Key takeaways:

-

High whale activity on Binance and profit-taking by long-term holders may increase selling pressure and volatility.

-

Bitcoin could potentially drop to fill the CME gap below $115,000.

After starting the week with new all-time highs, Bitcoin (BTC) reverted to negative returns as its price dropped 5% to $116,850 on Tuesday. The price rejection occurred at $120,000, the highest daily-candle close ever, and now a key level for traders.

On the four-hour chart, BTC is currently trading below the 20-period simple moving average (SMA), and a potential close below the key indicator might trigger further downside.

Profit-taking by Bitcoin whales pushes down price

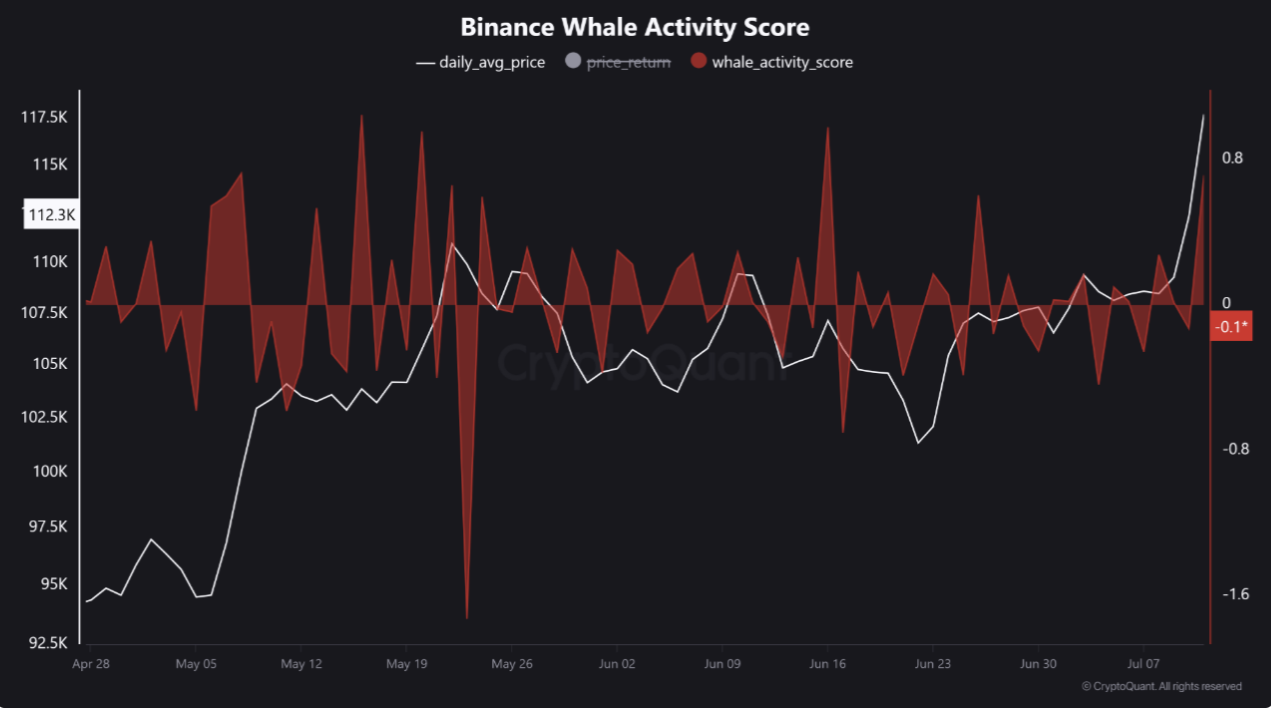

Bitcoin could see increased market volatility due to increased whale activity on Binance, according to a recent analysis by CryptoQuant.

According to the firm, the Binance Whale Activity Score has seen a sharp rise following Bitcoin’s all-time highs of $122,000.

Related: Bitcoin ‘shows no signs of fatigue' as it overtakes gold in gains for 2025

The Binance Whales Activity Score tracks the behavior of large Bitcoin holders (whales) on Binance, the world’s largest exchange. A high score indicates that whales are driving a substantial portion of activity on Binance.

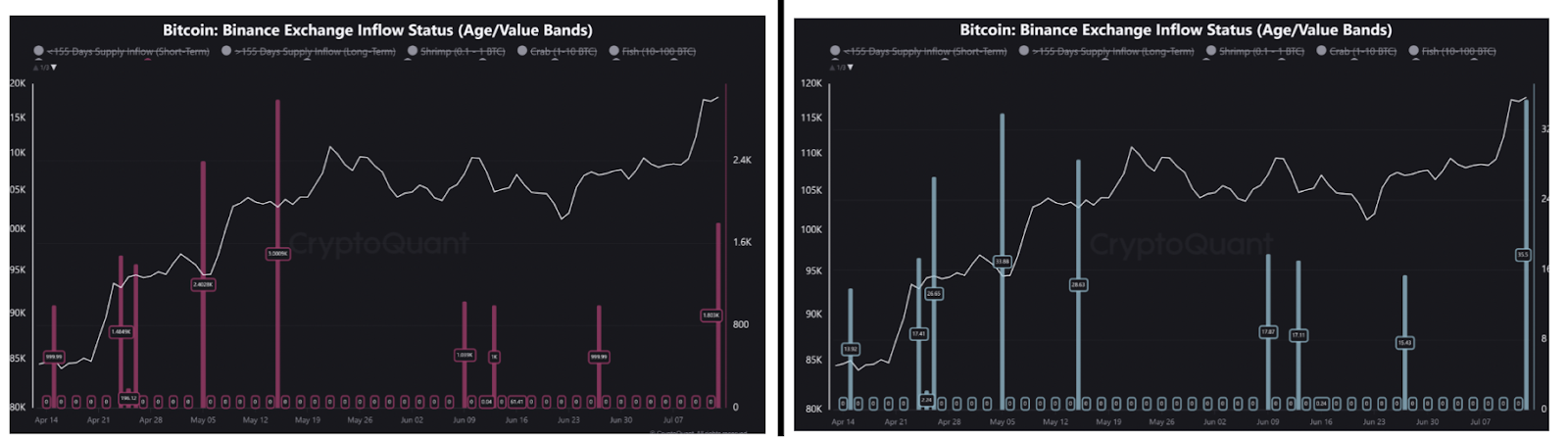

Data shows that whales deposited approximately 1,800 BTC onto Binance on Monday. The Exchange Inflow by Value Bands reveals the scale of these transfers, with transactions over $1 million accounting for more than 35% of the total Bitcoin inflows to the exchange.

“This indicates a concentrated and deliberate move by major players to position assets on the world’s most liquid platform,” said CryproQuant analyst Crazzyblockk in a QuickTake analysis on Monday.

This surge in deposits suggests that large-scale investors are either preparing to secure gains after the historic run to $122,000 or are planning to utilize Binance’s deep liquidity to hedge or open new positions amid peak volatility, the analyst explained, adding:

“Either way, the presence of this much ‘sell-side’ pressure on the market’s primary trading venue increases the risk of sharp price swings.”

Meanwhile, André Dragosch, European Head of Research at Bitwise, observed a significant spike in long-term holder realized profits, explaining the ongoing correction.

WATCH: Significant spike in Long-Term Holder Realized Profits pic.twitter.com/Lr5rExSqGa

— André Dragosch, PhD⚡ (@Andre_Dragosch) July 15, 2025

This magnitude of profit-taking, coupled with 98% supply in profit, is often a precursor to significant price corrections.

BTC price may “fill” sub-$115,000 futures gap

Bitcoin’s recent rally created a CME futures gap between $114,380 and $115,630. Futures gaps get “filled” most of the time, and traders approach these levels from the point of resistance or support, depending on the market structure.

If history is a guide, BTC price should eventually drop to fill the CME gap down to $114,400 as shown in the chart above.

Bitcoin will “probably fill up the CME gap during the CPI release and continue the rally up,” crypto analyst Mikybull Crypto said in an X post on Tuesday.

However, MN Capital founder Michael van de Pope pointed out the possibility of a deeper correction toward $108,000.

“Staying above $108K and the trend remains upward. The bull market is here.”

Volatility incoming, indeed.

Great for traders that do trade this volatility on #Bitcoin and a small correction.

Something to worry? Definitely not.

Staying above $108k and trend remains upwards.

The bull market is here. pic.twitter.com/cHPHz4dxOu

— Michaël van de Poppe (@CryptoMichNL) July 15, 2025

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.