Stock market rally defies gravity, leaves many behind

The S&P 500's seemingly unrelenting climb from early April into July 2025 has left many investors shaking their heads.

This spring, the stock market lost nearly 20% of its value amid a flurry of newly announced tariffs. Worry that tariff-induced inflation would derail the economy, causing stagflation or recession, was rampant.

That worry remains, given that tariffs remain much higher than one year ago and economic data show that the U.S. economy is slowing. Yet stocks have brushed aside concerns since April 9, when President Donald Trump paused many reciprocal tariffs, clearing the way for trade deals.

Related: Billionaire says you’re making this big stock market mistake

As a result, many investors expecting a reckoning have been left stuck on the sidelines, wondering if it's too late to buy.

Veteran hedge fund manager Doug Kass understands the feeling. Kass has been professionally managing money since the 1970s, and his long career includes a stint as the research director for Leon Cooperman's Omega Advisors, one of the most famous hedge funds ever.

This week, Kass discussed the recent stock market rally and its causes and delivered a stern message on risks every investor should consider after the S&P 500's record-setting run.

Image source: TheStreet

The stock market's gains have been driven by animal spirits, speculation, and computer algos

It used to be that humans on major exchanges, like the New York Stock Exchange, executed trades for other humans.

Quaint, right?

Now, the stock market's inevitable pops and drops are at the whim of computer programmers who have designed programs to exploit every tick higher or lower, and products developed by money-hungry Wall Street firms, like short-term options, that are designed to capitalize best on greed and fear.

Related: Veteran analyst reveals stocks likely to rally next

“In the steel cage match since the market's lows in April, the bulls have been virtually unbeatable — like Muhammad Ali and Hulk Hogan,” wrote Doug Kass in a post on TheStreet Pro. “But, as we all know, all the WWF matches were fixed — a feeling that the bears have developed over the last three months as retail, zero days to expiration option traders, and volatility-controlled funds have aggressively bought every dip, contributing to the generation of animal spirits and fear of missing out.”

The combination has led to momentum fueling momentum for momentum's sake.

Computers trading with computers and speculators looking for quick gains from the options market have created a self-fulfilling cycle of upside, creating massive fear of missing out, or FOMO, for those who sold during the downturn or held off on new investments, hoping for a better entry point.

The gains have been particularly eye-popping for risky stocks, particularly within emerging industries like crypto, artificial intelligence, space, and quantum computing.

Circle Internet (CRCL) , a stablecoin cryptocurrency player, has gained 132% since its June IPO. CoreWeave (CRWV) , an AI cloud computing company, is up 165% since April 8. Rocket Lab (RKLB) , which sends light payloads into low orbit, has gained 188% since its early April lows. And Quantum Computing (QUBT) is up 278% since its bottom in March.

What's one thing those companies share in common? None has turned a profit yet.

Problems with U.S. economy may not be ignored forever

The S&P 500's 24% gain in 2024 was built on the back of surging spending on artificial intelligence, the promise of earnings growth associated with using AI to streamline business practices and procedures, and the prospect of lower interest rates, thanks to the Federal Reserve shifting from hawkish to dovish monetary policy.

So far, the Fed has yet to cut rates in 2025, despite lowering rates by 1% into the end of 2024, creating a headwind. AI spending remains robust, given that Alphabet recently increased its capital expenditure outlook this year to $85 billion from $75 billion.

Still, cracks have appeared in the economy that didn't exist last year:

- Layoffs totaled 247,256 in Q2, according to Challenger, Gray, & Christmas, the most since the Covid pandemic closed businesses in 2020.

- The unemployment rate is 4.1%, up from 3.4% in 2023.

- The World Bank estimates U.S. GDP growth will be just 1.4% in 2025, down from 2.8% last year.

- And let's not forget tariffs, which, while likely to be less than feared in April, still represent a massive tax hike.

That economic backdrop is problematic for stocks, especially following their big move higher.

“The level of delusion (that tariffs will have no inflationary impact) is now beyond the pale. It simply seems the administration is following the Roy Cohen strategy on inflation and tariffs — in that if you repeat ‘The Big Lie' enough (that tariffs aren’t raising prices), people will come to believe it,” opined Kass.

Stock market valuation could create a headwind for stocks

So far, markets have ignored the inflationary threat, assuming trade deals will soften the blow and corporations can make up any margin hit either by benefiting from a weaker US Dollar on currency conversion or by cutting costs.

Indeed, those betting the U.S. economy will sidestep the worst-case scenario — slow growth with inflation or even recession — have profited largely.

Related: Morgan Stanley resets S&P 500 target for 2026

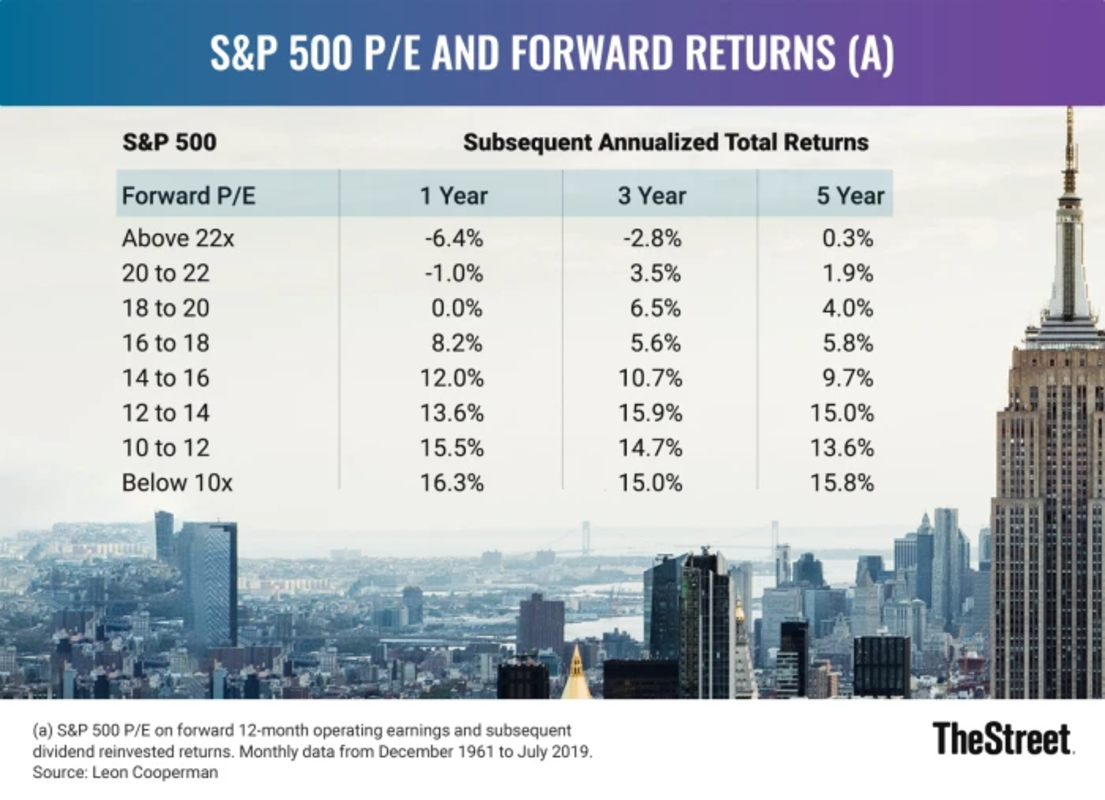

However, valuations on many stocks have surged, and as a result, the S&P 500's forward one-year price to earnings ratio is 22.4, according to FactSet.

A P/E ratio that high has historically depressed forward stock market returns. Absent a significant uptick in earnings estimates, now largely expected, stocks could take a breather.

Images source: Leon Cooperman/Doug Kass

“My recent complete sales of numerous longs (in housing, financials, private equity and selected technology) have resulted in an expanded cash war chest, which I want in the time ahead,” noted Kass on July 23. “I see about 5x more risk than reward, and I see no “margin of safety.”

Of course, stocks can go higher and lower than many believe possible, which is why, as John Maynard Keynes said, “The market can remain irrational longer than you can remain solvent.”

Sitting in cash hasn't been a winning strategy lately, something Kass concedes.

“I am often wrong and always in doubt,” wrote Kass. Nevertheless, he says, “The fact is, though many in the business media say the opposite, earnings estimates are dropping and not increasing — as equities climb.”

If so, having some cash to take advantage of any weakness may pan out yet.

Related: Goldman Sachs revamps Fed interest rate cut forecast for 2025