With much of the world’s attention focused on wind turbines, solar panels, and electric vehicles, natural gas has grown in importance as the backbone of modern energy systems. It fuels power plants, heats homes, drives industry, and—through liquefied natural gas (LNG)—connects continents. The newly released 2025 Statistical Review of World Energy highlights just how indispensable natural gas has become, despite mounting pressure to decarbonize.

Following the previous article on global oil production and consumption trends, let’s dig into the numbers behind the global gas market, with a focus on production, consumption, and the increasingly critical role of LNG exports.

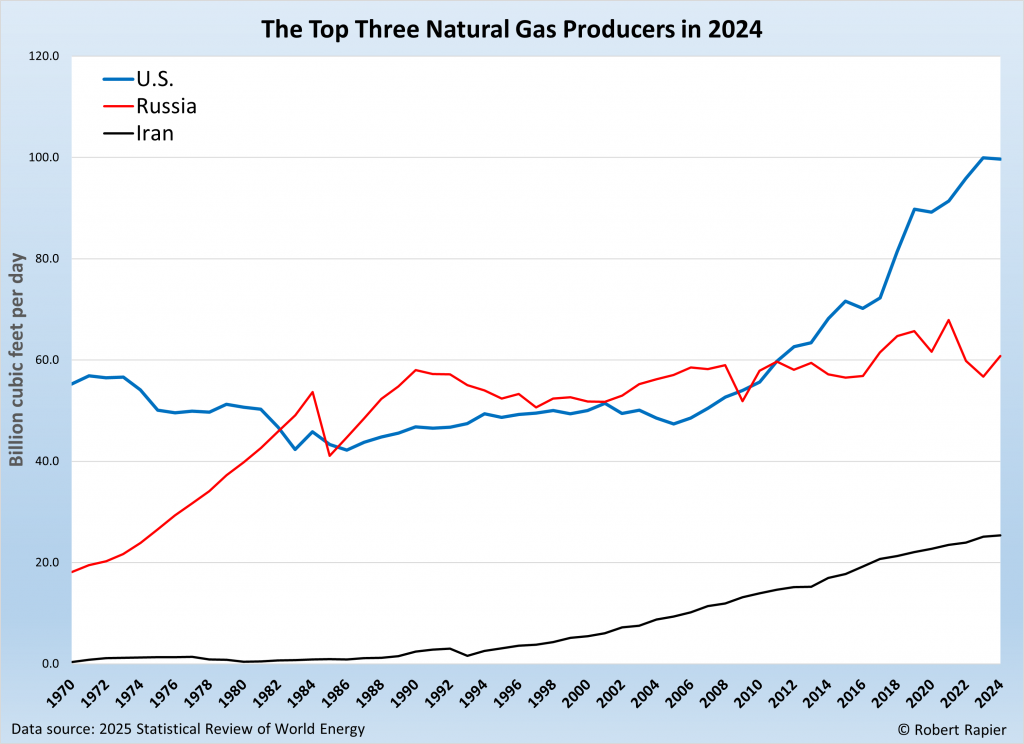

In 2024, global natural gas production reached a record-breaking 398.0 billion cubic feet per day (Bcf/d). The United States alone accounted for 25% of that, producing just under 100 Bcf/d. That marked a slight decline from the record output in 2023, but still more than five times Canada’s output, its closest North American peer. Much of this strength comes from the shale gas revolution that began about 20 years ago, turning the U.S. into both the world’s largest natural gas producer and ultimately the world’s top LNG exporter.

Russia, which the U.S. overtook for first place among gas producers in 2011, remains the world’s second-largest producer, with 60.8 Bcf/d of output in 2024. But that figure remains below its pre-sanction highs as exports to Europe dried up and pipeline projects faced delays. Moscow has attempted to pivot to Asian markets, but logistical and political hurdles have slowed progress.

Other top producers include:

-

Iran and Qatar, which remain vital players in the Middle East, producing around 25 and 17 Bcf/d, respectively.

-

China, whose domestic gas output has doubled over the past decade, now stands at 23 Bcf/d—an impressive feat as the country pushes to displace coal with cleaner-burning alternatives.

-

Australia, at 14 Bcf/d, has carved out a global leadership role in LNG, although future growth may be constrained by aging fields and regulatory pressure.

Africa’s contributions are modest in comparison. Algeria leads the continent with 9.1 Bcf/d, followed by Egypt and Nigeria. Infrastructure bottlenecks and underinvestment have limited the continent’s broader potential.

Notably, over the past decade, more than half of global natural gas production growth has come from OECD countries, albeit production in the EU has declined by two-thirds. This underscores that despite a global push toward renewables, countries continue to seek flexible energy supplies that balance affordability with lower carbon intensity.