I almost can’t believe it, sitting here in my abundantly-provisioned London home in 2025, but my dad once told me that when he was a kid they’d sometimes run out of food.

There would be bread maybe, but little else. At least not for the children.

“Sometimes I’d have salt and pepper sandwiches,” my dad confided.

Was his story credible? Honestly I’ve no idea.

My dad is long gone and my grandmother rustled up those spartan provisions either during or right after World War 2. Rationing was still in effect, and my dad’s claim sounds both plausible and like the punchline to an old joke.

What I don’t doubt though was that life could be tough for them. The family lived in the poorer part of town and both parents did various physical jobs.

My dad and his sister grew up fine, but the risk of being spoiled never troubled them.

From salt and pepper to the spice of life

My dad was frugal all his life. My grandmother, too. When I think back to the money she’d share with us grandchildren while she wore the same clothes for a decade, my heart aches. Though I was oblivious to it at the time, of course.

Back in the late 1940s, my dad and my grandmother were going without. There were essentials that they should have had – but sometimes they didn’t have them.

By the 1990s though they were at most doing without.

Not that either seemed to mind.

My dad had a good job, and he’d got us into a semi-detached house in a fancier postcode.

My grandmother marvelled at it when she was brought over for dinner on Friday evenings – while cooing over the professional-looking Wendy Houses, trellises, and fences my dad crafted from discarded shipping pallets he’d scavenged from industrial estates.

For her part, I suspect saving versus spending brought my grandmother a lot of comfort, and perhaps a sense of agency. Not that she would have put it that way.

Going without versus doing without in 2025

People who’ve had no money don’t scoff at those who hold too much as if it’s magical.

Compared to having no money, it is.

But almost nobody who reads this blog will fit that description. I’d wager we’ll know very few people like it in our wider circles, too.

That doesn’t mean there aren’t some going without in Britain today. Of course there are.

But that hasn’t got much to do with the lives of you and me. Even when we think we’re making big sacrifices, we’re pretty much always doing without, not going without.

I’ll define going without as trying to live without the essentials most people take for granted.

In contrast, doing without means you’re missing something – again usually something most others have and value, sure – but not something essential.

Going without: the essentials of modern life

- Around 2,000 calories a day

- Fruit, vegetables, and a healthy protein

- Somewhere safe, warm, and dry to sleep in and store your things

- Sufficient clothes to look tidy in social situations

- A straightforward way to get to and from work

- Access to electricity, cooking, and washing facilities

- A mobile number and an Internet connection

- Either a smartphone or a computer

Doing without: stuff you can sacrifice but you don’t want to

- Your own transport

- Furniture that’s not secondhand or from IKEA

- Netflix, Disney, Spotify, games consoles, and other entertainment platforms

- Holidays, whether at home or abroad

- New clothes, unless bought from TK Maxx or similar

- Buying meals, whether eating out or takeaways

- A home occupied only by you and your immediate family

- Anything made by Apple

- Bitcoin (I’m joking! Mostly)

These lists are clearly not exhaustive. They’re just an attempt to divvy up the non-negotiables of modern life.

That won’t stop the disagreements, of course. Perhaps a few of you old-timers will still argue you don’t need a mobile phone or the Internet? (Really?)

On the other side, maybe you live far from public transport and you say your car is a must. You either can’t or won’t move somewhere more convenient.

But mostly these are edge cases. There’s a pretty clear distinction between needs and wants these days – yet conversations about living standards often talk as if there isn’t.

Your margin is their opportunity

A few days ago I fell down a YouTube rabbit hole and binged a certain kind of FIRE video, though the speakers didn’t always use that lingo.

The algorithm sent me instance after instance of videos that followed the same template.

Essentially, a 50-something white- or grey-haired man with a working class accent, apparently single, said he’d had enough of the grind and so he was going to quit and move onto a boat / live in Spain / sell his house and rent a studio / travel the world / sleep in a van.

Their message wasn’t that they’d scrimped and saved and run the numbers and worked out they could retire.

It was that they knew they weren’t rich, as they put it – and that they knew they’d never be rich.

But they’d decided to anyway call time on trying to change things, and instead accepted their fate.

The videos often referred to comments on earlier videos that scolded them for not having sufficient money to retire. Mostly, such feedback seemed to ignore the retiree’s aspirations, and reflected instead the commenter’s own vision of a happy life.

Goodbye to all that

I’d link to a video but I don’t want to call out anyone in particular – I’m not criticising their decisions, but it could be perceived that way coming from a blog like Monevator.

The truth is I’ve no idea if their plans are right or wrong. But I understand their motivations.

I do think many of their critics in the comments were wrong though. They’d list things these people were giving up, which they deemed unacceptable. But it often wasn’t even clear the would-be quitter had those things to give up anyway. And they all admitted life would be spartan.

Would these underfunded escapees be going without? I don’t think so, based on the information they presented. At least not anytime soon.

They’d be doing without, certainly. And they were probably condemning themselves to a pretty tight old age.

But they seemed resigned to that fate anyway. Life was getting too expensive, work wasn’t worth it anymore, and they wanted to live differently while they could.

Most Monevator readers can empathise with that – even if we’d far rather get out with an arsenal of financial assets at our back.

You get what you pay for

I recently heard a property developer on a podcast recount some tough times on his journey to a ten-figure real estate portfolio.

He said that he and his wife would share a meal when they went to a restaurant. As in one would get the plate first and eat most of it, and then the other would mop up what was left.

It seems outlandish. Why not cook for two at home or at least go somewhere cheaper, rather than suffer through this baroque ritual?

But then I thought perhaps they truly loved fancy restaurants? Maybe it was motivating for them to eat out – to help them focus on what they’d once enjoyed and were striving to get back? Or maybe they just really missed the experience?

They could do without a full plate each, but maybe they could not go without eating out?

Another example – a friend of mine takes her dog to be professionally groomed every fortnight. My girlfriend – who hasn’t got a dog but wants one badly – guessed the treatment cost £25. I’d flukily estimated correctly that it cost £80 but I was still astonished.

It adds up to £2,000 a year. My friend is not Lord Sugar. It must be 5% of her post-tax pay.

Of course she says this grooming is essential, whereas I think it’s a luxury. We had dogs growing up and I can’t remember them even getting a bath. Maybe a hose if they splashed in the mud.

It’s 2025 though and dogs must be fluffy and allowed onto the furniture and even to sleep on the bed at night. My friend kisses hers on the snout. I hope it has a good dentist, too.

Some young people will tell you that their expensive gym membership is essential. I say get a £25 chin-up bar that fits over a doorframe. They say working out in public is for them what clubbing and partying was for my generation.

Talking about my generation, many consider a few bottles of good red wine a week a must. But the young adults I know barely drink, and almost none wine.

It’s all personal, then. Not a newsflash I know.

Your future self wants a word

My co-blogger The Accumulator covered this ground years ago, writing:

Regular reflection upon and discussion of our true values are necessary counter-measures to materialistic pressures. This strategy can make a big difference to your saving while maintaining your quality of life.

But first you have to work out the difference between what makes you happy, and what you’re told makes you happy.

TA wrote that in the midst of his journey to becoming financially independent. His thinking was all about doing without today in order to have more tomorrow.

That’s the usual way to think about doing without. But those guys on YouTube who are forsaking many of life’s luxuries remind us that there’s another way.

Which is to give up more tomorrow in order to live the way you want today.

In recent years the Retirement Living Standards Survey has emerged as a touchstone for understanding the level of income you’ll need to achieve different standards of living.

This year’s updated figures look like this:

Source: Pensions UK’s R.L.S. website

The figures look reasonable to me, yet they always cause controversy. Readers invariably debate this or that aspect of the spending as either too lavish or too stingy.

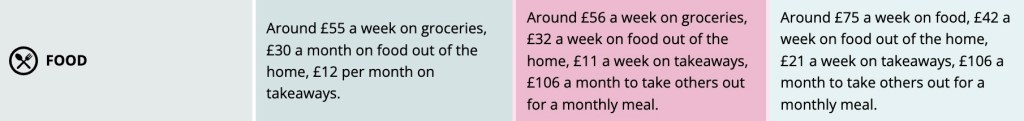

For instance here’s a single-person’s food budget – from Minimum to Moderate to Comfortable:

In a fanciful violation of the laws of physics, I can almost hear furious keyboards being bashed even before the results appear in the comments below.

What’s clear though is nobody is eating salt and pepper sarnies on these budgets.

With or without you

Rising markets have fattened our portfolios for a decade.

But inflation has put up the price of our appetites, too.

Work doesn’t pay like it did – frozen tax thresholds and a stagnant economy have seen to that – which makes pulling the ripcord ever more attractive even for those who maybe shouldn’t.

There’s never been more publicity about FIRE. Yet relatively few people have substantial savings or assets to put towards achieving it.

Given all this, it’s not surprising that if more people catch the getting-out bug, then it can only entail more frugality for them – either now or in the future, and probably both.

But I’m not convinced this needs to be a sob story.

My father and my grandmother went from what would now be seen as near-poverty conditions post-War to modest middle-class comfort by the early 1990s.

Yet the comfort of those decades would seem frugal by today’s standards.

Are people really being reckless if they choose to accept that previous level of lifestyle in exchange for more time and freedom in 2025?

I don’t think so.

By doing without – without having to go without – maybe more of us can find a compromise that works for us.