Updated on July 16th, 2025 by Nathan Parsh

The Dividend Kings are a select group of 55 stocks that have increased their dividends for at least 50 consecutive years. We believe the Dividend Kings are among the highest-quality dividend growth stocks to buy and hold for the long term.

With this in mind, we created a full list of all 55 Dividend Kings. You can download the full list, along with important financial metrics such as dividend yields and price-to-earnings ratios, by clicking on the link below:

Each year, we individually review all the Dividend Kings. The next in the series is MSA Safety (MSA), which has increased its dividend for 55 consecutive years, including a 3.9% raise in May of 2025. This article will provide a more detailed analysis of the company.

Business Overview

MSA Safety Incorporated, formerly Mine Safety Appliances, was established in 1914. Today, it develops and manufactures safety products. Customers come from various industrial markets, including oil & gas, fire service, construction, mining, and the military.

Source: Investor Presentation

MSA Safety’s major products include gas and flame detection, air respirators, head protection, fall protection, air-purifying respirators, and eye protection gear.

Growth Prospects

MSA has put together a solid growth record in the past decade, growing earnings-per-share by an average rate of 13.2% per year from 2015 through 2024 period. Looking at just the last five years, the earnings growth rate is 12.8%. Results in 2020 fell moderately, which was not unexpected given the coronavirus pandemic. However, earnings bounced back in 2021 and 2022. The company has posted record results in each of the last two years and is expected to do so again in 2025.

The company views its long-term outlook as healthy, which bodes well for its future growth.

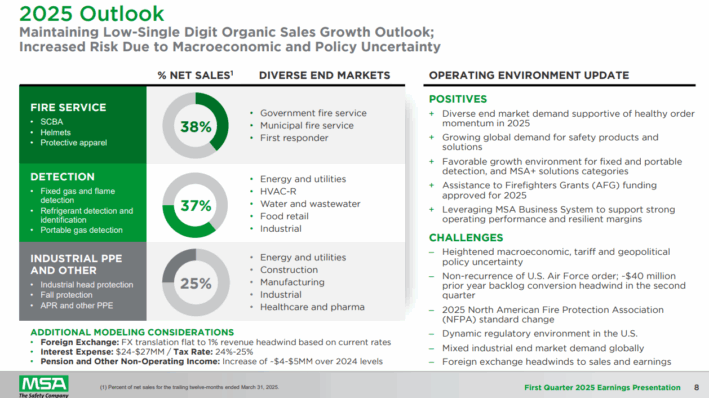

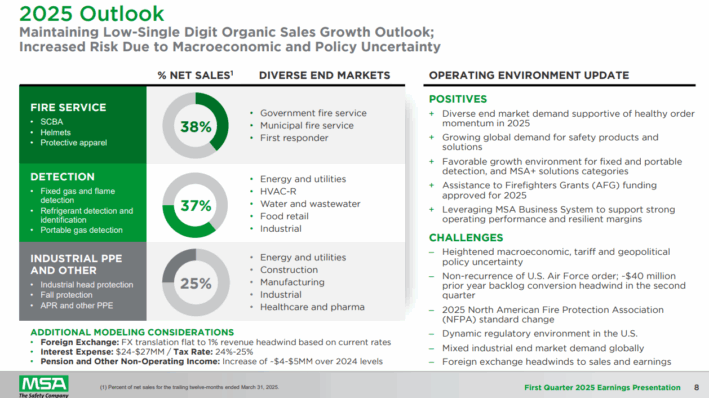

Source: Investor Presentation

MSA’s acquisition of Globe Manufacturing in 2017 enhanced the company’s revenue growth profile and enabled it to expand into new product categories, including protective clothing for firefighters. Innovations such as the thermal imaging camera in the self-contained breathing apparatus and the company’s V-Series line of fall protection have also contributed to this improvement.

In addition, the Sierra Monitor acquisition, Bristol Uniforms acquisition, and Bacharach acquisition, along with a strong backlog, cement the possibility of continued growth. Results were down in 2020, but still resilient, falling by less than 7%.

Moreover, many of MSA’s products are in demand in the current environment. Over the intermediate term, we assume a 7% annual growth, slightly below the company’s long-term growth rate.

Competitive Advantages & Recession Performance

MSA Safety has several competitive advantages that fuel its growth as the leader in the safety and protection products industry. It has a global reach that its competitors cannot match, with roughly a third of its annual sales coming from outside the Americas, and it can invest in growth initiatives to maintain its industry leadership.

To be sure, there is some cyclicality inherent in the business—safety is always important, but budgets become squeezed at other times. That said, investors should be encouraged that the dividend continues to increase during recessions.

Earnings-per-share performance during the Great Recession is below:

- 2007 earnings-per-share of $1.80

- 2008 earnings-per-share of $1.96 (8.9% increase)

- 2009 earnings-per-share of $1.21 (38% decline)

- 2010 earnings-per-share of $1.05 (13% increase)

That said, the company remained highly profitable during the Great Recession. This allowed it to continue increasing its dividend yearly during the recession, even when earnings declined. And thanks to its strong brand portfolio, the company recovered quickly after 2010.

Valuation & Expected Returns

Using the current share price of nearly $171 and expected earnings-per-share of $8.20 for the year, MSA stock trades for a price-to-earnings ratio of 20.9. Over the past decade, shares of MSA have traded with an average P/E ratio of approximately 23.0 times earnings. Considering the company’s quality, we believe that a valuation target of 21.0 times earnings is a fair assessment.

A current P/E ratio close to our target indicates that valuation will play a relatively minor role in total returns through 2030. We expect multiple expansion to add just 0.1% to annual returns over the next five years.

Aside from changes in the price-to-earnings ratio, future returns will be driven by earnings growth and dividend yields.

We expect 7% annual earnings growth over the next five years, which is below the long-term and medium-term averages.

In addition, MSA stock has a current dividend yield of 1.2%. The dividend is also well-protected, with an estimated payout ratio for 2025 of just 26%.

In total, we project that MSA will provide a total annual return of 8.3% through 2030.

Final Thoughts

MSA Safety is a strong business with competitive advantages and a reasonable growth profile. Its total return potential is just over 8% per year, driven by 7% growth and a 1.2% dividend yield.

Typically, only stocks with at least 10% expected total returns are eligible to receive a buy recommendation. However, MSA has proven itself throughout all portions of the economic cycle and has a stellar dividend growth track record. Because of this, we rate shares of MSA as a buy.

Additionally, the following Sure Dividend databases contain the most reliable dividend growers in our investment universe:

If you’re looking for stocks with unique dividend characteristics, consider the following Sure Dividend databases:

Thanks for reading this article. Please send any feedback, corrections, or questions to support@suredividend.com.