The efficient market hypothesis (EMH) says that active equity management is a waste of time. Because stock prices incorporate all relevant information, it is not possible to consistently beat the market, according to EMH true believers. That’s because EMH is based on the concept of the wisdom of crowds. Behavior of crowds is a superior lens for viewing market activity. With this lens, you can replace “active management delusion” with stock market opportunity.

Wisdom of Crowds

Simply put, the wisdom of the crowds maintains that the average of the estimates provided by many individuals is more accurate than are the individual estimates themselves. A popular example of the wisdom of crowds is asking a group of individuals to estimate the number of jellybeans in a large jar at the front of the room. It is most often the case that the average is more accurate than any of the individual estimates. The statistical equivalent is the law of large numbers — the larger the number of individual estimates, the more accurate is the resulting average.

Portraying active equity management as being driven by the wisdom of crowds seems to make sense. Afterall, millions of investors are competing by placing billions of trades for stocks worth trillions of dollars. Mark J. Higgins, CFA, CFP, makes that argument in a recent Enterprising Investor post. Citing extensive evidence of underperformance, Higgins contends that active equity is doomed to fail because it is underpinned by the wisdom of crowds. He characterizes the $6 trillion in actively managed funds (from a total $12 trillion invested in US equity mutual funds), as “active management delusion.”

Behavior of Crowds

A superior lens for viewing market activity is the behavior of crowds. Stock prices gyrate wildly, often with no new information or for no obvious reason. The average stock sports an annual return standard deviation of 50%. This implies a 95% return confidence range of +/- 100%. This level of price chaos cannot be explained by the wisdom of crowds. Stock fundamentals do not change enough during the year to justify this craziness.

It is better to view the stock market as a collection of ever-evolving emotional crowds, each of which is made up of individuals keenly aware of what the other crowds are doing. Emotionally driven behavior takes over in such situations. Because large sums of money are involved and the market moves rapidly, our ancestral fight or flight and herding instincts come to the fore.

The result is rampaging emotional crowds with little or no self-control. When a stock price begins rising, even for no obvious fundamental reason, the prospect of making large sums of money pushes us to join the herd pricing frenzy. The opposite happens when the stock’s lofty price begins to decline: chaotic selling ensues.

The result is a market in which stock prices are always wrong, to one degree or another, relative to underlying fundamentals. Emotional crowds coalesce around random bits of information, often broadcast by the largest “megaphone.” Prices are determined by the herd, not by averaging independent individual price estimates, such as in the jellybean example. An individual’s price estimate depends on what the herd thinks it should be with little or no consideration of fundamentals.

Active Equity

Despite the prevalence of emotionally driven pricing, there exists underlying weak trading pressure that inevitably moves prices back in line with fundamentals. Consequently, stocks gyrate erratically around their fundamental value, visiting the correct price only briefly before moving away again.

The challenge for active equity managers is to identify measurable and persistent emotional pricing patterns in the sea of noise that is the market. This can be accomplished by a range of analysis including fundamental, technical, and behavioral. The few resulting stocks selected for inclusion in a portfolio are “best idea stocks.”

It is not enough simply to identify the best idea stocks. It is equally critical to manage the portfolio with an eye toward avoiding emotional errors, some of which mimic those being harnessed by the manager’s stock picking efforts. The evidence implies that most active equity managers are either failing at stock picking, failing at portfolio management, or both.

Behavioral Crowds: A Stock Picker’s Friend

Studies confirm that active equity managers can identify attractive investment opportunities. “Best Ideas” is the most compelling of these studies. Authors Miguel Anton, Randolph B. Cohen, and Christopher Polk find that the top 10 stocks held by active equity mutual funds — as measured by portfolio weights relative to index weights — significantly exceed their benchmarks. As relative weights decline, however, performance fades and at some point, probably around the 20th stock, a stock’s performance falls below the benchmark’s.

Applying a variation of the “Best Ideas” relative weight methodology, my firm rates stocks by the fraction held by the best active equity funds. We define the best funds as those that consistently pursue a narrowly defined strategy while taking high-conviction positions. We update our objective fund and stock ratings based on monthly data. The best and worst idea stocks are, respectively, those most and least held by the best US active equity funds. We derive each stock’s rating from the collective stock-picking skill of active equity funds, each pursuing a distinct investment strategy.

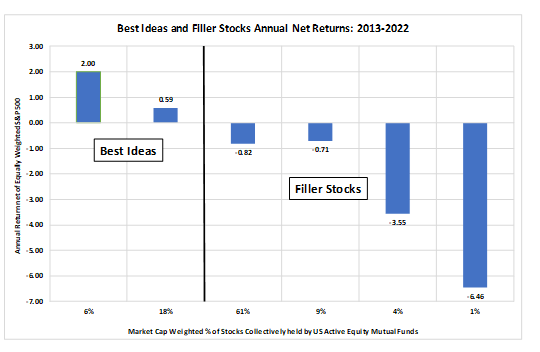

Exhibit 1 presents the annual net returns of best idea and “filler stocks” from 2013 to 2022, distilled from more than 400,000 stock month observations. The two best-idea categories eclipse their benchmarks by 200 and 59 basis points (bps), respectively, as measured by the average stock return net of the equally weighted S&P 500. The filler stocks — as in “fill out the portfolio” — by contrast, underperform. These results would have been even more dramatic had we excluded large-cap stocks since stock-picking skill decreases as market cap increases. The smallest market-cap quintile best idea returns far outpace those of the large-cap top-quintile best ideas.

Individual stock outperformance declines as the best funds hold less and less of the stock. Those held by fewer than five funds — the category to the far right in Exhibit 1 — return –646 bps. The designations reflect our roughly normal distribution rating system. The two best idea categories comprise 24% of the market value held by funds. Filler stocks account for 76%, outnumbering the best ideas by more than three to one.

Exhibit 1.

Source: AthenaInvest, Inc.

The market value-weighted average annual return of all stocks held by funds is –53 bps before fees. Yet had the funds invested only in best ideas, they would have outperformed.

The evidence reveals emotional crowds roiling the market create stock picking opportunities of which successful active equity managers take advantage. It turns out that the more crowds roil the market, the greater the number of these opportunities.

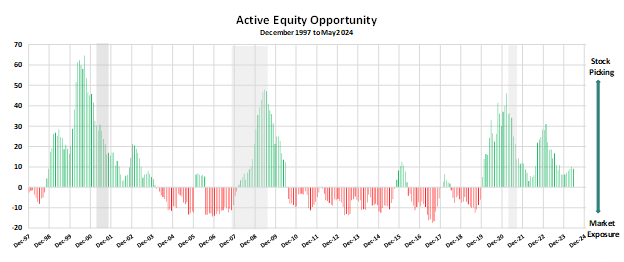

Another approach we use to estimate how attractive the current market environment is for stock pickers is the Active Equity Opportunity (AEO) metric. It is based on the dispersion of monthly individual stock returns as well as other criteria. An AEO graph for the period 1997 to today can be seen in Exhibit 2.

Exhibit 2.

Source: AthenaInvest, Inc.

The red bars represent negative AEO values, which mean active equity is more likely to underperform. Green bars indicate a market environment that is attractive for stock pickers. The grey shaded areas in the graph represent National Bureau of Economic Research (NBER) recessions. Notice that when the environment is stock picking friendly, the emotional crowds can drive AEO to soaring heights.

Two periods are worth noting. From 2010 through 2019, AEO was mostly negative, reaching an all-time low in 2017. This was an unfavorable period for stock picking: equity index funds most likely outperformed even the best active equity managers. But in 2020, this trend turned around and since then, stock pickers have operated in a much more favorable environment.

Behavioral crowds are the stock picker’s friend, and the more emotional crowds roil the market, the more attractive are the opportunities for active equity management.

Behavioral Crowds: The Bane of Portfolio Managers

Active equity funds underperform, on average, so it must be the case that poor portfolio management decisions are the root cause of this failure. Unfortunately, behavioral crowds are one of the contributors to this problem, offsetting the benefits they provide for front-end stock picking.

Emotional crowds provide fertile hunting grounds for active equity managers. If these managers simply invested in their 20 or so best ideas, then their funds would have a better chance of outperforming. But the behavioral crowds that are the source of the initial opportunity have a different and negative impact on the ensuing portfolio management decisions.

Investors are emotionally triggered by volatility, drawdowns, and tracking error relative to a benchmark. High-conviction active management is susceptible to these emotional triggers. A high-conviction fund cannot avoid emotionally driven episodes without dampening long-term returns. They simply come with the territory.

But investors are impatient, largely for evolutionary reasons, and they feel compelled to take action to relieve the emotional pain these triggers inflict. Boy does it feel good to sell the “offending” fund and reinvest in another fund that is thought to have better prospects. Investors gain emotional relief at the expense of their long-term wealth.

The problem for a fund is that its fees are based on assets under management, so investors selling fund shares means AUM and fees decline. Since all fund investors are experiencing the same emotional trigger, an emotional selling crowd easily forms, resulting in significant fund outflows. This is the dark side of behavioral crowds.

One common way a fund insulates itself from this business risk is moving beyond best ideas in the portfolio and loading up on filler stocks. The result is that many “active equity” funds turn themselves into closet indexers. In “Mutual Fund Flows and Performance in Rational Markets,” Jonathan B. Berk and Richard C. Green describe the economic rationale for such return-sabotaging behavior: a reduced risk of emotional triggers and smaller outflows. Another approach is to hedge the portfolio using various options and futures strategies. The result is the same: reduced trigger risk at the expense of investors’ long-term wealth.

Behavioral crowds giveth and they taketh away, producing the sorry active equity track record extensively documented by academic research.

Behavioral Crowds: Active Management Opportunity

How can you reap the rewards of emotional crowd-driven stock picking opportunities without falling victim to the negative impact of emotional portfolio management errors?

First, develop a financial plan that separately funds allocations targeted to meet liquidity, income, and growth needs. The resulting allocation to growth will be mostly or entirely invested in equities. This approach makes it easier to tolerate the ups and downs experienced in the growth portion of the portfolio.

Second, a financial adviser acting as a behavioral counselor can soothe jangled nerves, particularly when markets are in turmoil — exactly the time when active equity has its best chance of success. The adviser can help the client stick with the plan. Research shows that those who first create a financial plan and then stick with it end up with the greatest wealth.

A financial plan and a good financial adviser smooth the path to investing in high-return but emotionally charged high-conviction best idea funds. To further blunt the impact of emotional triggers, the growth portfolio should be invested in four to six high-conviction funds that are consistently pursuing unique strategies like value, growth, and top-down economic. Investing in multiple strategy funds smooths out the performance of the overall portfolio and makes it easier to tolerate periods of underperformance in any individual fund.

The best active equity funds are those that consistently pursue a narrowly defined strategy while taking high conviction best idea positions. These are typically funds with AUM of less than $1 billion.

Final Thoughts

The behavior of crowds is a stock picker’s friend, but the bane of portfolio managers. For those who can manage the emotions triggered by volatility, drawdowns, and tracking error, the performance rewards are there for the taking. When behavioral crowds are roiling the markets, as they are now, best idea active equity has an excellent chance of outperforming. To fully benefit from these superior returns, it is important to take the steps necessary to avoid the emotional portfolio management errors that dilute stock picking performance.