Key takeaways:

-

Bitcoin traders now turn their focus to higher levels after Friday’s $115,000 liquidity grab.

-

Fundstrat’s Tom Lee predicts Bitcoin could hit $250,000 by year-end.

Bitcoin (BTC) recovered sharply after sweeping range lows on Friday and is trying to continue its uptrend into the weekend, indicating that bulls are still in control of the market.

Bitcoin traders eye highs after $115K liquidity grab

Data from Cointelegraph Markets Pro and TradingView showed daily gains surpassing 2% as BTC/USD reached $118,300 on Bitstamp.

Now up $3,700 versus weekly lows seen on Friday, Bitcoin impressed traders, who began to prepare for a fresh attack on all-time highs.

Related: Satoshi-era Bitcoin investor cashes out 80,000 BTC for $9B via Galaxy Digital

“Bitcoin closed above the bullish key levels and filled the CME gap at $115K,” said popular crypto analyst Ash Crypto in an X post on Saturday.

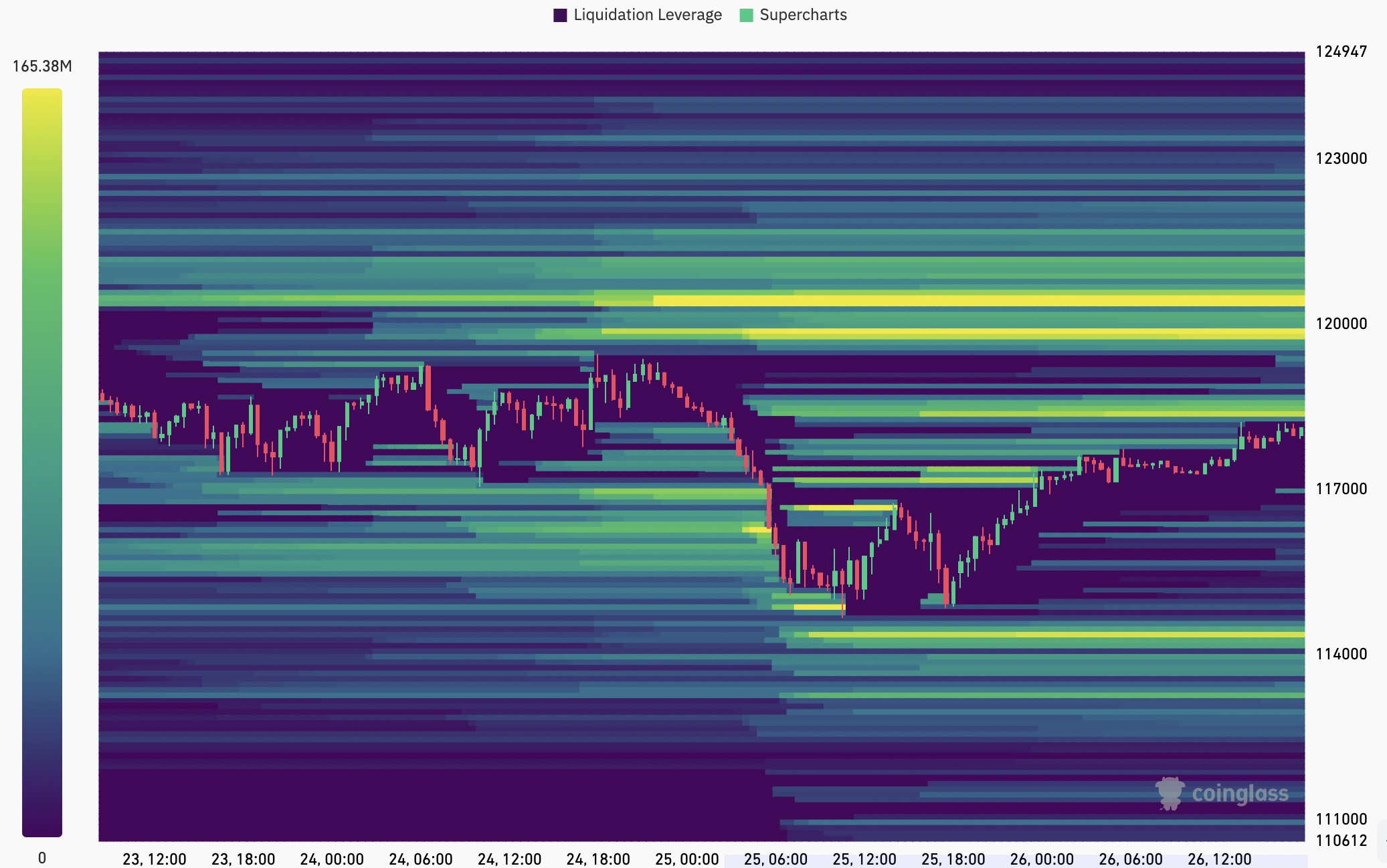

As Cointelegraph reported, Bitcoin’s drop to $115,000 was accompanied by the massive liquidation of overleveraged positions, but it provided an opportunity for investors to add exposure.

“Institutions bought the dip,” Ash Crypto wrote, adding:

“Bulls are in control.”

Earlier, Cointelegraph reported on expectations that price action would shift to take liquidity both above and below, with $114,000 and $118,500 as the key levels in play.

The latest data from monitoring resource CoinGlass now shows liquidity being taken with the latest move above $118,000, while the next major cluster sits at $120,500.

“Liquidity doesn’t lie. Price gets pulled to where the stops are,” popular trader Merlijn The Trader noted in part of an X reaction, adding:

“The $120K zone isn’t just glowing, it’s calling. And $BTC never ignores the call.”

If the $120,000 level is broken, it could spark a liquidation squeeze, forcing short sellers to close positions and driving prices toward $124,000, which is a high-liquidity cluster.

Bitcoin at $250,000 “makes sense,” says Tom Lee

Fundstrat’s head of research, Tom Lee, says Bitcoin could climb to $250,000 by the end of 2025, a forecast he has reiterated multiple times.

During a recent interview on CNBC, Lee was asked about the levels the BTC price could reach over the next few months.

“I think the $200,000 to $250,000 range for Bitcoin still makes sense,” Lee answered, adding, “because that would still only value it at 25% of the size of the gold market.”

Lee argued that Bitcoin could currently be undervalued as “digital gold,” as it should be over $1 million per BTC.

“So I think digital gold means Bitcoin should be worth over a million dollars per Bitcoin. That could happen in the next few years, but maybe pricing in 25% of that – especially with the Genius Act – makes sense.”

Lee isn’t the only one calling for BTC price to rise above the $200,000 mark. These include Bitwise researchers André Dragosch and Ayush Tripathi, who said BTC price could reach between $200,000-$230,000 by the end of the year, citing Trump’s proposed tax cuts and rising US debt.

Crypto analyst Stockmoney Lizards predicted Bitcoin could peak around $200,000 based on a technical breakout.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.