Even though I'm a buy-and-hold investor, I like growth stocks as much as the next guy. Growth stocks are the best choices to add to your portfolio in order to beat the broader indexes like the S&P 500, Nasdaq Composite, and Dow Jones Industrial Average. But I'm not looking to time the market, and I'm not interested in flash-in-the-pan growth stocks that will be falling as quickly as they rise.

Instead, I'm most interested in names that have a long runway for growth. I'm looking for companies with strong business models, a reasonable competitive moat, and most importantly, some momentum to carry it forward for the next decade.

These three names are top picks that hit all of those requirements: Meta Platforms (META 0.28%), Taiwan Semiconductor Manufacturing (TSM 0.56%), and Netflix (NFLX 0.34%).

Image source: Getty Images.

1. Meta Platforms

The owner of the Facebook, Instagram, Messenger, Threads, and WhatsApp platforms, Meta Platforms, has a dominant share in social media. More than 3.4 billion people use at least one of Meta's platforms each day, the company says, up 6% from a year ago.

And Meta is doing an outstanding job of monetizing those users. By using artificial intelligence (AI) and the massive database of personal information supplied by its users, Meta was able to increase ad impressions by 5% in the first quarter on a year-over-year basis, and the average price per ad increased by 10%.

Revenue for the first quarter was $42.3 billion, up 16% from a year ago, and earnings per share of $6.43 were up 37%.

I'm confident that Meta will keep up the momentum. CEO Mark Zuckerberg has said Meta plans to buy 1.3 million graphics processing units (GPUs) this year to power its AI ambitions, including its Meta AI generative AI assistant, and is investing as much as $65 billion in capital expenditures.

Meta stock is definitely booming, up 22% so far in 2025.

2. Taiwan Semiconductor

Meta isn't the only company buying GPUs as fast as it can — Mordor Intelligence estimates the GPU market will be $86.7 billion this year and will grow to $352.5 billion by 2030 — a compound annual growth rate of 33.6%. That's great news for investors of Taiwan Semiconductor, often just known as TSMC, because it is responsible for fabricating most of those products. Statista reports that TSMC currently has a 53% market share of the global foundry market.

TSMC is a popular fabricator because it doesn't make its own chips, so there's no concern that it would use another company's proprietary information. TMSC fabricates 25% of the chips needed by Apple and also counts major companies such as Advanced Micro Devices, Qualcomm, and Nvidia as customers. TSMC is also spending $165 billion to build manufacturing facilities in Arizona, which should shield it from the long-term impacts of any tariffs or trade tension between Beijing and Washington.

Revenue in the second quarter was $30.07 billion, up 44% from the same quarter a year ago. TSMC stock is up nearly 20% in 2025.

3. Netflix

A few years ago, I was pretty down on Netflix, writing for another publication that the streaming service was in danger of becoming another Blockbuster (a company it helped run nearly out of business), if it failed to adapt to the growing and ever-changing competitive landscape.

Well, I obviously underestimated CEO Reed Hastings and his team, because Netflix did adapt, and it's become the unquestioned king of streaming. That's not going to change any time soon.

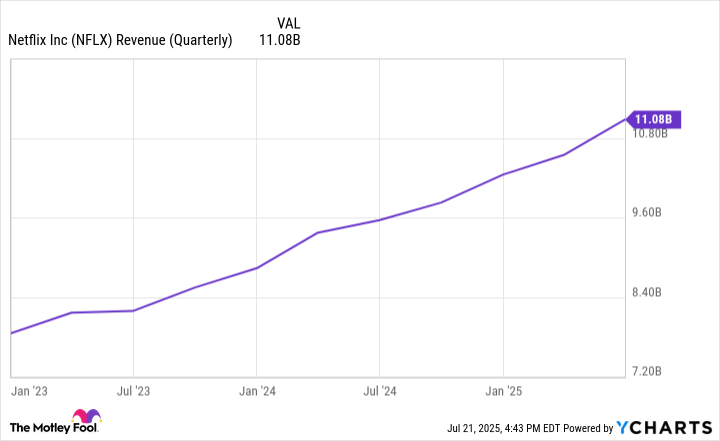

First, Netflix made a huge change to its business model. After giving a wink and nod to password sharing for years, Netflix finally instituted a new practice in 2023 that began charging an extra $8 to any account holder who shared their account with someone outside their home. That was a game-changer, as Netflix's revenue showed an immediate jump. Quarterly revenue is now up 41% since the change.

NFLX Revenue (Quarterly) data by YCharts

In addition, Netflix began covering more live events and sports, most notably championship boxing matches, the popular weekly Monday Night Raw telecast, and selected NFL football games.

Netflix's second-quarter revenue came in at $11.08 billion, up nearly 16% from a year ago. Notably, Netflix's ad-supported tier (all Netflix live events include advertising) reached 94 million users this year, more than doubling from a year ago.

Netflix stock is up a whopping 36% this year and still has plenty of room to run for a long-term investor.

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool's board of directors. Patrick Sanders has positions in Nvidia. The Motley Fool has positions in and recommends Advanced Micro Devices, Apple, Meta Platforms, Netflix, Nvidia, Qualcomm, and Taiwan Semiconductor Manufacturing. The Motley Fool has a disclosure policy.