Published on July 17th, 2025 by Aristofanis Papadatos

Surge Energy (ZPTAF) has two appealing investment characteristics:

#1: It is offering an above-average dividend yield of 7.8%, which is more than six times the average dividend yield of the S&P 500.

#2: It pays dividends monthly instead of quarterly.

Related: List of monthly dividend stocks

You can download our full Excel spreadsheet of all monthly dividend stocks (along with metrics that matter like dividend yields and payout ratios) by clicking on the link below:

The combination of an above-average dividend yield and a monthly dividend makes Surge Energy an attractive option for individual investors.

But there’s more to the company than just these factors. Keep reading this article to learn more about Surge Energy.

Business Overview

Surge Energy is an independent oil and gas exploration, development and production company that operates primarily in Alberta, Saskatchewan and Manitoba.

The company holds a focused and operated portfolio of light and medium gravity crude oil assets, including large oil‑in‑place reservoirs with low recovery factors.

Surge Energy maintains a significant inventory of low-risk development drilling locations, including advancing water‑flood enhanced recovery projects, while retaining operator control and high working interests across its key plays. Its strategy revolves around disciplined capital allocation, including targeting the highest return opportunities.

Surge Energy is headquartered in Calgary, Canada. It was founded in 1998 under the name Zapata Energy and changed its name to Surge Energy in 2010. As 89% of the production of Surge Energy is crude oil, the company should be viewed as an almost pure oil producer.

Surge Energy offers investors exposure to two of the top five conventional oil growth plays in Canada, namely the Sparky and Saskatchewan. Each of these two plays offers exceptional economic characteristics.

Source: Investor Presentation

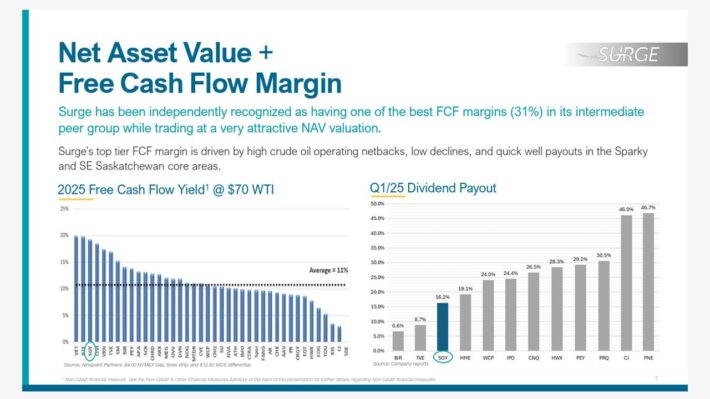

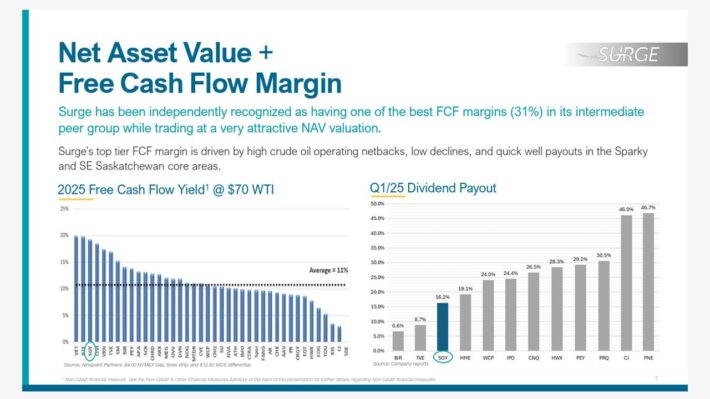

Thanks to the exceptionally high operating netbacks of its crude oil reserves and low decline rates, Surge Energy enjoys one of the widest free cash flow margins (31%) in its peer group.

As an oil producer, Surge Energy is sensitive to the cycles of the oil industry. This sensitivity is clearly reflected in the volatile performance record of the company. On the bright side, Surge Energy has remained profitable every single year over the last decade.

Even in 2020, when most oil producers incurred losses due to the coronavirus crisis, Surge Energy remained profitable. This is a testament to the high quality and low production cost of the reserves of the company.

In the first quarter of this year, Surge Energy posted essentially flat production over the prior year’s quarter but it benefited from higher realized oil prices and lower hedging losses. As a result, the adjusted funds flow per share of the company grew 8%, from $0.37 to $0.40.

As Surge Energy is highly sensitive to the gyrations of the price of oil, it is important to examine the status of the global oil market. OPEC provided strong support to the price of oil via unprecedented production cuts in the last few years but this strategy reached its limits last year due to the boom of production in countries outside the cartel.

The U.S., Canada and Brazil, have been taking advantage of the reduced output of OPEC and thus they have been growing their output at a fast pace. As a result, they have been gaining market share from OPEC while mitigating the effect of the sacrifices of OPEC members.

This situation led many OPEC members, which rely on oil sales to fund their government budgets, to become dissatisfied with their reduced production quotas. Notably, Angola exited OPEC at the beginning of 2024 due to its dissatisfaction with its low production quota.

Due to turmoil among its members, OPEC began to unwind its production cuts in April, with a stated goal to raise its output by 2.2 million barrels per day until the end of 2026. As this shift in the policy of OPEC is likely to result in a global surplus of oil, the price of oil has fallen below the technical support of $70 this year.

Nevertheless, it has remained above average and thus Surge Energy is likely to remain highly profitable this year.

Growth Prospects

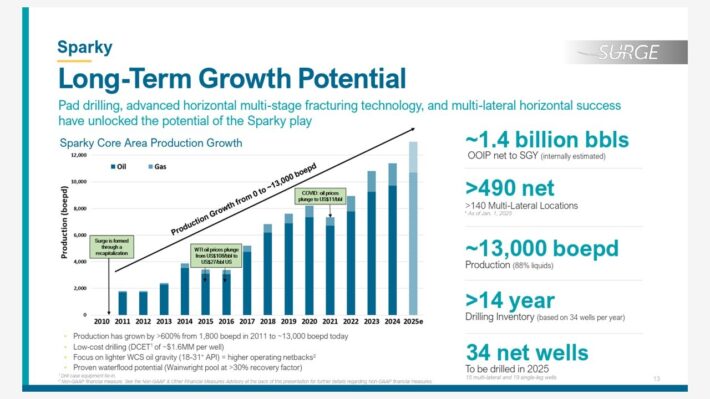

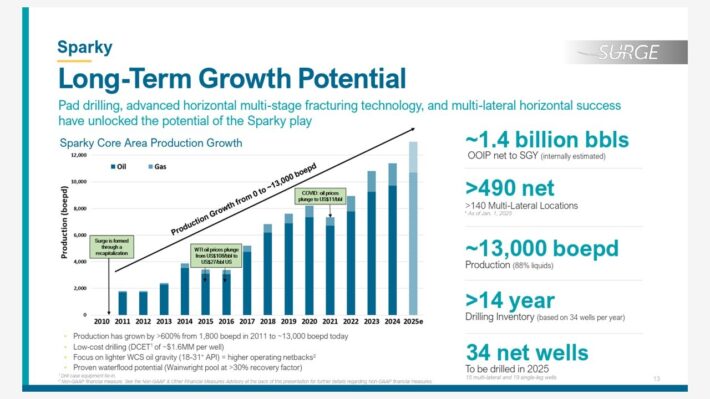

Surge Energy has exciting growth potential, primarily thanks to its dominant land position in the Sparky area, which includes one of the largest accumulations of oil in Canada.

Source: Investor Presentation

Thanks to its focus on this highly prolific area, Surge Energy has grown its production in the Sparky area at an impressive rate, from 1,800 barrels per day in 2011 to approximately 13,000 barrels per day this year.

As there are absolutely no signs of fatigue, we expect strong production growth to remain in place for the next several years.

On the other hand, as an oil and gas producer, Surge Energy is vulnerable to the wild swings of the price of oil. The company posted record funds flow per share in 2022 thanks to the onset of the war in Ukraine and the resultant sanctions of the U.S. and European Union on Russia, which led the price of oil to skyrocket to a 13-year high.

However, now that the global oil market has absorbed the impact of the war in Ukraine and OPEC has begun to unwind its production cuts, the price of oil has moderated.

As a result, the funds flow per share of Surge Energy decreased from an all-time high of $2.96 in 2022 to $1.99 in 2024. We expect funds flow per share of approximately $2.05 this year.

Despite the promising growth prospects of Surge Energy, we have assumed flat funds flow per share over the next five years in order to be on the safe side, given the wild swings of the price of oil and the somewhat high comparison base formed by the expected funds flow per share this year.

Surge Energy has a somewhat leveraged but decent balance sheet. Its net debt is $406 million, which is 84% of the market capitalization of the stock. Under normal business conditions, the company is not likely to have any problem servicing its debt.

On the other hand, in the event of a severe and prolonged downturn, Surge Energy may come under some pressure due to its somewhat leveraged balance sheet.

Nevertheless, the defensive business model of Surge Energy, which has helped the company remain profitable even during the fiercest downturns of the energy sector, renders this upstream player fairly resilient to downturns.

Dividend & Valuation Analysis

Surge Energy is currently offering an above-average dividend yield of 7.8%, which is more than six times the 1.2% yield of the S&P 500.

The stock is an interesting candidate for income investors, but they should be aware that the dividend is not entirely safe due to the dramatic cycles of the price of oil.

With that said, Surge Energy has a healthy payout ratio of only 19%. Given also its high-quality assets and its resultant promising growth prospects, the company is likely to raise its dividend in the upcoming years.

In reference to the valuation, Surge Energy is currently trading for 2.4 times its expected funds flow per share this year. Given the high cyclicality of the company, we assume a fair price-to-funds flow ratio of 2.0.

Therefore, the current funds flow multiple is higher than our assumed fair price-to-funds flow ratio. If the stock trades at its fair valuation level in five years, it will incur a 3.4% annualized drag in its returns.

Taking into account flat funds flow per share over the next five years, the 7.8% current dividend yield but also a 3.4% annualized headwind of valuation level, Surge Energy could offer a 4.8% average annual total return over the next five years.

While the high dividend yield with a wide margin of safety is attractive, the expected total return signals that investors should probably wait for a lower entry point.

Final Thoughts

Surge Energy has been thriving since 2021 thanks to an ideal environment of above-average oil prices. The stock is offering an above-average dividend yield of 7.8% but its somewhat rich valuation signals that investors should probably wait for a more opportune entry point.

It is also important to note that Surge Energy has proven highly vulnerable to the cycles of the price of oil. Therefore, it is suitable only for patient investors, who can endure high stock price volatility.

Additional Reading

Don’t miss the resources below for more monthly dividend stock investing research.

And see the resources below for more compelling investment ideas for dividend growth stocks and/or high-yield investment securities.

Thanks for reading this article. Please send any feedback, corrections, or questions to support@suredividend.com.