With Bitcoin breaking into new all-time highs, the inevitable question emerges for every investor: how high can this bull market actually go? In this analysis, we’ll take a data-driven and mathematical approach to try to estimate potential price targets for both Bitcoin and (Micro)Strategy throughout the current cycle.

Reevaluating The Pi

The Pi Cycle Top Prediction chart relies on two key moving averages: the 350-day moving average multiplied by two (green line) and the 111-day moving average (orange line). Historically, when the 111-day MA crosses above the 350-day MA x 2, a cycle peak has occurred within just a few days. Despite its past accuracy, including flawless calls during prior cycles, it’s important to remain cautious.

At current trajectories, the indicator forecasts a cycle peak around January 17, 2027. However, for any crossover to occur, BTC would need to sustain prices well above the 350DMA*2 for months, likely at prices substantially higher than $200,000. That level of sustained price appreciation seems unlikely this cycle, although I’d love to be proven wrong! While the tool remains a valuable risk management indicator, we shouldn’t rely solely on it for timing macro tops just because of its historical accuracy.

MVRV Ratio

A more grounded method involves the Market Value to Realized Value (MVRV) ratio. By analyzing the relationship between market price and the realized price (the average cost basis of all BTC in circulation), we can set realistic expectations. If we extrapolate a conservative cycle peak MVRV score of 2.8 using prior diminishing returns, peaks we’ve already set in this cycle in the MVRV, and the current realized price of $50,000, we arrive at a current projected Bitcoin top of around $140,000.

However, since the realized price continues to increase as capital flows into Bitcoin, a $70,000 realized price later in the cycle would suggest a potential peak closer to $200,000. This method reflects a more dynamic approach to understanding Bitcoin’s market behavior based on on-chain data and investor psychology.

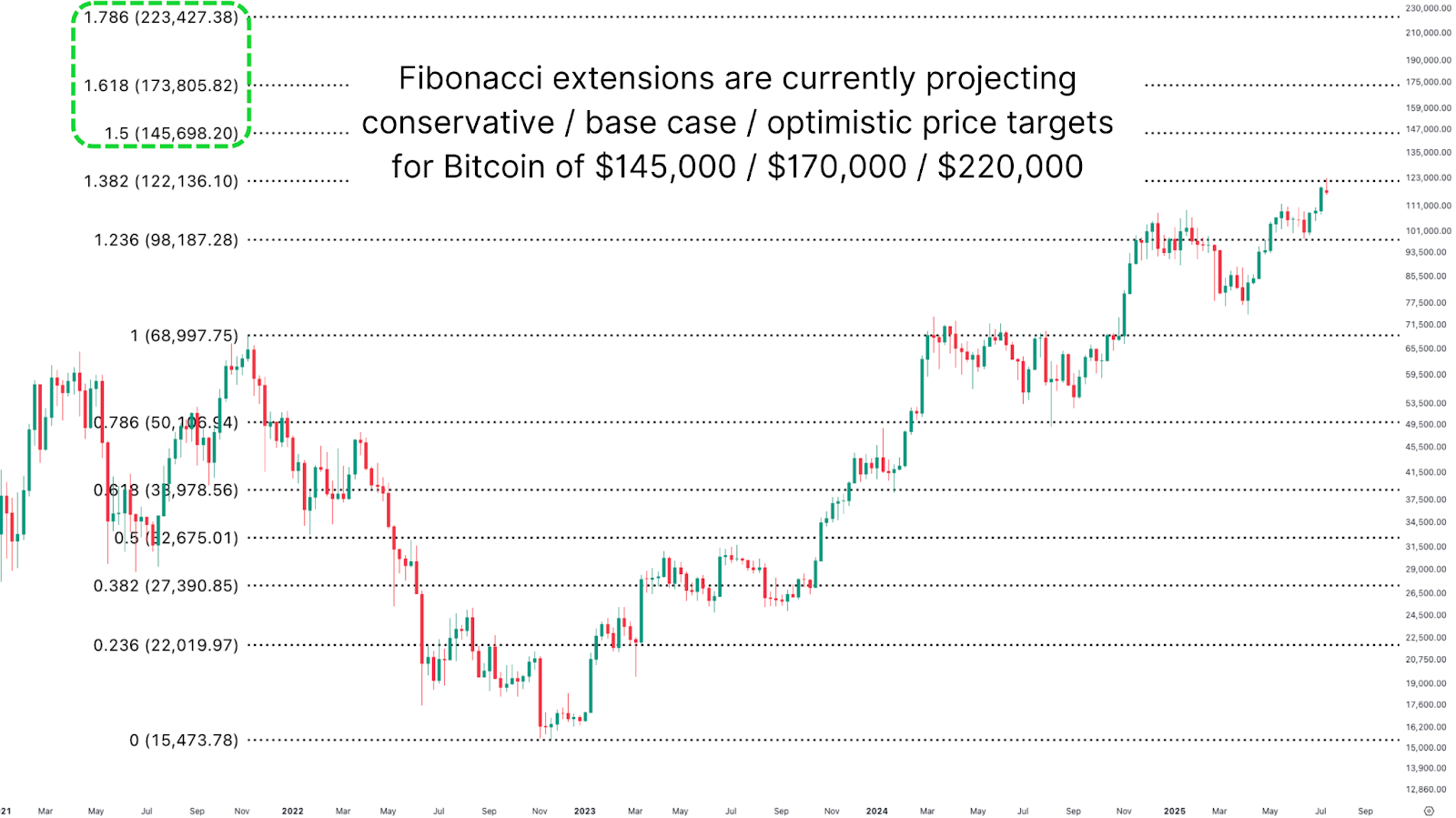

Fibonacci Extensions

For more technically inclined traders, Fibonacci extensions can offer insights when entering price discovery. Using TradingView’s Fib extension tool on previous cycle lows and highs, we’ve identified significant levels that have acted as resistance and support historically with an incredibly high degree of accuracy. Along with that, the recent high corresponded incredibly closely to the 1.382 Fib level at ~$122,000.

Looking ahead, the 1.618 extension suggests ~$170,000 as a likely cycle top, with a more aggressive upside target of ~$220,000. Interestingly, this aligns closely with the $140k to $200k projections derived from MVRV analysis, providing solid cross-model validation.

Strategy’s Peaks

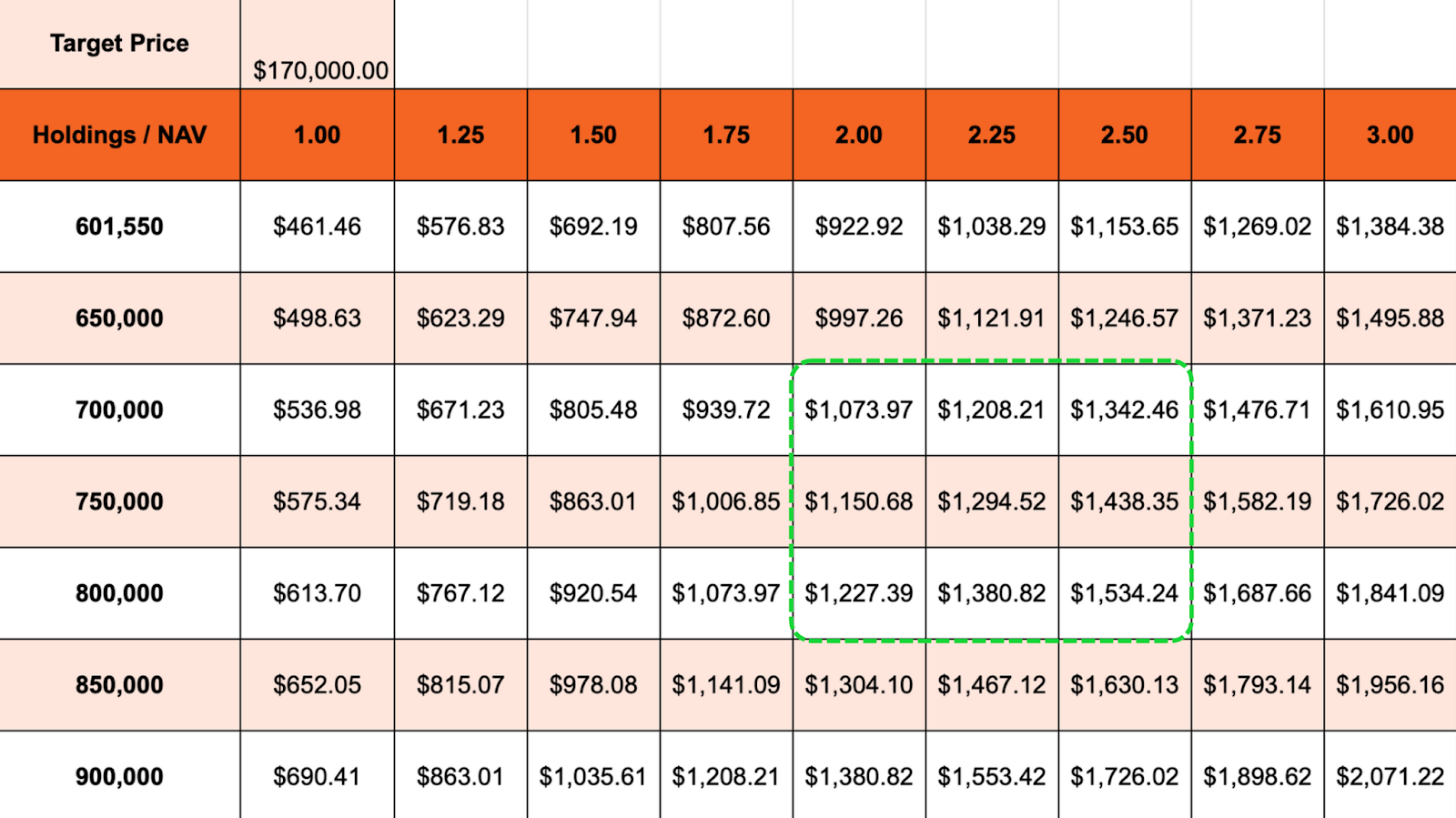

(Micro)Strategy’s share price is heavily influenced by its growing BTC reserves. The company currently holds over 600,000 BTC and is expected to increase this to between 700k and 800k as the cycle continues. Applying the same Fibonacci framework to MSTR shows a potential resistance around $543, also the current all-time high, and upcoming targets of ~$800 and ~$1,300.

To validate this, we analyzed MSTR’s premium to its Bitcoin Net Asset Value (NAV), which has fluctuated between 2x and nearly 3x multiple times this cycle. Assuming a future Bitcoin price of $170K and continued accumulation, a 2–2.5x premium suggests that MSTR reaching $1,300 is a credible upper bound.

Conclusion

Bitcoin’s price potential this cycle ranges from $140,000 on the conservative end, to $170,000 in the base case, and up to $220,000 in a bullish scenario. For Strategy, this translates into a likely upper bound of around $1,300, offering asymmetric upside for investors betting on indirect Bitcoin exposure.

Ultimately, while modeling future price action is informative, data should guide your decisions, not dictate them. Don’t cling to round numbers or models alone. Be prepared to act when risk signals emerge, even if your favorite model hasn’t hit its magic number.

💡 Loved this deep dive into bitcoin price dynamics? Subscribe to Bitcoin Magazine Pro on YouTube for more expert market insights and analysis!

For more deep-dive research, technical indicators, real-time market alerts, and access to expert analysis, visit BitcoinMagazinePro.com.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always do your own research before making any investment decisions.