Key Points

- The Department of Education has paused processing some types of student loan forgiveness.

- PSLF is still processing, while IBR-related forgiveness is currently paused due to “system updates”

- SAVE, PAYE, and ICR based loan forgiveness are blocked by court orders.

As borrowers brace for massive changes to federal student loan programs, questions are swirling about whether forgiveness has been completely suspended across the board. Some headlines suggest that no one is getting debt relief. The reality is more complicated.

Whether student loan forgiveness is processing or not depends on the loan forgiveness program you're waiting on.

The Public Service Loan Forgiveness program is still processing applications, even as a PSLF buyback backlog grows. The Income-Based Repayment plan, or IBR, is temporarily paused for “system updates”, but not due to a court order. Student loan forgiveness under SAVE, PAYE, and ICR is blocked by a federal injunction. And even disability discharge is delayed for system updates.

The fact that so many issues are arising around student loan forgiveness processing is leading many to question what's happening. Are “system updates” really happening, or is the new administration slow-walking their legal mandates to provide loan forgiveness for eligible borrowers? It's concerning a lot of borrowers.

Would you like to save this?

PSLF Is Functioning, But Some Experience Delays

Public Service Loan Forgiveness, known as PSLF, continues to process applications and discharge balances for eligible borrowers. This program requires 120 qualifying monthly payments while working full-time for a qualifying employer, such as a government agency or nonprofit.

The Department of Education has not stopped PSLF forgiveness. In fact, the administration has reiterated in various court cases and hearings that PSLF is based on a statute passed by Congress, and therefore not impacted by the legal challenges that have affected newer income-driven repayment plans. And borrowers are reporting green banners and golden letters nearly everyday.

However, the PSLF buyback initiative (launched to help borrowers retroactively count previously ineligible payments) is facing long delays, with borrowers reporting processing timelines of nine months or longer. There's currently a backlog of over 65,000 applications waiting to be processed, and only 2,224 were processed in June 2025.

SAVE, PAYE, And ICR Forgiveness Are Legally Blocked

Three income-driven repayment plans (SAVE, PAYE, and ICR) are currently unable to process student loan forgiveness due to an injunction issued by the 8th Circuit Court of Appeals. The ruling challenged the legality of the SAVE plan and its underlying regulation, which also affects the loan forgiveness features of PAYE and ICR.

The Department of Education said it is complying with the ruling by halting forgiveness under these three plans. Payments made under these plans will still count toward loan payoff, but borrowers reaching the forgiveness threshold will not have their balances discharged at this time. Instead, they'll be placed in an administrative forbearance pending the outcome of the legal cases.

Borrowers on SAVE who want to continue progressing toward forgiveness are being told to switch to IBR.

It's important to remember that SAVE, PAYE, and ICR are being shut down due to the One Big Beautiful Bill, so these plans won't exist in the future anyway.

IBR Forgiveness Is Paused For “System Updates”

While SAVE, PAYE, and ICR forgiveness are paused by court injunctions, the IBR plan is not. That’s because IBR was created directly by Congress and includes an explicit statutory pathway to forgiveness after 20 or 25 years, depending on when the borrower took out loans.

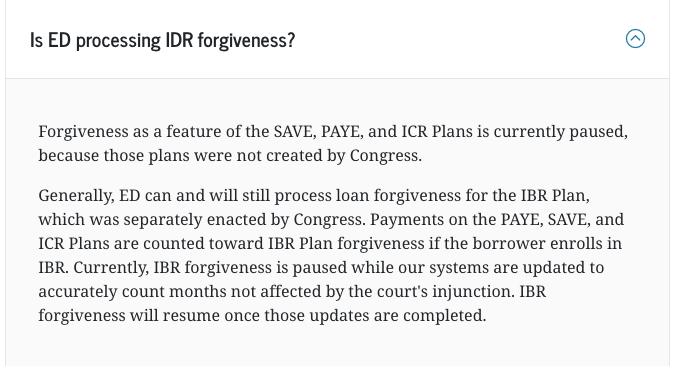

Even so, the Department of Education has acknowledged it is not currently processing IBR discharges. In guidance updated this month, officials said IBR forgiveness is paused due to “system updates” related to how months in deferment and forbearance are counted. Here is the updated FAQ:

No court has ordered a pause on IBR discharges, and no statute blocks the department from continuing forgiveness under the plan. However, no IBR loan forgiveness processing is currently happening, and there is no ETA on when this will resume.

Disability Discharge Is Also Delayed

Disability Discharge is another program that has been delayed by system issues. In December 2024, the Department of Education announced they were migrating internal systems, and that processing may be delayed through March 2025. In an announcement in April, it appeared the migration was completed, but borrowers are still reporting that their disability discharge applications are not being reviewed.

The timeline to process a Total and Permanent Disability (TPD) discharge used to be about 60 to 90 days. Borrowers waiting should be put in an administrative forbearance, with no payments being due.

Student Loan Borrowers Are Left In Limbo

The uncertainty comes as federal policy is shifting again. President Trump signed the “Big Beautiful Bill” earlier this month, enacting sweeping changes to income-driven repayment plans. The bill phases out PAYE, ICR, and SAVE, and introduces a new option: the Repayment Assistance Plan (RAP). Under RAP, forgiveness won’t be available until after 30 years of repayment.

Borrowers already enrolled in IBR will be allowed to remain under the existing terms, including forgiveness after 20 or 25 years. But new borrowers won’t be able to enroll in IBR once RAP is available. New borrowers will only have access to the Standard Plan or RAP.

And starting next month, interest charges are resuming for millions of borrowers enrolled in SAVE who were previously in a court-ordered administrative forbearance. The department reiterated that those borrowers are not progressing toward forgiveness and should consider switching to IBR.

For now, borrowers hoping for relief under existing plans are stuck navigating a mix of paused processing, legal roadblocks, and policy transitions.

Don't Miss These Other Stories:

Editor: Colin Graves

The post Is Student Loan Forgiveness Processing Paused? appeared first on The College Investor.