Key takeaways:

-

A whale bet $23.7 million targeting Bitcoin at $200,000 by year-end, signaling strong bullish conviction.

-

Analysts say Bitcoin remains bullish, but $115,000 will be key for uptrend continuation.

Bitcoin (BTC) took out bid liquidity on Friday as an unknown trader made a significant bullish bet targeting a BTC price of $200,000 by the end of the year.

Whale bets $23.7 million on much higher BTC prices

Data from Cointelegraph Markets Pro and TradingView showed BTC/USD slicing through nearby resistance to hit $114,960.

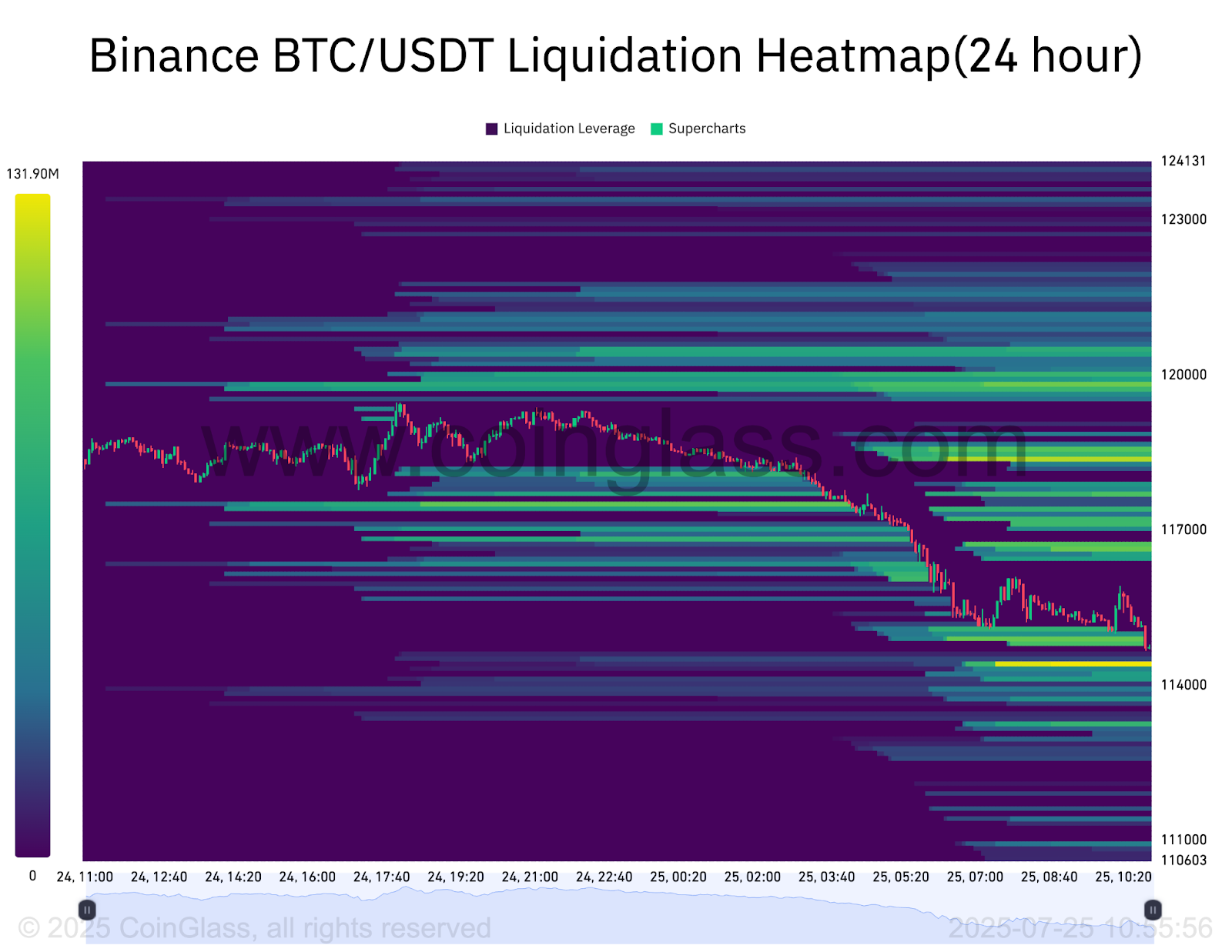

As Cointelegraph reported, the move sparked massive long liquidations across Bitcoin markets, totaling $130 million in the past 24 hours.

Related: Bitcoin consolidation expected to end with impulse move to $135K: Data

Monitoring resource CoinGlass showed liquidity being replenished lower down on exchange order books.

Despite this drop, which brings a pause to Bitcoin’s rally, the bullish conviction remains. As Deribit analysts noted, a whale recently went long BTC with a $23.7 million position targeting as high as $200,000 by the year’s end.

This was a complex trade that involved a bull call spread, which limits both potential gains and losses.

“The Dec $140K-$200K call spread dominates, buying low Dec $140K IV, funded by higher IV $200K calls,” Deribit Insights wrote, adding that the “Call spreads bet on an imminent ATH break.”

2) The Dec 140-200k Call spread dominates, buying low Dec 140k IV, funded by higher IV 200k Calls.

A zero cost Jul25 124k – Aug29 140k Call spread bets on an imminent ATH break.

But otherwise, 2-way (net selling) of 130+150k Calls, and Aug102-Sep150k Strangles pressure IV. pic.twitter.com/7zhLW41wHV

— Deribit Insights (@DeribitInsights) July 20, 2025

Market attention is always drawn to such positions, as similar whale trades have influenced the price trajectory considerably in recent weeks.

Recently, a Satoshi-era whale awakened after 14 years of dormancy and moved $9.6 billion worth of Bitcoin, sparking correction concerns among market observers.

Bitcoin “remains bullish”

A break below the $115,000 range low was what traders needed to decide whether to add or reduce exposure.

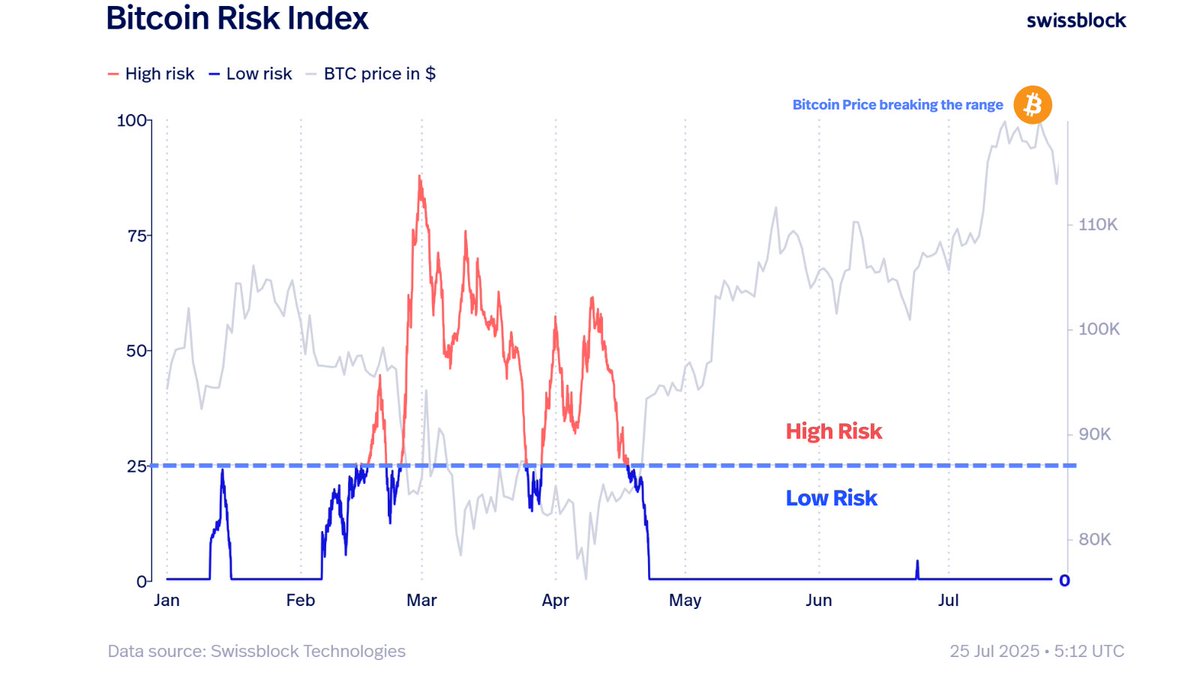

“Bitcoin finally broke out of its range, but this isn’t capitulation, it’s a rotation-led correction,” said asset manager Swissblock in a Friday post on X.

The Bitcoin risk index, a metric that gauges the likelihood of significant BTC price drawdowns, is currently at zero. This indicates that there is “no overheating” and the bullish structure remains intact, Swissblock said, adding:

“The trend remains bullish. Corrections at low risk levels = opportunity, not exit.”

Analyst Daan Crypto Trades said that the $115,000 range low needed to hold to secure the uptrend.

“A breakdown from this range should lead to a retest of $113,500 next, which could be a decent level to look out for if that happens.”

As Cointelegraph reported, the $115,000 support level is key as a daily candlestick break and close below it may accelerate selling as short-term buyers rush to the exit. That could sink the pair to $110,530, where the buyers would be expected to step in.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.