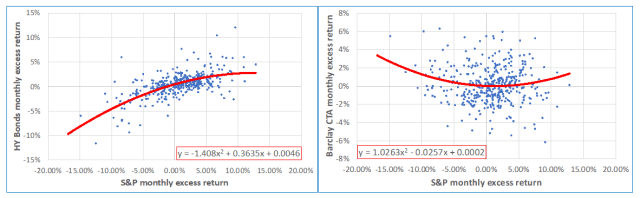

Exhibit 2 depicts monthly excess returns of high yield bonds and Barclay CTA Index, plotted against the S&P 500 excess returns. High yield bonds exhibit concave response to the S&P 500 returns, while Barclay CTA Index is convex with respect to the S&P 500.

Exhibit 2. High Yield Bonds Concave to S&P 500, CTAs are Convex

Notes: Left panel: High Yield Bonds vs S&P500, Right panel: Barclay CTA index vs S&P500. Period 1990-2022. Horizon=1M. Quadratic model fit is depicted for each asset.

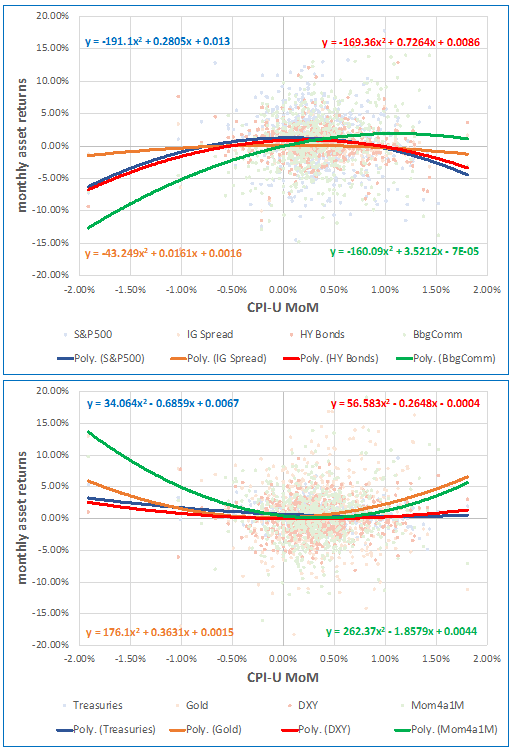

Exhibit 3 depicts monthly returns of four productive and four scarce assets, plotted against the inflation risk factor. The upper panel shows the broad US equity market (S&P 500), investment grade bond returns (duration hedged), high yield bonds, and the Bloomberg Commodity Index, each plotted against CPI month-over-month.

Except for the Bloomberg Commodity Index, the assets show generally weak correlations to inflation, but all have a marked negative convexity. By contrast, the four assets in the lower panel, namely US Treasuries, Gold, the US Dollar index (DXY), and a simple four-asset momentum strategy (with one-month lookback), show a convex response to inflation innovations.

We believe that the convex responses arise from an underlying scarcity of the asset or strategy. In practice, the convexity metrics can tell us which assets are likely to perform above and beyond their linear or beta exposure, during times of great risk and uncertainty—that is, in a crisis.

Exhibit 3. Productive Assets are Concave to CPI, Scarce Assets are Convex

Notes: Upper panel for four productive assets, Lower panel for four scarce assets. Period 1973-2022. Horizon=1M. Quadratic model fit is depicted for each asset.

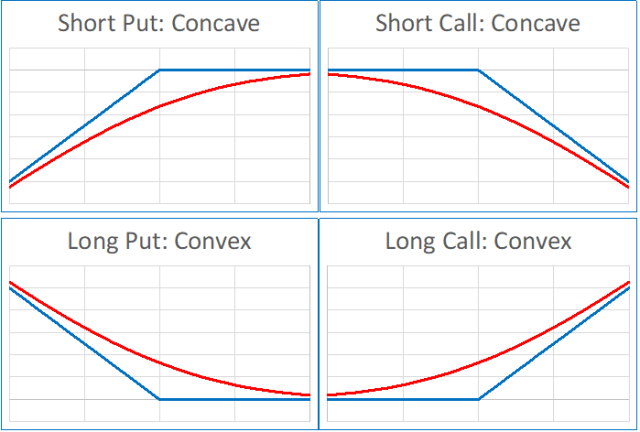

Convex and concave responses to price action are very familiar from textbook option payoffs: most assets are empirically concave or convex with respect to major risk factors. Recalling the pioneering work of Arrow and Debreu, as well as Black and Scholes, and Merton, these convexities are central to asset-return profiles in a world of multi-dimensional risks and uncertain outcomes.

Exhibit 4. Concave and convex Black-Scholes option prices and payoffs

In Practice

From an investor’s perspective, productive assets generally provide exposure to nominal GDP growth, while scarce assets are key for resilience in recessionary and inflationary environments.

In a traditional 60/40 portfolio, for example, stocks are productive and bond duration is scarce. Bond duration is a good diversifier in a deflationary recession, but other scarce assets may mitigate rising inflation as well as deflationary recessions.

These scarce assets can and should be used to build diversified portfolios.

A methodology to combine concave and convex assets into a whole investor-specific portfolio is suggested in our paper, “4×4 Goal Parity.” In that paper, which we summarized in an earlier blog post, we show across 50+ year simulations that goal-based portfolios can deliver S&P 500-competitive returns with approximately half the risk.