With Bitcoin’s price hovering around $120,000, speculation about where we are in the current cycle is intensifying. The data, particularly when mapped against previous cycles, suggests that this bull market could top out within the next three months. But does this hold true, or are there reasons to believe this time truly is different?

The 100-Day Countdown

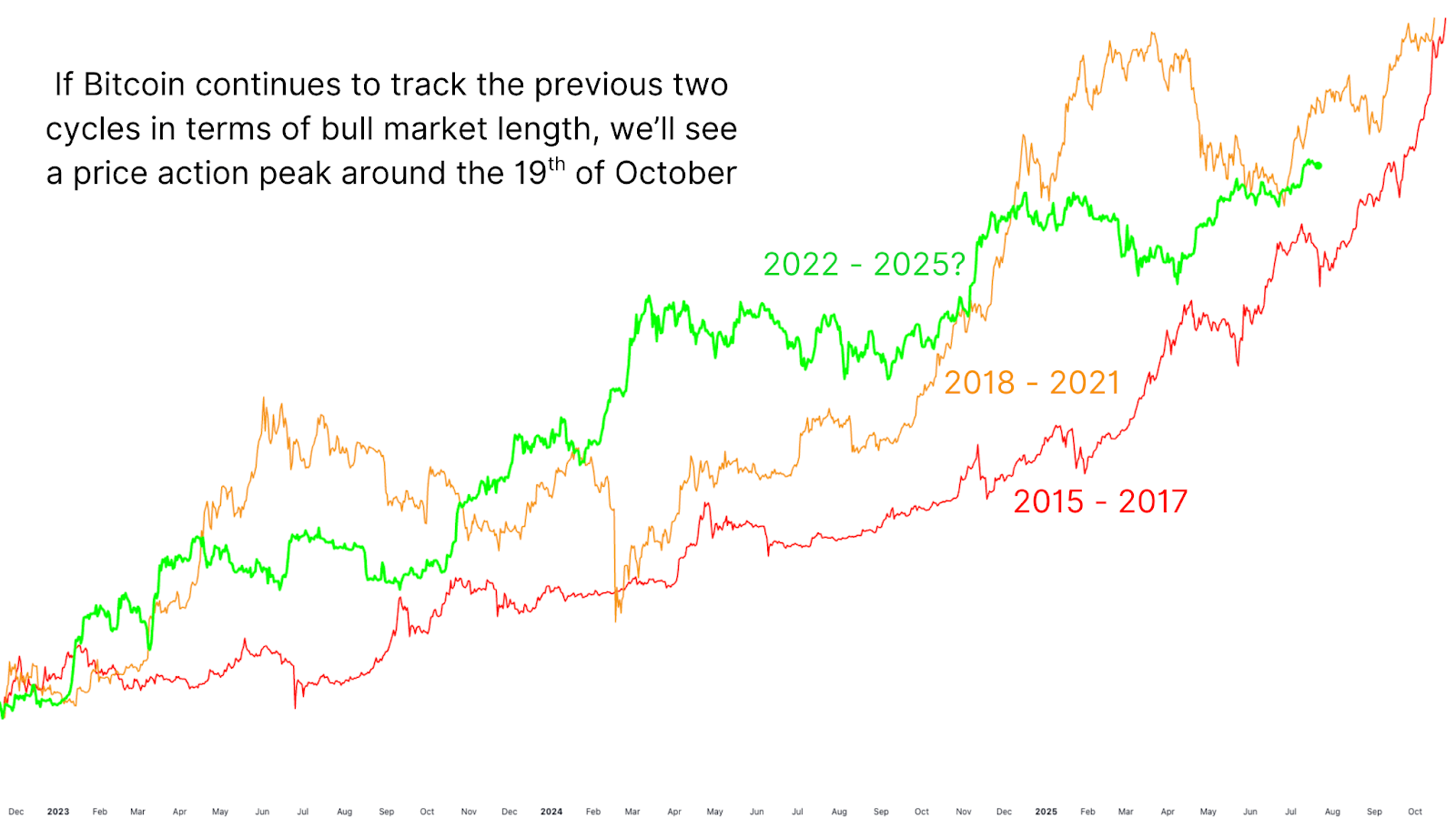

Viewing the Bitcoin Growth Since Cycle Low chart, we can see that we’re currently around 975 days into the ongoing cycle. For comparison, the 2017 bull market topped out 1,068 days after its cycle began, while the 2021 cycle peaked at 1,059 days. That places us potentially under 100 days from a peak if we’re following historical precedent.

A deeper look into TradingView overlays, aligning both the 2017 and 2021 cycles with the current price action, both earlier cycles entered their parabolic “banana zone” around this same timeframe, resulting in explosive price increases. Averaging the timing between the two would indicate a potential peak around October 19th.

Is This Time Different?

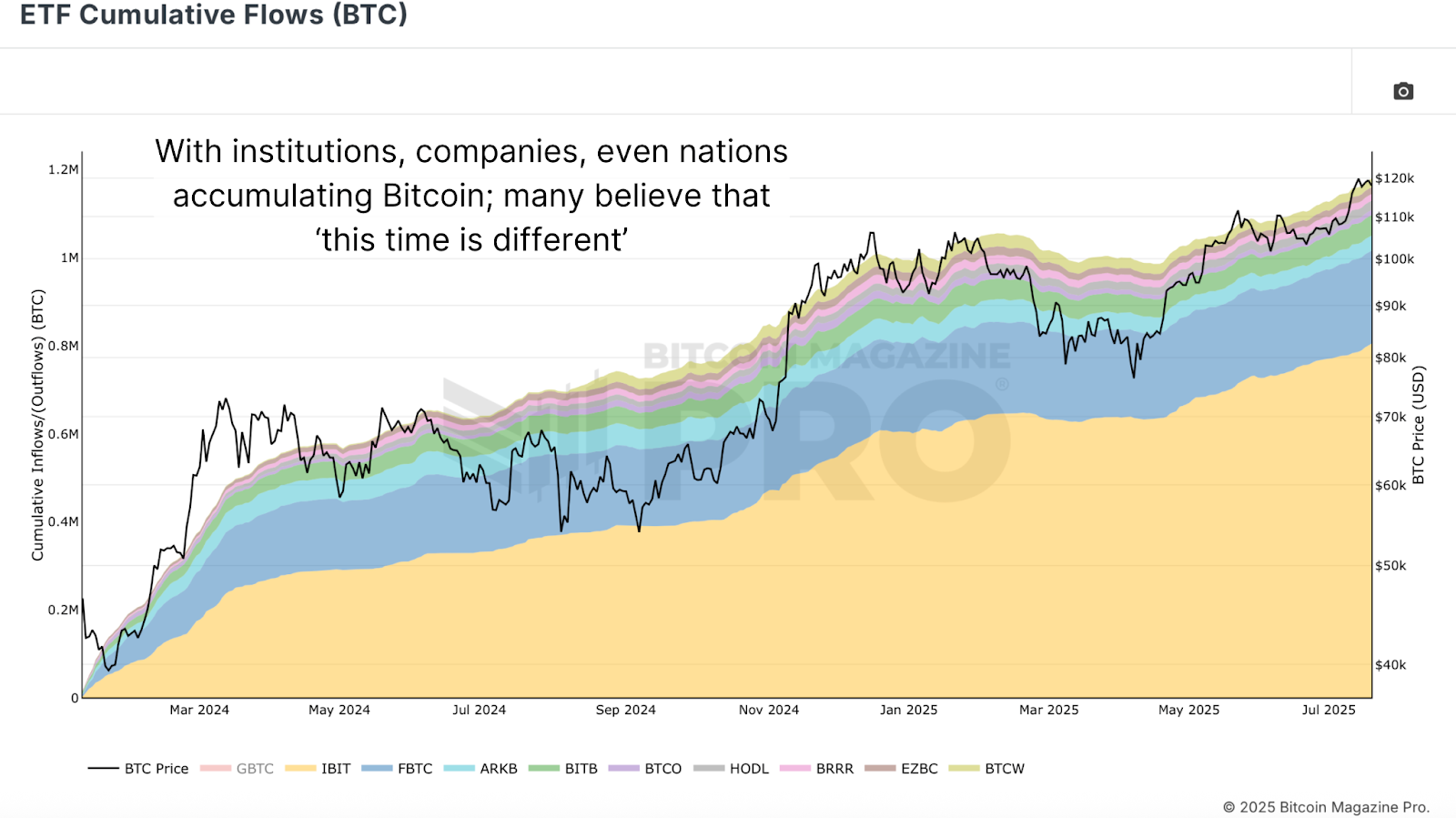

One major counterpoint to this historical view is the magnitude of recent Bitcoin ETF Cumulative Flows. Since January 2024, over 1.2 million BTC have been absorbed by ETFs, with a good portion of that unlikely to return to the market any time soon. This has dramatically altered the supply-demand balance.

In addition to ETFs, Bitcoin treasury companies are sitting on over 870,000 BTC, with that number growing daily. Sovereign holders also account for over 500,000 BTC, and we could still see national strategic reserves that would further tighten supply. When you add in coins held for over 10 years that may be lost (currently around 3.3 million total, so we’ll round down to a very conservative 1.5 million), the potential non-circulating supply exceeds 4 million BTC, or over 20% of the total circulating supply.

Many argue that this cycle is unique due to ETF inflows and institutional adoption, but realistically, this sentiment has echoed in every previous cycle, yet each cycle has ultimately followed a similar trajectory. While current fundamentals are undeniably stronger, assuming a supercycle without hard data remains speculative. Until proven otherwise, history suggests that our traditional 4 year cycles should remain our base case.

October Peak?

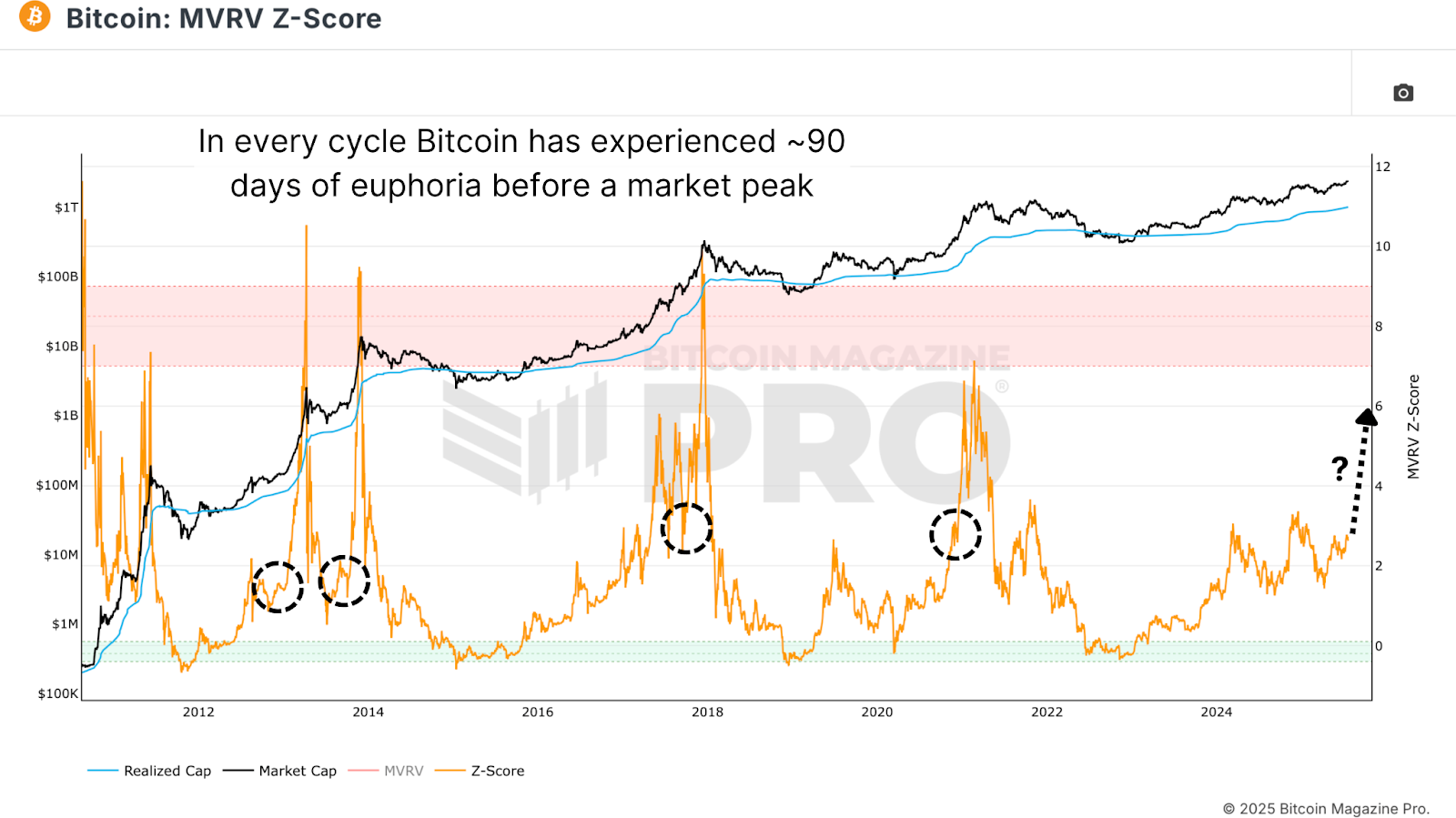

Let’s assume for a moment that the cycle does indeed top in October. Is such a sharp move even feasible? Absolutely. When Bitcoin crossed $10,000 in 2017, it doubled in just two weeks. Even this cycle, Bitcoin rallied close to 100% in under 100 days leading up to its $100,000 milestone. Following the ETF approval, BTC surged 80% in just 50 days. Once momentum builds, Bitcoin’s parabolic potential becomes reality fast, and when looking at the MVRV Z-Score, we can see the on-chain data backs this up with similar runups from similar data levels towards market peaks.

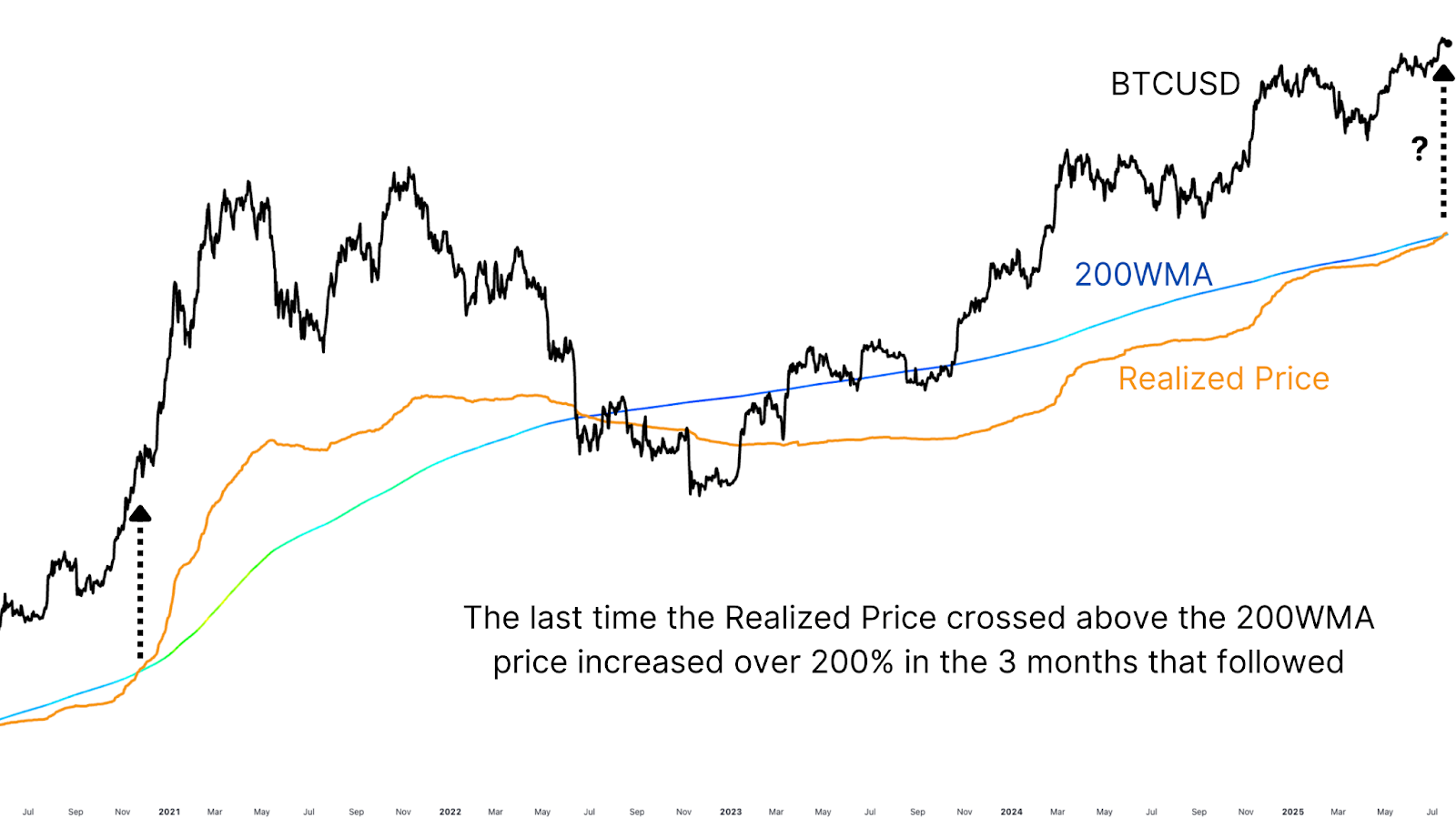

Zooming out further, the 200-Week Moving Average recently surpassed $50,000 for the first time ever. More importantly, Bitcoin’s realized price has crossed above the 200-week MA, a rare event that only occurred once before, in November 2020. Back then, BTC rallied by 212% in 90 days.

If we follow even half that trajectory, a 105% gain from current levels would place BTC near $250,000, again, right around mid-October. While it’s risky to base projections on a single historical instance, it’s interesting that this is once again occurring at a very similar stage of the cycle.

Conclusion

Every cycle carries whispers that “this time is different”. And while this cycle has plenty of reasons to believe that could be true, ETF inflows, institutional dominance, sovereign accumulation, etc, the data still points toward a cycle top sometime in Q4 2025. Could we blow past that and enter a true supercycle? Maybe, and I’d love to be proven wrong! But we’ll need evidence before assuming this narrative. For now, the historical cycle blueprint remains our most reliable guide.

For a more in-depth look into this topic, check out a recent YouTube video here: Why This Bitcoin Bull Market Might Have Less Than 100 Days Left

💡 Loved this deep dive into bitcoin price dynamics? Subscribe to Bitcoin Magazine Pro on YouTube for more expert market insights and analysis!

For more deep-dive research, technical indicators, real-time market alerts, and access to expert analysis, visit BitcoinMagazinePro.com.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always do your own research before making any investment decisions.