I did not have a good week at work. Whenever I struggle with work and have no one to confide to, there are usually some random thoughts. Sometimes they just keep repeating and repeating. This is when I realize that I need to sit down and spend some time to process.

It is about how similar John Huber’s illustration is with Avantis Global Small Cap Value UCITS ETF (AVGS).

John Huber’s post on quiet compounders tries to bring to our attention that you don’t always need a company that earns a high ROIC or ROE. The sort of high profitable companies that can compound wealth over the long term. If you find one (and it is a real one), then you can buy and don’t look for a long time. But they don’t trade cheap usually (because market is pretty efficient. If they have durability, you would not be the first or only person to know.)

He shares about the companies… that does not really have growth, but trades at tremendously attractive valuation:

Consider the following:

- A durable, mature company that trades at 5x FCF

- The FCF is stable but will never grow (0% growth forever)

- The P/FCF never moves higher (it will always stay at 5x)

The result of this stock is it will return 20% annually forever.

But, the real beauty of this 20% FCF yield setup that I think is underappreciated by investors and management teams alike is this: you don’t need to care about what the market thinks about your stock. You control your destiny. The multiple doesn’t need to move higher if the stock is that cheap. The share price will rise at 20% per year if the valuation stays at 5x FCF, the FCF is stable, and the FCF is used to buy back shares.

This is very simple math, but I’ve noticed that many management teams focus too much on how to “get the story out”. The cheap stock is not a problem, but in fact is a gift horse.

What if the Stock Does Not Get the Attention from the Markets?

Charlie Munger teaches us to always invert, which means don’t just look at what you want but that you can learn about conviction, or how things played out if you look at the opposite of what you want.

What most of us want is the value of our shares to appreciate.

But what if the premise is that the business has no growth?

That would be your fear. Why would you want a stock if it does not appreciate for the next 20 years?

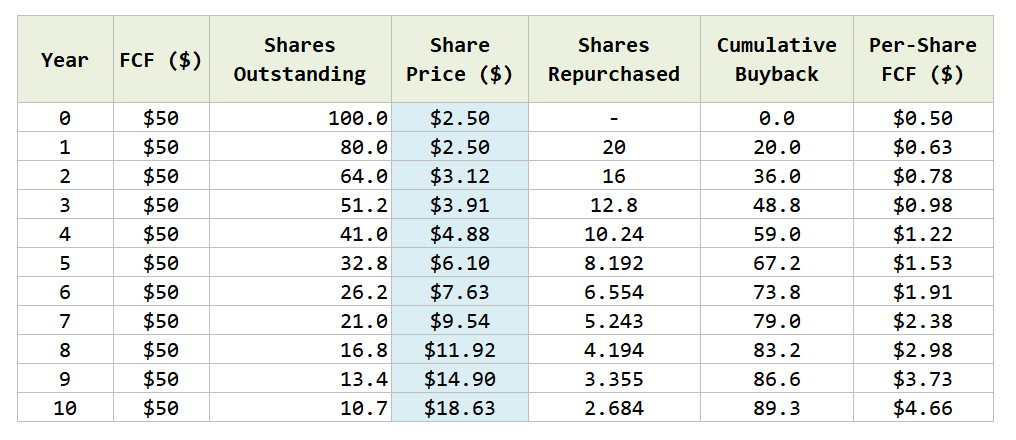

I asked ChatGPT to help me model what Mr Huber presented: If we have a business that trades at 5 times FCF today. Our assessment is that the business is stable to give the FCF yield but it will never grow (0% FCF growth forever). If the Price to FCF remains consistent and the business takes whatever they earn to buyback the shares, what will happen?

Uncertainty will make us wonder if a business can have stable FCF for 10 years but if our assessment gives us quiet confidence that it can, then what happens if the stock yield so much and is so neglected?

If the company consistently takes its 20% FCF yield and buyback its own shares, the Free Cash Flow (FCF) per share grow from $0.50 to $4.66 or 9 times in the 10 years.

Now in what fxxk would would people in the public markets not notice that?

Mr Huber may have a few points:

- The key difference compare to asset-based business is that the value company is profitable.

- Even without growth, value is value.

- But only if the business show some sort of intrinsic value that outweighs the price. The most difficult judge is not the stuff you can value today (e.g. properties relative to the price they traded at), but what people find it hard to judge over time.

- The price can don’t move, but if you keep churning out cash flow after cash flow, and you don’t make stupid decisions over its allocation, sooner or later some fxxker is going to notice.

Why not pay out the 20% yield as dividend?

Ask yourself where would you get a better yield then….. a 20% FCF-yielding business?

That allocation is probably the simplest.

Does Businesses like that Exists?

Mr. Huber’s example looks pretty fairy tale until you realize that is the job of an investor. If it is so easy to know a business has a 20% FCF yield, and can last 10 years, would that trade at that price?

It is usually not so easy to figure out until in hindsight.

It is possible for FCF to remain relatively the same with low growth.

For some reason, Mr. Huber’s post made me think about the Avantis Global Small Cap Value ETF Strategy.

If you recall from my post, Avantis starts their process by asking what would help us find stocks with higher expected returns in the future:

And the research triangulates to smaller companies that ranks higher in operating cash flow (less interest) that don’t trade too expensive.

By that virtue, it eliminates a key downside: Companies that potentially are more value traps with low profitability.

It at least moves us closer to companies with FCF but questionable growth. But is the FCF attractive enough?

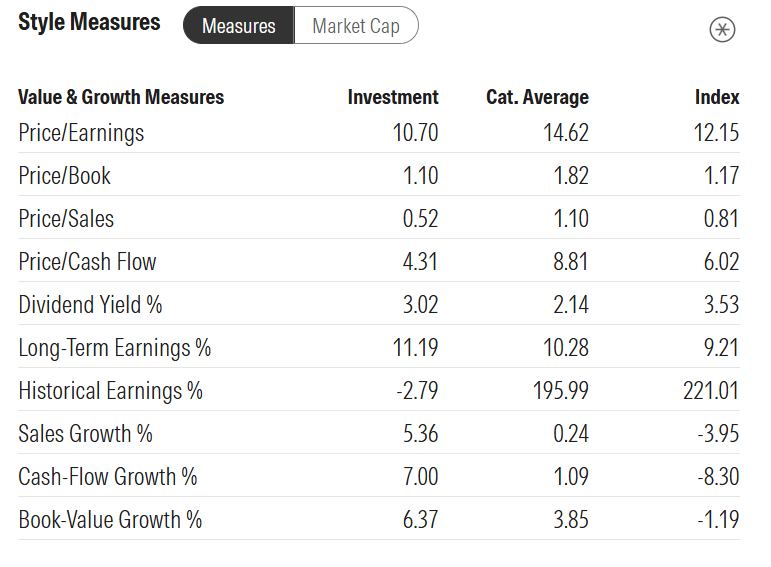

Morningstar gives us a snapshot of the aggregate valuation and growth metrics of the 1347 stocks that form the fund:

Category Average is Global Small/Mid Cap Equity and Index is the MSCI World Small Value NR USD.

The portfolio is cheaper by value, lower in price-to-book, price-to-sales, price-to-cash-flow and has higher earnings yield.

Particularly, the price/cash-flow is intriguing low at 4.3 times. This is the operating cash flow estimated of each stock, then aggregated together. This is not free cash flow, which is taking the net cash from operations deducting away the capital expenditure.

But I feel it is good enough.

In their assessment of profitability, Avantis uses operating profit less off the interest expense, divide by book value.

To let you size up this 4.3 times, the IWDA (MSCI World) has a price to cash flow of 13 times.

4.3 times translates to a cash flow yield of 23%. Now i am sure that FCF yield is much lower.

I get the argument that the growth rate of this 1347 stocks is less than the others.

But what if we invert and assume that we buy these 1347 stocks and they don’t go up in price as a collective.

Then what happens to the 23% yielding cash flow?

Okay, even if that is too crazy, remember that the aggregate earnings yield is almost 9.3%.

As an aggregate, these business are not your asset attractively cheap no earnings/cash flow business but with cash flow.

Would the cash flow just disappear? Has to go somewhere right?

If you speak to my friend Ser Jing, he as his eye less on the stock price of this holdings but how much gross profits all the stocks in his Compounder fund generates.

And this is where you ask yourself if you own 10 stocks, and their aggregate earnings yield is 9.3% or aggregated cash flow yield is somewhat close to that, diversified across not just one industry, a few regions, how worried should you be if the prices languish for a couple of years?

What John Huber, Tobias Carlisle would like to tell us is that value can don’t work for the next 10 years, but that is not the only return we get, and the more concrete return is the aggregate cash flow we earn by waiting in the fund.

They should pile up.

If you are a dividend investor who has received 8 years worth of 5% dividends, you should kind of get it. You should also kind of get that markets are fairly efficient that the market will eventually realize it.

The more cash accumulated the bigger the value gap and the more absurd it gets.

i think this is my interpretation of the concept and as a collective, the management of the 1347 stocks are not going to make the better capital allocation decision of one good company management team.

The returns are more blunted for an index.

But you also have to be aware: That one company’s FCF may not be that sturdy for 10 years.

And this is the advantage of the collective cash flow of 1347 companies at 23% (even though that is operating cash flow).

Perhaps tomorrow we will talk about small US banks.

If you want to trade these stocks I mentioned, you can open an account with Interactive Brokers. Interactive Brokers is the leading low-cost and efficient broker I use and trust to invest & trade my holdings in Singapore, the United States, London Stock Exchange and Hong Kong Stock Exchange. They allow you to trade stocks, ETFs, options, futures, forex, bonds and funds worldwide from a single integrated account.

You can read more about my thoughts about Interactive Brokers in this Interactive Brokers Deep Dive Series, starting with how to create & fund your Interactive Brokers account easily.