Published on July 17th, 2025 by Aristofanis Papadatos

Petrus Resources (PTRUF) has two appealing investment characteristics:

#1: It is offering an above-average dividend yield of 8.7%, which is more than seven times the average dividend yield of the S&P 500.

#2: It pays dividends monthly instead of quarterly.

Related: List of monthly dividend stocks

You can download our full Excel spreadsheet of all monthly dividend stocks (along with metrics that matter like dividend yields and payout ratios) by clicking on the link below:

The combination of an above-average dividend yield and a monthly dividend makes Petrus Resources an attractive option for individual investors.

But there’s more to the company than just these factors. Keep reading this article to learn more about Petrus Resources.

Business Overview

Petrus Resources is a Canadian oil and gas producer that was founded in 2015 and is based in Calgary, Alberta. It is focused on the development of low-cost, liquids-rich natural gas and light oil assets in Western Canada.

Its operations are concentrated in its core Ferrier area, located in the Alberta Deep Basin, where the company targets the Cardium formation using horizontal drilling and multi-stage fracturing. Petrus Resources maintains full operatorship and high working interests in its assets and thus it achieves tight cost control and capital efficiency.

The output of Petrus Resources is 33% oil and 67% natural gas. As a result, the company is highly sensitive to the dramatic cycles of the prices of oil and gas, particularly the latter. It has incurred losses in 7 of the last 10 years and has exhibited a markedly volatile performance record, which has been clearly reflected in the stock price.

To provide a perspective, the stock slumped 95% between 2017 and 2020. In 2015, it incurred excessive losses due to a steep decrease in the prices of oil and gas. The company initiated a dividend only in late 2023.

On the other hand, Petrus Resources has some advantages compared to well-known oil and gas producers. Most oil and gas producers have been struggling to replenish their reserves due to the natural decline of their producing wells.

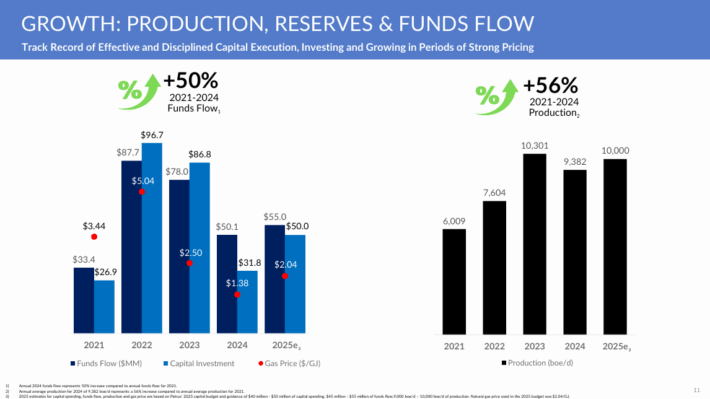

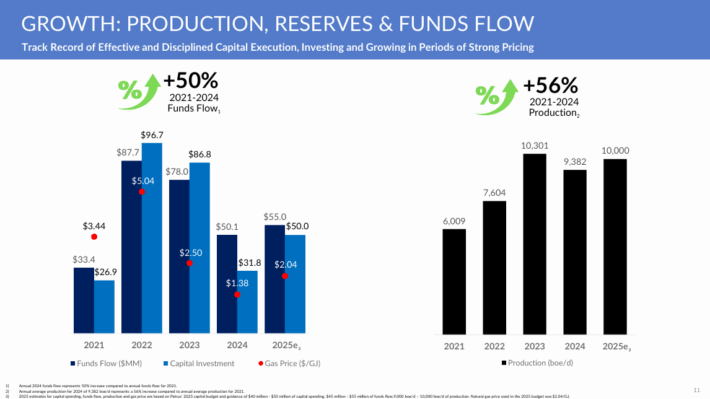

Source: Investor Presentation

Petrus Resources greatly benefits from the high quality and low decline rate of its reserves in the Deep Basin in Alberta. As shown above, the company has grown its production by 56% over the last four years.

This is undoubtedly an impressive production growth rate, which cannot be achieved by the well-known oil majors, such as Exxon Mobil (XOM) and Chevron (CVX).

In the first quarter of this year, Petrus Resources reported a slight decrease in its production over the prior year’s quarter. Given also the effect of a significant decrease in the average realized prices of oil and gas, the adjusted funds flow per share of the company declined 18%, from $0.11 to $0.09.

As 67% of the output of Petrus Resources is natural gas, it is important to examine the outlook of the U.S. natural gas market. Total U.S. production is expected to grow 3% this year, to a new all-time high, but U.S. LNG exports are expected to surge to an all-time high as well. LNG exports are expected to keep growing next year.

Due to the boom in LNG exports, the U.S. gas market has become tighter this year and thus the price of natural gas has significantly increased.

As per the latest forecast of the Energy Information Administration [EIA], the price of natural gas is likely to increase further next year, from an expected average price of $3.70 this year to $4.40 next year.

This outlook certainly bodes well for the business of Petrus Resources. Nevertheless, due to a significant decrease in the price of oil and a weak start to the year, we expect funds flow per share to decrease from $0.29 in 2024 to $0.25 in 2025.

Growth Prospects

As mentioned above, Petrus Resources has grown its production at a fast pace over the last four years. In addition, it is ideally positioned to benefit from potentially higher gas prices next year thanks to a tight natural gas market.

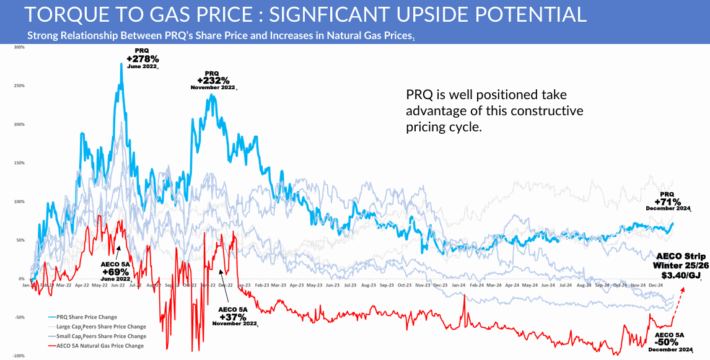

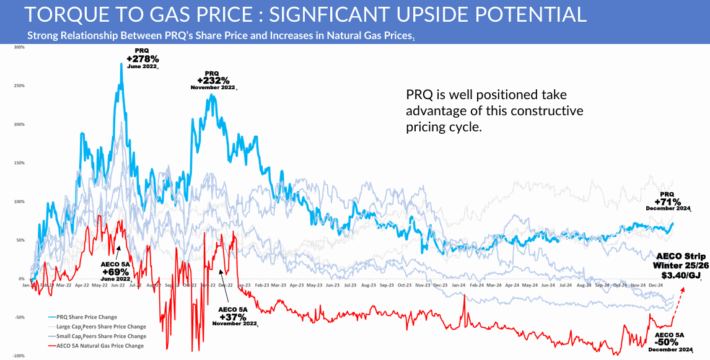

Source: Investor Presentation

On the other hand, investors should always keep in mind the dramatic cyclicality of the price of natural gas. That price skyrocketed to a 13-year high in 2022, shortly after the onset of the war in Ukraine, but plunged to pre-war lows in less than a year due to an abnormally warm winter. The price of natural gas remained depressed until this year.

We have assumed flat funds flow per share for Petrus Resources in five years from now in order to be on the safe side, given the high cyclicality of the price of natural gas.

Petrus Resources has a decent balance sheet. Its interest expense consumes 13% of its operating income while its net debt is $79 million, which is 59% of the market capitalization of the stock. Under normal business conditions, the company is not likely to have any problem servicing its debt.

On the other hand, in the event of a severe and prolonged downturn, the stock of Petrus Resources is likely to come under great pressure, as experience has shown.

Dividend & Valuation Analysis

Petrus Resources is currently offering an above-average dividend yield of 8.7%, which is more than seven times the 1.2% yield of the S&P 500. The stock is an interesting candidate for income investors, but they should be aware that the dividend is not safe due to the dramatic cycles of the prices of oil and gas.

Petrus Resources has a reasonable payout ratio of 36%, which provides a decent margin of safety for the dividend under the prevailing business conditions. Moreover, thanks to its promising growth prospects, the company is not likely to cut its dividend sharply in the absence of a major downturn.

In reference to the valuation, Petrus Resources is currently trading for 4.1 times its expected funds flow per share this year. Given the high cyclicality of the company, we assume a fair price-to-funds flow ratio of 3.0.

Therefore, the current funds flow multiple is higher than our assumed fair price-to-funds flow ratio. If the stock trades at its fair valuation level in five years, it will incur a 6.1% annualized drag in its returns.

Taking into account flat funds flow per share in five years from now, the 8.7% current dividend yield but also a 6.1% annualized headwind of valuation level, Petrus Resources could offer a 3.1% average annual total return over the next five years. The expected return signals that the stock is not attractive right now.

Final Thoughts

Petrus Resources has promising growth prospects thanks to production growth and expected higher gas prices next year amid a tight gas market. The stock is offering an above-average dividend yield of 8.7% but it appears almost fully valued. Therefore, investors should probably wait for a significantly lower entry point.

Moreover, the company has proven highly vulnerable to the cycles of the prices of oil and gas. As a result, it is suitable only for patient investors, who can endure high stock price volatility.

Additional Reading

Don’t miss the resources below for more monthly dividend stock investing research.

And see the resources below for more compelling investment ideas for dividend growth stocks and/or high-yield investment securities.

Thanks for reading this article. Please send any feedback, corrections, or questions to support@suredividend.com.