Bitcoin price predictions are coming thick and fast after Monday’s all-time high, and one analyst is tipping Bitcoin to reach $135,000 before a significant market correction.

Before this breakout, there were almost two months of consolidation, which now feels like “ancient history,” Fairlead Strategies founder and managing partner Katie Stockton told CNBC on Monday.

She said that the firm creates “measured move projections” from the breakouts and assuming the previous uptrend continues ahead of any corrective phase:

“That puts Bitcoin at around $135,000 as an intermediate-term objective.”

Stockton said stocks that track Bitcoin (BTC) markets, such as Coinbase or Strategy, are also likely to perform well. “There is positive action across the universe of cryptocurrencies,” she said, citing Ether (ETH) and XRP (XRP) movements.

Analysts echo BTC price prediction

Bitcoin broke out from its multi-week sideways channel on Monday to reach an all-time high of $122,871 on Coinbase before retreating back below $120,000 during early trading on Tuesday morning.

Stockton’s prediction closely mirrors other analysts’ recent forecasts.

“Based on the July 10 breakout signal, which has historically led to an average 20% rally over the following two months, we project Bitcoin could reach $133,000,” 10x Research head of research Markus Thielen told Cointelegraph on Tuesday.

“We expect some near-term consolidation, followed by a push toward $133,000, with our $160,000 year-end target still firmly in sight.”

“Investors are still looking at $150,000 as the next major price level to reach during this cycle,” LVRG Research director Nick Ruck told Cointelegraph, adding:

“We remain optimistic that Bitcoin can continue, pending no sudden black swan events.”

Related: Bitcoin is rallying on US deficit concerns, not hype: Analyst

Cointelegraph technical analysts tagged $132,000 to $138,000 as a “reasonable short-term target” before momentum slows.

Bitcoin’s breakout of what appears to be a “bull flag” pattern hints at a $130,000 target, analysis suggested.

Retail is still absent from crypto

Bitcoin smashed past the $120,000, breaking above a seven-year trendline that has acted as a strong resistance level since 2018.

“This is an incredibly bullish signal, especially given the environment this is happening in,” Nic Puckrin, investor and founder of The Coin Bureau, said in a note shared with Cointelegraph.

“But, most importantly, retail buyers are nowhere to be seen yet. This rally is still driven by institutional capital, while the typical signs of retail involvement — soaring search traffic and crypto app rankings — are absent,” he added before stating that retail is unlikely to get involved “until we get to around $150,000 and the FOMO kicks in.”

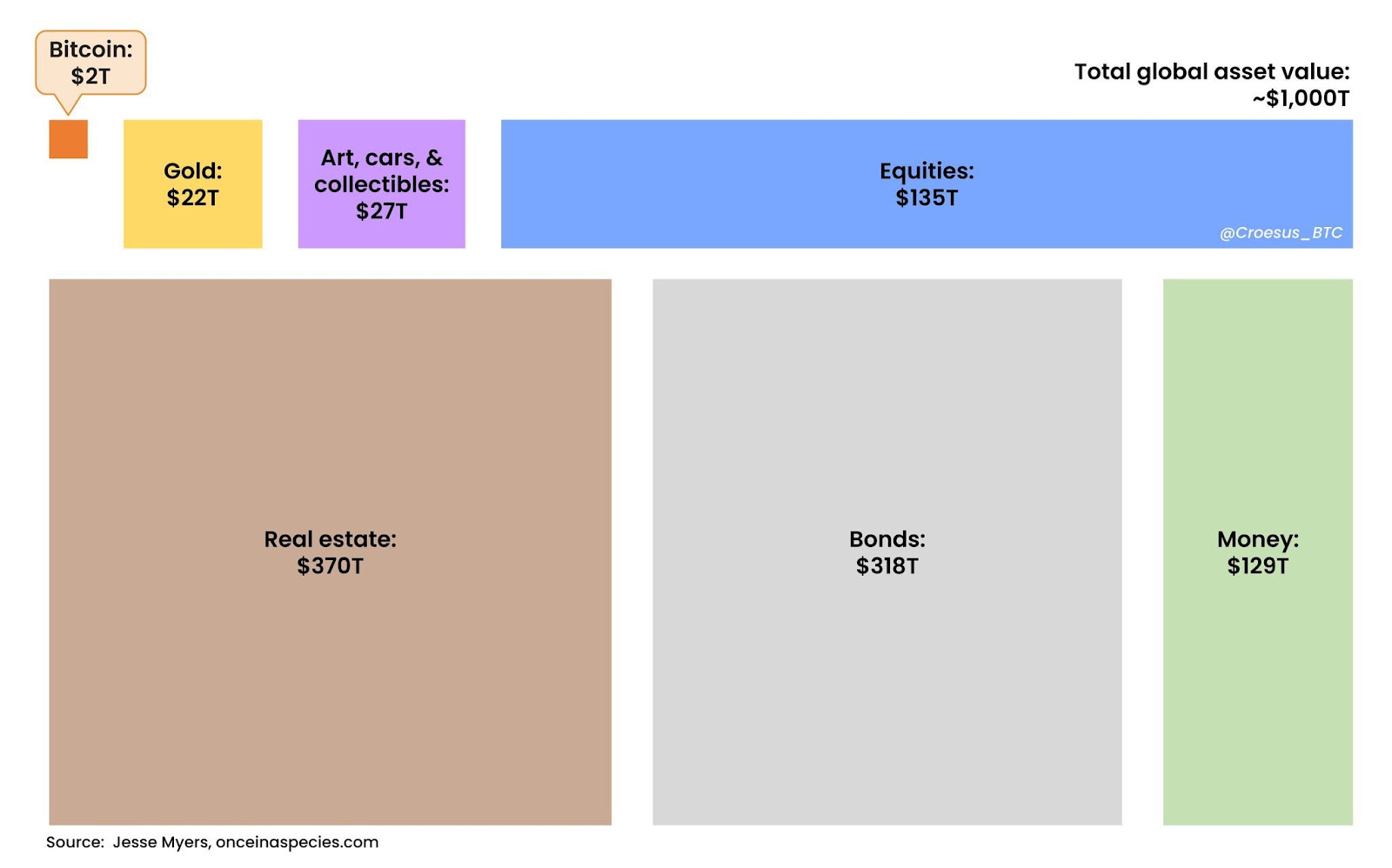

Bitcoin is still a tiny asset class

The big move increased Bitcoin’s market capitalization to $2.4 trillion, which enabled BTC to flip Amazon and become the world’s fifth-largest global asset.

However, in terms of asset classes such as gold, equities, real estate and bonds, it is still a minnow, Bitcoin Opportunity Fund co-founder James Lavish observed on Monday.

Magazine: Bitcoin vs stablecoins showdown looms as GENIUS Act nears